Credit Cards

Verizon Visa Card Review: Unlocking Exclusive Benefits!

How about a credit card that can help you save on your bills with every swipe? Then meet the Verizon Visa Card! Explore the 4% cash back on groceries and gas, and 3% on dining and takeout.

Advertisement

Make your spending more rewarding, from earning Verizon Dollars to exclusive discounts!

If you’re curious to discover the financial wonders of the Verizon Visa Card, in this review, we’ll take you on a journey through the features, benefits, and potential drawbacks of this unique financial tool.

Whether you’re a devoted Verizon customer or simply seeking a credit card that can amplify your everyday spending, uncover the key details you need to make an informed decision.

- Credit Score: To be eligible for the Verizon Visa Card, a good to excellent credit score is typically required.

- Annual Fee: Enjoy the privileges of the Verizon Visa Card without the burden of an annual fee.

- Intro offer: The Verizon Visa Card welcomes new cardholders with an enticing introductory offer. When you spend $1,000 within the first 90 days of opening your account, you can receive a $100 statement credit, providing an instant boost to your financial journey.

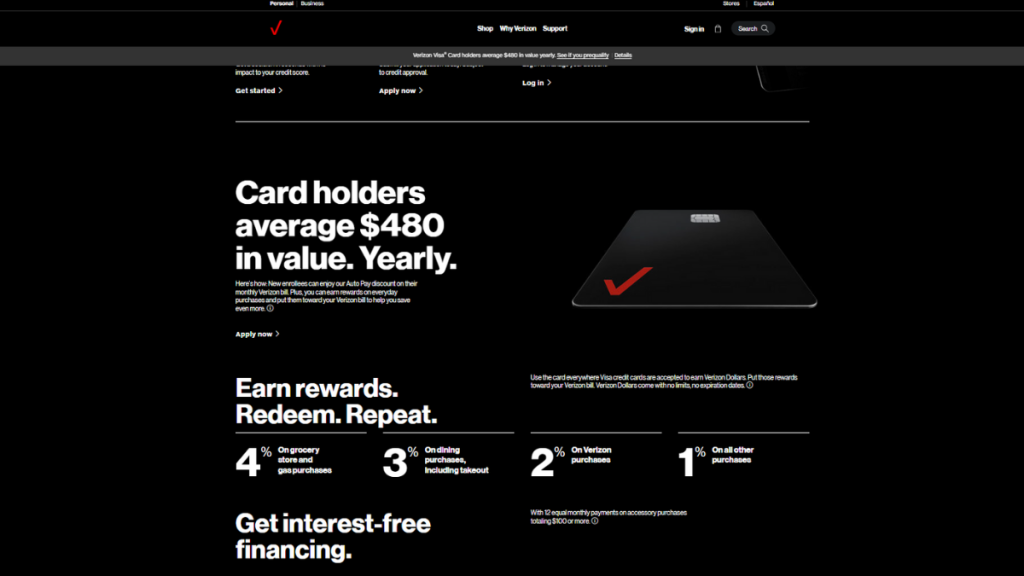

- Rewards: The Verizon Visa Card offers a rewarding cash back system. Cardholders can earn up to 4% cash back on grocery store and gas purchases, 3% on dining and takeout, and 2% on Verizon purchases. Additionally, 1% cash back is provided on all other purchases made with the card.

- APR: 26.99% to 30.99%.

- Other Fees: N/A

Verizon Visa Card: how does it work?

This is a credit card offering exclusive benefits tailored for Verizon customers in the United States. With no annual fee, this card can provide financial perks to those who want to maximize their savings.

One of the standout features of the Verizon Visa Card is its cash back program which you can review now. Cardholders can earn up to 4% cash back on groceries and gas, as well as 3% on dining and takeout.

Additionally, 2% cash back is offered on Verizon purchases and 1% cash back on all other purchases made with the card. This is a valuable way to offset everyday expenses!

Moreover, a key benefit of the Verizon Visa Card is the ability to redeem rewards as “Verizon Dollars.” Then, you can apply these Verizon Dollars to save on monthly Verizon bills.

The card also provides interest-free financing for accessory purchases totaling $100 or more, enabling cardholders to make essential tech upgrades without incurring interest charges.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

As you can see in this review, the Verizon Visa Card is a financial tool that can complement the lives of Verizon customers, offering a unique blend of rewards, savings, and convenience.

Benefits

- Lucrative cash back rewards;

- Verizon bill savings;

- Verizon Dollars come with no limits and no expiration dates;

- Interest-free financing;

- Generous introductory offer;

- Versatile redemption options.

Disadvantages

- Its benefits are primarily focused on Verizon-related expenses;

- Credit approval required;

- The highest cash back percentages are limited to specific spending categories;

- Restrictions on redemption;

- Not ideal for non-Verizon customers.

Is a good credit score required for applicants?

So, do you want to apply for a Verizon Visa Card after reading this review? Then keep it in mind it requires a good credit score for approval!

Moreover, it’s advisable to have a good to excellent credit score, typically in the range of 700 or higher. This will increase your chances of approval for the card and access to its benefits and rewards.

Learn how to apply and get the Verizon Visa Card

Applying online for the Verizon Visa Card is a straightforward and convenient process, and you can review the complete process below. This is the gateway to unlocking rewards and savings!

Learn how to get this credit card online

This step-by-step guide will walk you through the straightforward process of getting your hands on this card. Enhance your financial life!

- Eligibility check: Firstly, ensure that you meet the eligibility criteria. To apply for the Verizon Visa Card.

- Visit the Verizon website: Access the official Verizon Visa Card page. You can find it on the Verizon website at the bottom of the page. Then, click on “Apply now” to access the application form.

- Provide your personal information: Then, you’ll need to enter your personal information, including your name, contact details, social security number, and date of birth.

- Review and submit: Finally, review the information you’ve entered and submit your application for the Verizon Visa Card.

- Await credit approval: After you’ve submitted your online application, you’ll receive a credit decision. Then, if your application is approved, you’ll receive your card by mail, and you can begin enjoying its benefits!

What about another recommendation: Celebrity Cruises Visa Signature®!

If, after reading this complete review on the Verizon Visa Card, you still want to see other options, what about the Celebrity Cruises Visa Signature®? This card can take your travels to the next level!

Elevate your travel game with enticing cruise rewards, elite access to Celebrity Cruises’ offerings, and a range of travel perks! So, learn how it can make your travel dreams a reality below!

How to get your Celebrity Cruises Visa Signature®

Want to start earning travel rewards? Get a little helping hand with this Celebrity Cruises Visa Signature® application guide.

About the author / VInicius Barbosa

Trending Topics

Kohl’s Card review: Exclusive deals!

In this Kohl’s Card review you will learn how this card offers boosted rewards on department store purchases and much more!

Keep Reading

How to Watch NHL Games for Free Online

Get in the game with our guide and learn how to watch NHL games online for free on your mobile device. Discover the top streaming options!

Keep Reading

United Gateway℠ Credit Card review

Pay no annual fee and earn 3X miles on groceries. Check this United Gateway℠ Credit Card review and see how it works!

Keep ReadingYou may also like

African Bank Personal Loan review

The African Bank Personal Loan offers quick funding and personalised rates to fit your budget. Check our full review to learn more!

Keep Reading

FNB Aspire credit card application: Flexible Payment Terms and No Transaction Fees

Earn high rewards on spending with this credit card. Follow our FNB Aspire credit card application guide and get yours today!

Keep Reading

BankAmericard® Secured application: Access Credit Education

In this BankAmericard® Secured application guide you will learn how to get this card in just a few minutes.

Keep Reading