Credit Cards

Westpac Lite Credit Card review: Low Fees, High Value!

Is the Westpac Lite Credit Card worth the application? Our comprehensive review evaluates its introductory offers, balance transfer terms, and suitability for different spending habits!

Advertisement

Simplify your finances with the Westpac Lite Credit Card: affordability and competitive interest rates!

Prepare to embark on a journey into the world of financial empowerment! In this review of the Westpac Lite Credit Card, you’ll see how this card offers an alternative for those looking to simplify their financial life!

In today’s dynamic financial landscape, choosing the right credit card can be a game-changer, and the Westpac Lite Credit Card is no exception.

Explore the details, uncovering the unique advantages and potential drawbacks of the Westpac Lite Credit Card in this review! This way, you can navigate your financial future with confidence and clarity!

- Credit Score: Applicants with a credit score in the range of 700 to 749 or higher generally have a better chance of approval.

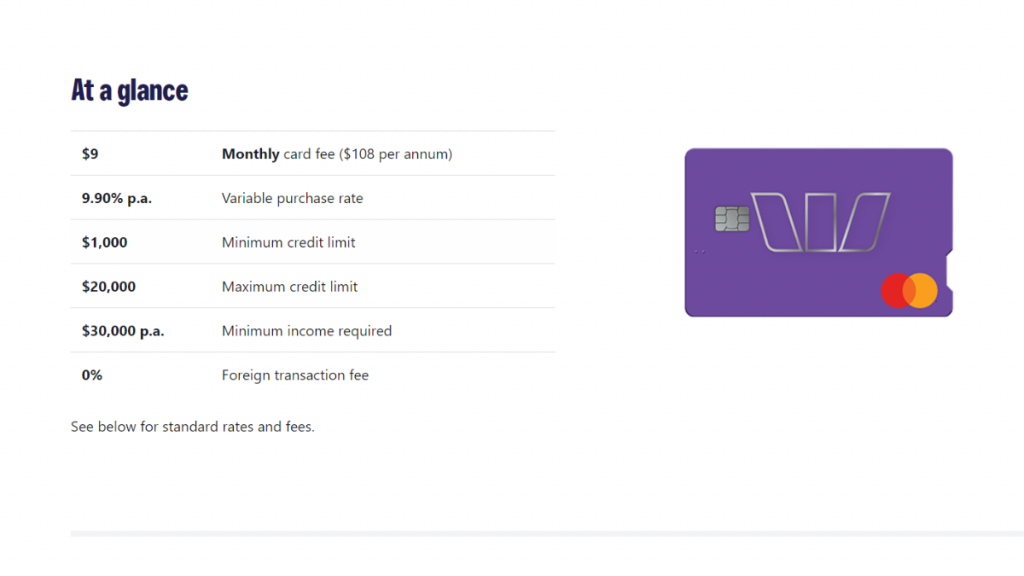

- Annual Fee: This card is known for its low annual fee, $9 a month. This makes it an attractive choice for budget-conscious individuals.

- Intro offer: No introductory bonuses or special promotions are applicable.

- Rewards: Gain access to personalized cashback offers through Westpac Extras. Plus, earn bonus cashback while shopping via the Westpac Lounge on ShopBack, and receive a host of discounts and special deals from a diverse selection of both physical and online retailers.

- P.A.: The interest rates for the Westpac Lite Credit Card are competitive, varying from 9,90%.

- Other Fees: In addition to the annual fee and interest rates, the Westpac Lite Credit Card may have other fees associated with it. Be sure to review the card’s terms and conditions for a complete list of fees.

Westpac Lite Credit Card: how does it work?

In summary, the Westpac Lite Credit Card provides a simple and cost-effective way to manage your finances, offering essential features without excessive fees.

The Westpac Lite Credit Card offers competitive interest rates and low annual fees, but you should always review the terms and conditions before applying. Remember, this card focuses on simplicity.

While not known for extensive rewards, the card may offer benefits like contactless payments, fraud protection, and a user-friendly mobile app for convenient account management.

Moreover, you have access to personalized cashback and can unlock bonus rewards by shopping on ShopBack. Its essential features come without unnecessary frills.

Besides, this card is designed for those who want straightforward financial management. This card offers competitive interest rates, which is beneficial if you plan to carry a balance from month to month.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

While credit cards play a pivotal role in our financial lives, choosing the right one requires a thorough understanding of its features.

Discover the Westpac Lite Credit Card from every angle as we outline its merits and limitations in this review.

Whether you’re a seasoned cardholder or just beginning your credit journey, this analysis will help you make an informed decision.

Benefits

First and foremost, it stands out for its low annual fee, a hallmark of affordability in the credit card landscape. Complementing this is the card’s competitive interest rates, which is a plus if you plan to carry a balance.

