Credit Cards

St. George Vertigo Card Review: Elevate Your Spending Experience!

Navigate the world of credit with confidence using the St. George Vertigo Card. Enjoy low interest rates, cashback on daily expenses, and a suite of security benefits.

Advertisement

Whether you’re a credit pro or just starting, this card caters to your financial journey with perks and savings!

In this review of the St. George Vertigo Card, break down the features and advantages of this financial tool, and get essential insights to make informed financial decisions!

Whether you’re new to credit cards or looking to switch, uncover details of the St. George Vertigo Card and find out why it’s designed to simplify transactions and enhance your financial experience.

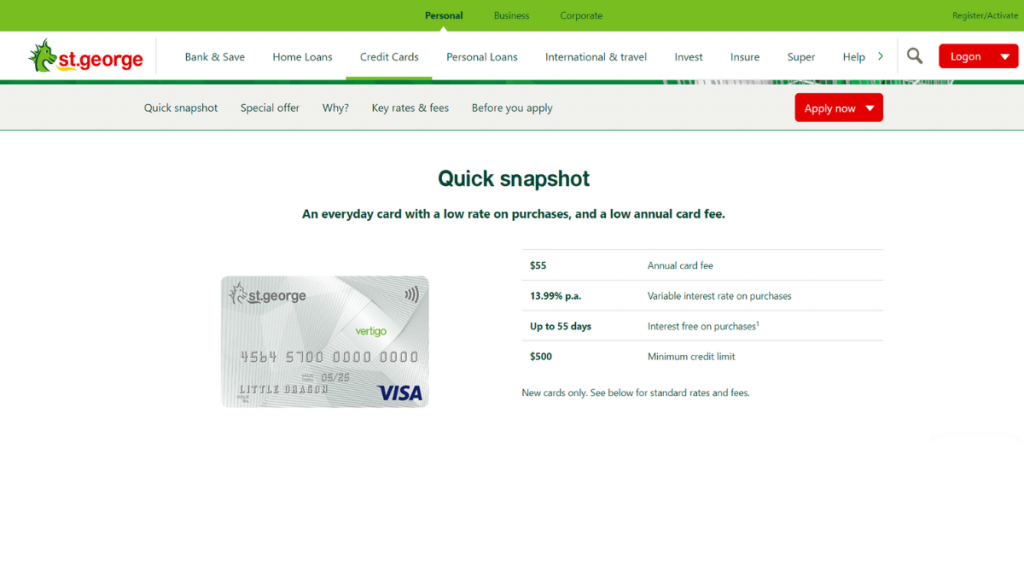

- Credit Score: N/A

- Annual Fee: $55.

- Intro offer: New cardholders are presented with a compelling choice as they embark on their St. George Vertigo Card journey. Opt for up to $400 cashback on qualifying supermarket and petrol transactions or seize a strategic advantage with a 0% p.a. interest rate on balance transfers.

- Rewards: levate your spending with the St. George Vertigo Card and reap the benefits. Unlock up to $400 (10%) in cashback across specific spending categories. Beyond monetary rewards, indulge in exclusive perks via Visa Offers and Perks, enjoy personalized discounts, and explore the My Offers Hub.

- P.A.: 13.99%.

- Other Fees: For each cash advance, a 3% fee is levied, and a late payment or missed payment triggers a $15 fee.

St. George Vertigo Card: how does it work?

When exploring this review, you’ll find that the St. George Vertigo Card functions as a versatile financial tool. After all, it offers benefits and features designed to enhance the overall spending experience.

With a competitive variable interest rate on purchases, it caters to those seeking flexibility in managing their monthly balances.

The card provides an option for an extended interest-free period of up to 55 days on purchases, empowering users to navigate their expenses strategically.

Moreover, one of the standout features is the introductory offer, allowing cardholders to choose between up to $400 cashback or 0% p.a. interest on balance transfers for a specified duration.

Besides, you can enjoy complimentary additional cardholders. It also emphasizes security with 24/7 fraud monitoring, a Secure Online Shopping Service, and the St.George Fraud Money Back Guarantee.

Finally, access to the My Offers Hub adds another layer of value, offering a curated space filled with personalized discounts and benefits.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Though the St. George Vertigo Card poses as a comprehensive financial companion, it’s very important to weigh the advantages and disadvantages to be sure you’re making the right choice!

Benefits

- Smart spending rewards;

- Strategic interest in balance transfers;

- Add additional cardholders;

- Compatible with mobile wallets;

- 24/7 fraud monitoring;

- Extended interest-free period.

Disadvantages

- Cash advance interest rate;

- Annual fee;

- 3% fee on overseas transactions;

- Penalties for tardy payments.

Is a good credit score required for applicants?

Yes, a good credit score is generally beneficial for applicants seeking approval for the St. George Vertigo Card, so make sure you review your credit history before applying.

Moreover, a good credit score demonstrates timely payments, responsible credit usage, and financial stability.

Learn how to apply and get the St. George Vertigo Card

Ready to start your journey to acquire the St. George Vertigo Card? Moreover, this is a seamless process that opens the door to a realm of financial convenience and rewards.

So, let’s navigate the steps together, ensuring a smooth and straightforward application process!

Learn how to get this credit card online

From exploring the features of the Vertigo Card on the official St. George Bank website to the final anticipation of card approval, find out all the steps below!

- Visit the St. George Bank website: Start by accessing the bank’s website. Navigate through the menu, locate the “Credit Cards” section, and click to review the details of the St. George Vertigo Card.

- Start application process: Next, access the dedicated application page nestled within the credit card section. Then, engage in the process by accurately filling in the required fields with your personal and financial information.

- Submit the form: With your comprehensive application now assembled, take the final step by reviewing and submitting it online. Post-submission, the bank will meticulously assess your eligibility.

- Approval: If approved, anticipate the imminent arrival of your brand-new St. George Vertigo Card in the mail!

What about another recommendation: Westpac Lite Credit Card!

Boasting a straightforward approach to credit, the Westpac Lite Credit Card offers a competitive interest rate on purchases, making it an appealing choice for those who prioritize financial ease.

Whether you’re new to credit or seeking a fuss-free option, this card caters to individuals who value straightforward terms and reliable financial management. Discover the Westpac Lite Credit Card now!

Westpac Lite Credit Card review: Low Fees

If you’re considering the Westpac Lite Credit Card, this review breaks down its rewards and eligibility requirements to help you decide!

About the author / VInicius Barbosa

Trending Topics

Total Visa® Credit Card review

Learn how to get the purchasing power of a real Visa card even if you have a bad score in this Total Visa® Credit Card review.

Keep Reading

How to use credit cards

Credit cards can make you or break you. Are you using them in the best possible way? In this article we will help you do just that.

Keep Reading

ABSA Visa Signature Credit Card review: tailor-made for you!

With the ABSA Visa Signature Credit Card, you'll enjoy exclusive access to a range of luxurious benefits and rewards. Read on for more!

Keep ReadingYou may also like

Wesbank Personal Loans review

Need funds for unexpected expenses? Wesbank Personal Loans offers a range of loan amounts, and you can learn about them in this review!

Keep Reading

Altitude® Go Visa Signature® Card application

The US Bank Altitude® Go Visa Signature® Card application process is simple and straightforward. Learn how to request yours today!

Keep Reading

College Ave Student Loans review

Read our College Ave Student Loans review to learn how you can get the funding you need for college with fair and flexible repayment terms.

Keep Reading