Credit Cards

US Bank Cash+® Visa® Secured Credit Card review

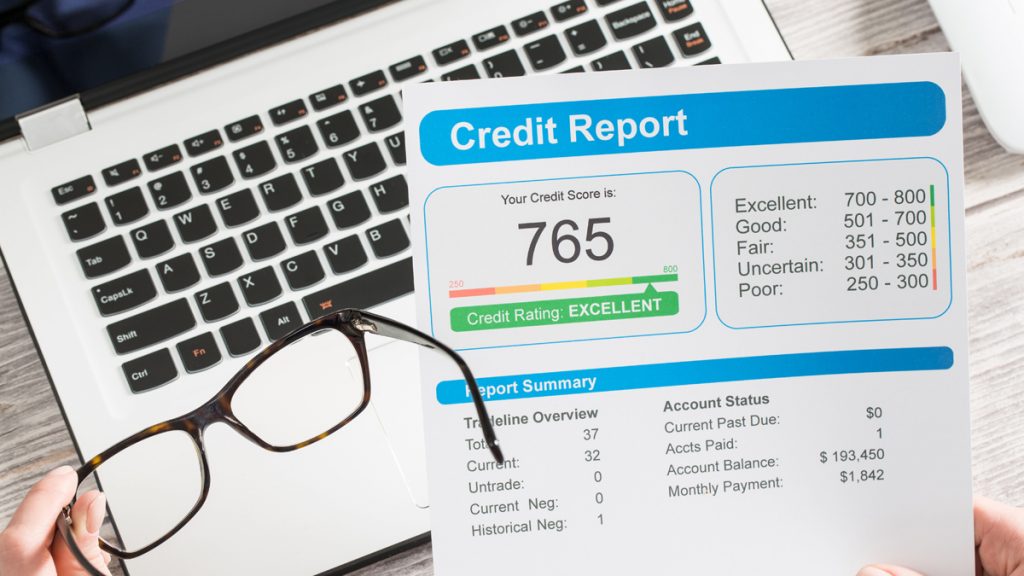

Looking for a secured credit card that can help you rebuild your credit score? Check out the U.S. Bank Cash+® Visa® Secured Credit Card, which comes with cash back rewards and no annual fee! Read our review below.

Advertisement

US Bank Cash+® Visa® Secured Credit Card: No annual fee and cash back rewards on purchases.

Did you know that one of the best ways to improve your credit score is by using a secured credit card? And with the U.S. Bank Cash+® Visa® Secured Credit Card, you can do much more than that. The card has no annual fee, provides 1% – 5% cash back on selected purchases, and is available for applicants with a bad score history.

Don’t let the mistakes of the past get in the way of your financial future. With this product, you’ll enjoy the purchasing power of a Visa card everywhere you go. By using the card responsibly, you’ll notice an increase in your score within months. Read on our full review to learn more about this product!

Get the U.S. Bank Cash+® Visa® Secured Card

Learn the full application process for the U.S. Bank Cash+® Visa® Secured Card and start earning rewards while building your credit score!

- Credit Score: You can apply even with a bad credit score.

- Annual Fee: There is no annual fee.

- Regular APR: This credit card has a 26.74% variable APR.

- Welcome bonus: There is no welcome bonus.

- Rewards: 1% – 5% cash back in eligible purchases.

U.S. Bank Cash+® Visa® Secured Credit Card: is it a good card?

The U.S. Bank Cash+ card requires a security deposit between $300 and $5,000. That deposit is refundable and will remain in a savings account accruing interests for as long as your account is active and in good standing. Your credit card limit is the same amount as said security deposit.

You can use your card anywhere in the world where Visa is accepted. There is a 5% cash back reward after spending $2,000 in combined purchases on two different categories. Not only that, but you also get 2% back on daily purchases like gas and groceries, and 1% back on all eligible purchases. You can redeem your earnings in statement credits, direct deposit or a U.S. Bank rewards card.

To help you repair your credit score, U.S. Bank reports all monthly payments to Equifax, Experian and TransUnion – the three major credit bureaus. By spending responsibly and paying your credit card bill when it’s due, the bank will automatically upgrade your card to the U.S. Bank Cash+® Visa Signature® Card. Upon upgrading the card, your security deposit is refunded to you.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

U.S. Bank Cash+® Visa® Secured Credit Card: should you get one?

The Cash+® Visa® Secured Credit Card is a great tool for people looking to rebuild or repair their credit scores. However, it can also be a powerful ally in reorganizing your finances and improving your spending habits. Even though there are many benefits to acquiring this card, you should know all the pros and cons before applying to it. See what they are below.

Pros

- There are no membership, monthly or annual fees;

- There’s a high rewards rate, with cash back varying from 1% to 5%;

- Reports all payments to the 3 major credit bureaus;

- U.S. Bank provides fraud protection and zero fraud liability;

- Easy account access via the bank’s mobile app;

- Cash back with bonus categories;

- Applicants with bad credit scores may be accepted.

Cons

- High APR of 26.74%;

- Spending caps on cash back rewards;

- No welcome bonus;

What is the required credit score?

Since this is a secured credit card that requires a security deposit for activation, people with a credit score ranging from 300 to 639 are welcome to apply. However, you will have to open an U.S. Bank savings account upon request.

If you need a product that will assist you on your journey to repair and rebuild your damaged score history, the U.S. Bank Cash+® Visa® Secured Credit Card is the perfect choice for you.

U.S. Bank Cash+® Visa® Secured Credit Card application

If you want to take the first step towards a better financial future, this credit card can help you get there. With no fees and cash back rewards, you’ll be able to improve your credit score in no time. To learn more about its easy application process, follow the link below!

Get the U.S. Bank Cash+® Visa® Secured Card

Learn the full application process for the U.S. Bank Cash+® Visa® Secured Card and start earning rewards while building your credit score!

About the author / Aline Barbosa

Trending Topics

Is The Post New safe?

We at The Post New strive to provide all the tools and resources to achieve a better financial future. Read on to learn about our website!

Keep Reading

How to get your OppFi® card: online application

In this OppFi® card application guide you will learn how to get this card with no security deposit even if you have bad credit.

Keep Reading

OpenSky® Plus Secured Visa® Credit Card review: get access to free credit score monitoring

Check out this OpenSky® Plus Secured Visa® Credit Card review and learn about this card's credit building capabilities.

Keep ReadingYou may also like

Delta SkyMiles® Platinum American Express Card review: Elite Perks and Miles Boosts

In this Delta SkyMiles® Platinum American Express Card review you will learn about this card's travel rewards, elite perks, and more!

Keep Reading

Is the crypto market going down?

Learn what you should care about as an investor while the crypto market is going down by reading this post.

Keep Reading

What is a bear market?

Learn what is a bear market, why it happens, how long they last and how you can navigate through it while protecting your finances.

Keep Reading