Credit Cards

Woolworths Black Review: Unveiling the Excellence

From complimentary coffee at Woolworths Cafe to enticing cashback rewards, the Woolworths Black Credit Card stands out in the crowd. Get a thorough understanding of its unique benefits!

Advertisement

This credit card is more than just a payment method, it’s a key to a world of exclusive benefits and privileges!

The Woolworths Black Credit Card is more than just a payment method, and in this review, you’ll explore the features, fees, and everything you need to know about this sleek financial companion.

Whether you’re an avid shopper, a coffee connoisseur, or a globe-trotter searching for adventure, this credit card has something for everyone. So, want to know more details?

Navigate through the intricacies of the Woolworths Black, taking a closer look at the associated fees, the enticing rewards that await, and the convenience it can bring to your everyday life.

- Credit Score: N/A;

- Annual Fee: Enjoy the perks of the Woolworths Black Credit Card with a reasonable monthly fee of just R69.00;

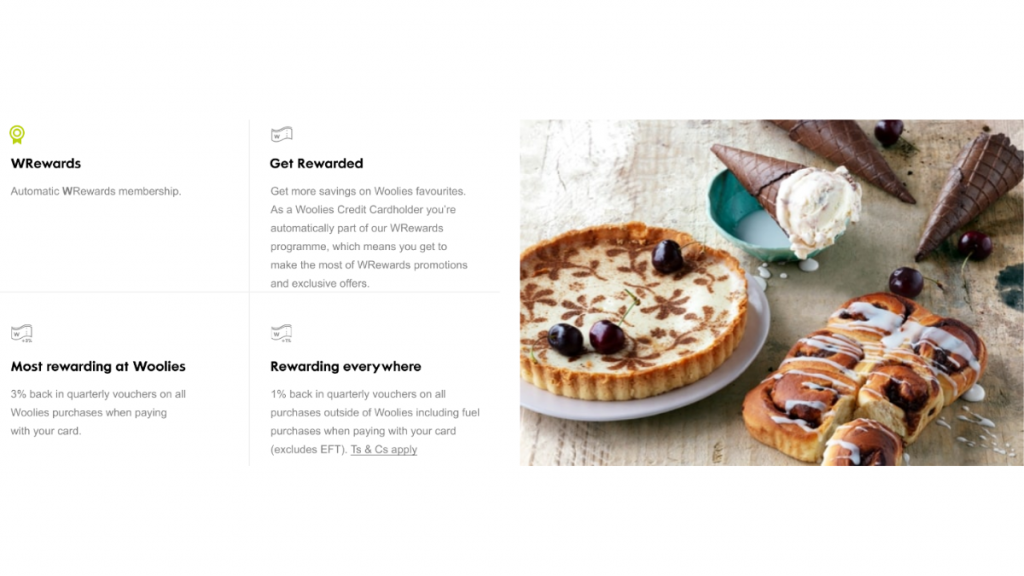

- Intro offer: None;

- Rewards: Cardholders can look forward to numerous rewards and benefits, including 3% back in WRewards quarterly vouchers on all Woolworths purchases, monthly free TASTE magazine vouchers, two complimentary coffees or teas at Woolworths Cafe each month, and 1% back in WRewards quarterly vouchers for purchases made outside of Woolworths;

- Interest rates: N/A;

- Other Fees: The Woolworths Black Credit Card includes several additional fees, such as an unpaid debit order fee of R128.00, an initiation fee of R144.00, and an international currency conversion fee of 2.5%.