By choosing this card, you unlock personalized cashback incentives courtesy of Westpac Extras. What’s more, venturing into the Westpac Lounge on ShopBack offers you bonus cashback rewards.

Additional advantages that come with your Westpac Lite Credit Card application include:

- No foreign transaction fees;

- Fraud protection;

- Exclusive mobile app;

- Compatible with Apple Pay, Google Pay, and Samsung Pay.

Disadvantages

While the Westpac Lite Credit Card boasts numerous benefits, it’s equally important to review its limitations. Notably, this card isn’t celebrated for its robust rewards or cashback offerings.

If you’re looking to maximize rewards on your spending, other cards might be more suitable. Besides, other disadvantages of this credit card include:

- Annual fee;

- A good to excellent credit score is required;

- Cash advances are not available.

Is a good credit score required for applicants?

As part of their standard procedure, Westpac carefully reviews applicants’ creditworthiness when processing credit card applications.

A credit score falling between 700 and 749 or higher is generally a sign of good to excellent credit standing.

Besides, having a strong credit score demonstrates a responsible credit history. This can improve your chances of approval with competitive interest rates and favorable terms.

Learn how to apply and get the Westpac Lite Credit Card

If you’ve set your sights on the Westpac Lite Credit Card after reading this review, check out the step-by-step process of applying!

Whether you’re new to credit cards or simply seeking a more straightforward financial tool. Check out the application process to ensure you’re well-prepared to take the next step toward financial empowerment.

Learn how to get this credit card online

Applying for the Westpac Lite Credit Card is a very simple process, and you can do it online. All you need to do is follow some easy steps.

- Visit Westpac’s website: Go to Westpac’s official website to access the online application form for the credit card.

- Choose the Westpac Lite Credit Card: Select the “Credit Cards” button on the homepage. Then, scroll down to find the Westpac Lite Credit Card and click on “Apply Now”.

- Complete the application form: Ensure the online application form is filled out accurately and with the most recent information. You’ll need to provide personal details, contact information, employment information, and financial information.

- Submit the application: Once you’ve completed the application form, click the “Submit” or “Apply Now” button to send your application to Westpac.

- Approval: If approved, you’ll receive your Westpac Lite Credit Card in the mail.

How to get this card using the app

If you want more convenience, you can download and review Westpac’s app features to apply for the Westpac Lite Credit Card. It’s an easy and straightforward process.

- Download the Westpac mobile banking app: If you don’t already have the Westpac mobile app, download it from your device’s app store and install it.

- Log in or register: Open the app and log in using your existing Westpac online banking credentials. If you’re new to online banking, you’ll need to start by registering for an account.

- Explore the app: Once logged in, explore the app’s features and menus to find the option for credit card applications. This information is typically found in the “Products” or “Services” section of the app.

- Follow the application steps: Follow the on-screen instructions to complete the application process. You’ll likely need to provide personal, financial, and contact information.

- Await approval: After submitting your application, Westpac will review it. With an approved application, the Westpac Lite Credit Card will find its way to your doorstep through postal delivery.

As you can see, the Westpac Lite Credit Card is a budget-friendly option! But, if you want a credit card with a focus on travel rewards and international use, you might want to explore an alternative option.

The Australia Post Travel Platinum Mastercard® is designed for frequent travelers, offering a range of benefits that include travel rewards, complimentary overseas travel insurance, and no foreign transaction fees.

Want to know more? Then explore how this card can elevate your travel experiences and financial strategies by clicking below. Your journey towards smarter credit card choices starts here!

How to get your Australia Post Travel Platinum?

Lock in exchange rates and save money on travel! Just follow this Australia Post Travel Platinum Mastercard® application guide.

About the author / VInicius Barbosa

Trending Topics

PenFed Credit Union Personal Loan review

This PenFed Credit Union Personal Loan review wll show you everything you need to know to get this loan easily.

Keep Reading

OppFi® card review: No security deposit required

In this OppFi® card review you will see that you can get this card with no security deposit even if you have bad credit. Check it out!

Keep Reading

Quicksilver Rewards Card application

Getting the Quicksilver Rewards Card from Capital One is simple and easy. Learn how to apply today and get started on earning rewards!

Keep ReadingYou may also like

BlueBird Amex debit card application process step-by-step

In this BlueBird Amex debit card application guide you will learn how to apply within minutes for this accessible debit card.

Keep Reading

Simplii Global Money Transfer: How to join and start using it easily?

Open an account today and start using Simplii Global Money Transfer to transfer money anywhere in the world with no transfer fees.

Keep Reading

How to open your account and join TD Ameritrade

Learn how to join TD Ameritrade, open your account and start investing today with some of the best tools and trading platforms out there.

Keep Reading