Credit Cards

US Bank Secured Visa® Credit Card review

Looking for a secured credit card? Check out the US Bank Secured Visa® Credit Card! This card has great features and benefits, like no annual fee and credit building tools!

Advertisement

US Bank Secured Visa® Credit Card: Establish a solid score with a real Visa purchasing power!

Are you looking for a convenient and reliable way to build (or rebuild) your credit? The US Bank Secured Visa® Credit Card is designed to help people who need an affordable path to establish a healthier credit history.

How to apply for US Bank Secured Visa® card

Learn how to apply for the US Bank Secured Visa® Card and get started on your path to building or rebuilding your credit history today!

- Credit Score: You can apply and get the U.S. Bank Secured with a bad credit score.

- APR: This card has a variable 28.49% APR on purchases. There’s also a 30.49% APR on cash advances.

- Annual Fee: Start your credit journey and pay ZERO annual fees with this card.

- Fees: The U.S. Bank Secured has a 3% foreign currency conversion fee, a 5% cash advance fee, and a late payment fee up to $41.

- Welcome bonus: There is no current promotion for the U.S. Bank Secured.

- Rewards: The U.S. Bank Secured does not offer any rewards on purchases.

The card is a great tool to help you improve your rating, with no annual fee, for an easier road to future financial success.

It also features convenient benefits like 24/7 customer service, giving you additional support as you learn how to manage your credit responsibly.

Plus, it’s backed by a major bank, so you can rest assured that your money is in good hands when using this card.

So, keep reading our US Bank Secured Visa® Credit Card review to learn more about this great option for building your financial future!

US Bank Secured Visa® Credit Card: how does it work?

The US Bank Secured Visa® Credit Card is the perfect way to build or rebuild your credit score! It works similarly to other credit cards, just with a deposit that’s used as collateral to insure U.S. Bank against default.

You’ll receive a card with a credit limit equal to the amount you deposit, which can be anywhere between $300 and $5,000.

The deposit will remain untouched in a U.S. Bank secured savings account and will earn interest for as long as your account is open.

Plus you get all the benefits of a U.S. Bank Visa® card, like worldwide acceptance (with a 3% foreign fee), online and mobile banking, $0 fraud liability, and more.

U.S. Bank also allows you to choose your payment due date to work around your payment’s schedule.

The US Bank Secured Visa® Credit Card monitors your account activity and makes regular reports to the three main credit bureaus in the United States.

So on-time payments and responsible use could help you build and establish a healthy score over time.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Next, we’ll review the ins and outs of the US Bank Secured Visa® Credit Card. Don’t miss out on all the info you need in order to make an informed choice about your financial future!

Benefits

- There are no membership fees to worry about while you build credit;

- You can qualify even with a low score;

- U.S. Bank reports all payments to Equifax, Experian, and TransUnion;

- You can choose your payment due date to work around your schedule;

- Get access to $0 fraud liability, account monitoring and mobile banking;

- Have the worldwide acceptance of a real Visa product.

Disadvantages

- You need to put down a security deposit of a least $300;

- There’s a very high variable APR – so on-time payments are a must;

- The U.S. Bank Secured has no rewards program;

- The U.S. Bank Secured charges a 3% foreign transaction fee.

Is a good credit score required for applicants?

You shouldn’t have any trouble qualifying for the US Bank Secured Visa® Credit Card as long as you can guarantee the $300 minimum deposit.

Since this is a secured card, the issuer is more lenient on granting its approval.

Learn how to apply and get a US Bank Secured Visa® Credit Card

If you’re looking to build or rebuild a strong credit history and gain access to more financial opportunities, getting a US Bank Secured Visa® Credit Card is a great solution.

Check the following link and learn everything you need to know about its application process.

How to apply for US Bank Secured Visa® card

Learn how to apply for the US Bank Secured Visa® Card and get started on your path to building or rebuilding your credit history today!

About the author / Aline Barbosa

Trending Topics

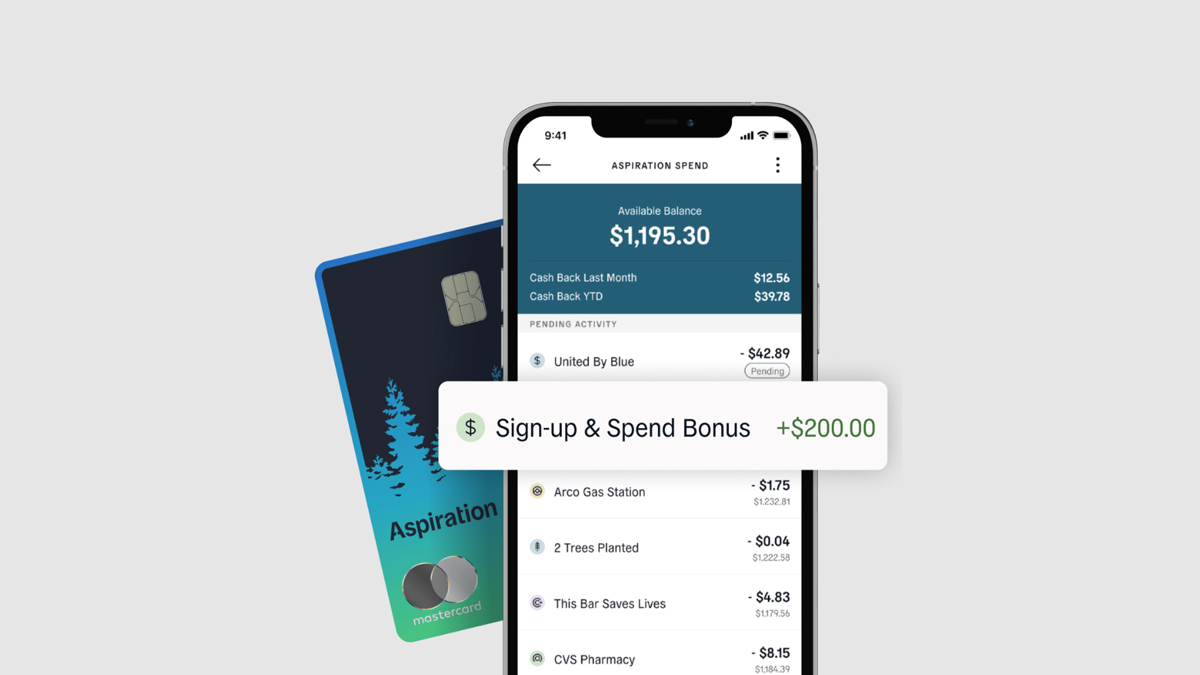

Aspiration Plus Account review

Are you looking for a new account with a high APY and great cash back rewards? Then check out this Aspiration Plus Account review.

Keep Reading

Susan G. Komen® Customized Cash Rewards credit card review

Looking for high cash back rewards with no annual fee? Check out the Susan G. Komen® Customized Cash Rewards credit card.

Keep Reading

Citi Rewards+® review: 0% intro APR and welcome bonus

The Citi Rewards+® credit card review will tell you about the 0% intro APR, 20,000 bonus points, Citi ThankYou Points, and much more!

Keep ReadingYou may also like

Discover it® Miles application: No annual fee

Trying to figure out how to get a nice mileage credit card? Read this Discover it® Miles application guide and learn how.

Keep Reading

How to open your Bask Bank Interest Savings account easily

In this Bask Bank Interest Savings account application guide, you will learn how to open it and earn more than 4% APY.

Keep Reading

Platinum Secured Card from Capital One application

Take the first step towards better credit and learn how to apply for the Platinum Secured Card from Capital One online and in minutes!

Keep Reading