Finances

Start saving money like a pro: learn how!

If you'd like to save money but don't know how to start, you've come to the right place. The Post New will show you how to start building your savings.

Advertisement

Start Saving Money: The Complete Guide.

If you don’t have a good safety net on your finances, you need to start saving money ASAP. And if you think you can’t do it, let’s change your mind about it. You can do it. And we’ll show you how.

Many people think they need a specific scenário to start saving money. That when a certain thing happens they will be able to start

But truth is that life is always a surprise. And if you keep waiting for the perfect moment or the perfect situation chances are you will never give the first step.

The ideal world is not like the real world. So let’s start exactly where you are, with the tools you have. And you will find a way with this reality.

If you feel like saving money is too complicated, you need to read this article. It contains tips and will guide you on this mission.

The sooner you start, the better. So don’t waste any more minutes, and keep reading to get started with saving money.

10 essential tips and tricks on how to start saving money

Saving money is the key to your financial success. As you accumulate money it will grow your purchase power and financial independence.

You can protect yourself in moments of unemployment or even economic crises that occur from time to time, both nationally and internationally.

And if something tremendous and unpredictable like a pandemic happens, you will have the resources to overcome these hard times.

So, let’s go down to business, and give you the ultimate guide for saving money (even when you think you can’t).

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Keep note of your expenses

It is essential to know how much you are spending and what you are buying. To start saving money you need to know where your money it going.

Maybe you have a way bigger expense with groceries than you think you have. Or maybe it’s cosmetics, clothes, dining, etc.

Use cash instead of cards on some occasions

It is way easier to overspend with a debit card than using cash. The same happens with credit cards, which is sometimes even worse because the money is not taken from your bank account right at the moment.

So, if you’re going to the supermarket, department store, or maybe to a bar or a restaurant, and you want to stick to your budget, bring a limited amount of cash with you.

Take only the money you need for that moment and leave the rest safe at home or at your account.

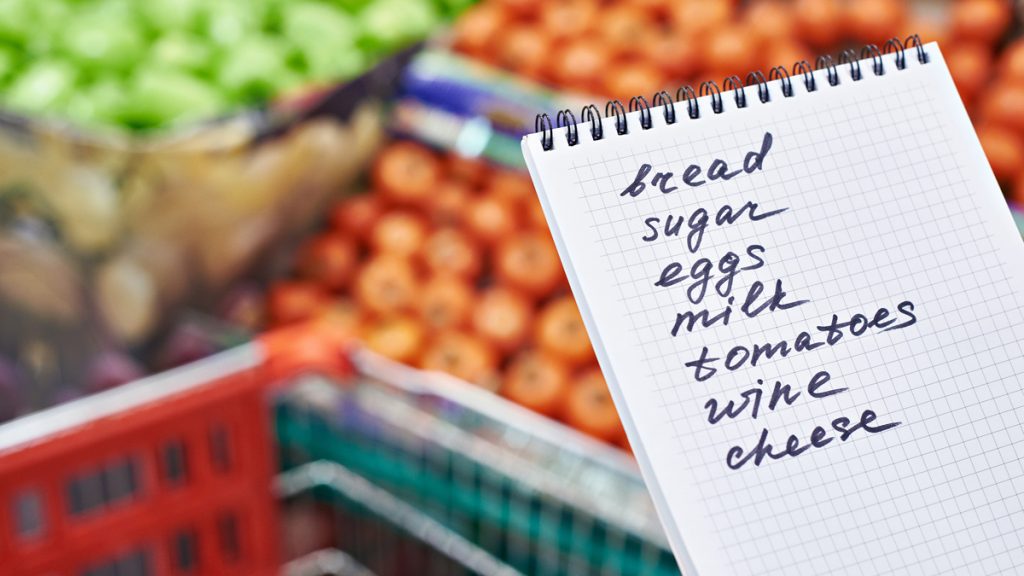

Make a list before going to the grocery store

This simple attitude will help you save tons of money. People have no idea how much they spend on unnecessary things at the supermarket.

And most of the time this extra money is spent on unhealthier things, like candies, snacks, etc.

Save your money and your health by sticking to your list.

Look for cheaper ways to do what you do – free is even better.

Even tho start saving money is important, it is also essential to have leisure and cultural activities too. It is good for your mental health.

But you can look for places that are less expensive or even the ones that offer free activities. It can be a music class, a free concert, or an evening pottery workshop at the community center closer to your home.

Saving $20 is better than saving $0

If you don’t have a high income or have a lot of bills to pay, maybe you can’t save a lot of money now. But it is okay to save just a little amount while you can’t save more.

Your savings will have to start someway, and saving a little is way better than saving nothing at all. Stick to your goal: if your budget fits just $20 a month, do it!

Resist the temptation to spend your savings

You’ll have many opportunities to spend your savings. Friends calling you for a trip, a new cellphone release, a sale on your favorite brand, etc.

This is the moment when a little voice may whisper in your ears well if I have this spare money on my budget, why can’t I buy/do this?

Your savings are not spare money. It has the important function of granting your financial safety, independence, and stability.

But you can put on your budget these variable expenses, and keep some percentage of your income for trips and parties.

You can even make second savings account for this purpose. Saving is one of the best ways to start saving money.

Auto-transfer is your friend

Whenever you can use technology in your favor, do it! Most accounts have the option to set an automated monthly transfer from your checking account to your savings account.

This will prevent you from forgetting about it and spending the money you shouldn’t spend.

Think long term

If you have zero savings right now, know that you are very vulnerable. If the effort to cut expenses and save money for months or years gets too rough, remember why you’re doing this and think long term.

This is just a small percentage of your life, and as soon as you reach your goal you’ll be able to enjoy the rest of your life knowing that you have an emergency fund.

Try to borrow or make things before you buy them

Before going to the stores or online shopping for everything you need, try to borrow from friends or family if you can.

Or search for DIY tutorials online to make or transform something instead of buying it. It will be interesting to learn something new and might help you save some money.

Take advantage of your credit card benefits

Some credit cards have many benefits that are never used by their cardmembers. Things like extended warranty, cellphone insurance, travel insurance, roadside insurance, or even discounts and rewards.

If your credit card offers a rewards program, see if you can get some cash back and optimize your spending according to your bonus categories if it has some. That is a great way to start saving money.

An essential step to saving money is to learn how to manage your bills. Follow the link below and get started with our tips!

How to manage your bills

Learn how to manage your finances to avoid debt and secure a healthy financial future!

About the author / Aline Barbosa

Trending Topics

Altitude® Go Visa Signature® Credit Card review

The US Bank Altitude® Go Visa Signature® Credit Card is perfect for your everyday spending needs. Check our full review to learn more!

Keep Reading

Online application to get your Current Visa debit card: Teach teenagers how to manage money

In this Current Visa debit card application guide we are going to show you, step by step, how to get this card.

Keep Reading

FNB Petro Credit Card review: Enjoy Fuel Discounts

Check out this FNB Petro Credit Card review and learn how this card can save you big on fuel purchases and offer free roadside repair.

Keep ReadingYou may also like

What does Open Banking means?

Open banking is here to change the way we deal with money management and banking services. Is it good? Keep reading to find out.

Keep Reading

Chase Ink Business Preferred Credit Card review: high ongoing rewards

In this Chase Ink Business Preferred Credit Card review you will learn about this card's high ongoing rewards and huge welcome bonus.

Keep Reading

BankAmericard® for Students review: 0% Intro APR and No Annual Fee

Build your credit with this credit card and pay no annual fee. Learn all you need to know in this BankAmericard® for Students review!

Keep Reading