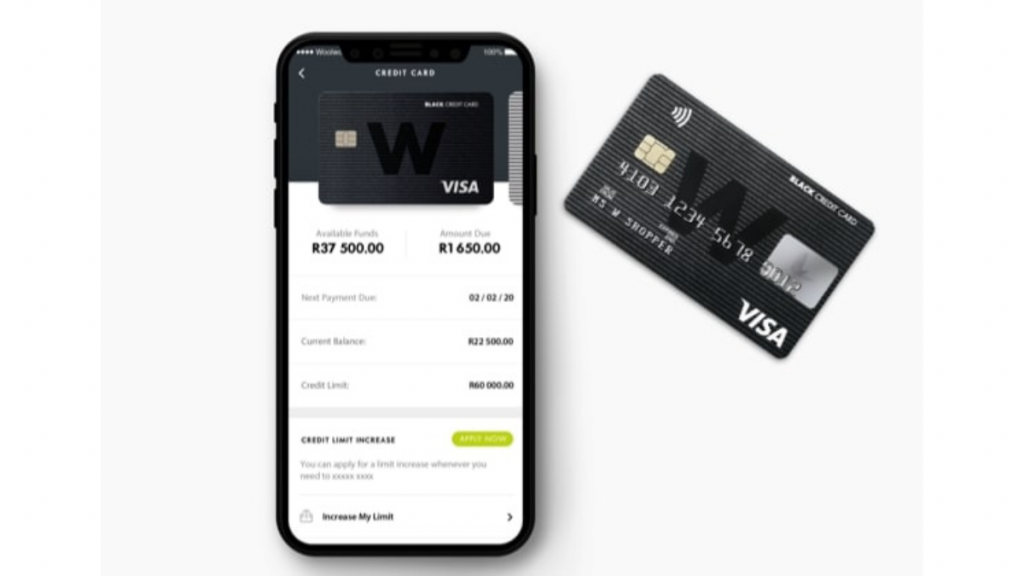

Woolworths Black Credit Card: how does it work?

The Woolworths Black is a premium financial companion that goes beyond the ordinary, as you’ll see in this review. With this card, you can expect exclusive rewards that enhance your shopping experience.

One of the card’s standout features is the opportunity to savor two complimentary hot beverages each month at Woolworths Cafe, adding a touch of luxury to your daily routine.

Besides, Woolworths Black is globally recognized and accepted by millions of merchants worldwide, wherever you see the Visa sign. This ensures that you can shop with ease wherever you are.

Additionally, the card comes with insurance coverage, including balance protection insurance and Visa Purchase Protection, offering peace of mind and extra protection for your purchases.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

The Woolworths Black Credit Card has garnered attention for its unique blend of benefits that you’ll review below. Furthermore, are you ready to explore this card’s features, fees, and more?

Benefits

- Enjoy an impressive 3% cashback in WRewards quarterly vouchers;

- Two free hot beverages each month at Woolworths Cafe;

- Free online delivery when shopping on the Woolworths website;

- This card is globally recognized;

- Balance protection insurance;

- Visa Purchase Protection.

Disadvantages

- Annual fee;

- Lack of a personal banker;

- Limited travel benefits;

- Absence of a Welcome bonus;

- International currency conversion fee;

- High-income requirement.

Is a good credit score required for applicants?

Although there’s no mention of a specific credit score, applicants must have a high income to apply for the Woolworths Black Credit Card. This includes a minimum monthly income of R41,666.00.

Besides, you must have a valid South African ID book or Smart card for identity verification. Financial documentation is also required, such as a recent payslip or three months’ worth of bank statements.

Additionally, you should have proof of your current residential address that is not over three months at the time of application. So, review your documents before applying for Woolworths Black.

Learn how to apply and get the Woolsworth Black Credit Card

Applying for a premium credit card is a strategic financial move that can unlock benefits. If, after this review, you want to apply for the Woolworths Black, you can see the step-by-step below.

Learn how to get this credit card online

You’re on the right track if you’re considering this elite card to elevate your shopping experience. Check it out!

- Check eligibility: Before applying, review the Woolworths Black Credit Card eligibility requirements.

- Visit the website: Go to the official Woolworths website and click the “Credit Cards” option on your left. Then, find the Woolworths Black and click to open.

- Application form: Access the application form online. This form will require you to fill in personal details such as income and other required data.

- Review and confirm: Review your information and submit the application electronically.

- Wait for a response: Once your application is submitted, the card issuer will review your information.

- Card delivery: If your application is approved, the Woolworths Black Credit Card will be issued, and you’ll receive it via mail.

What about another recommendation: FNB Aspire credit card!

If you’re exploring credit card options beyond the Woolworths Black, you can review the FNB Aspire Credit Card, a compelling alternative. After all, this is an amazing card with a unique blend of rewards.

With the FNB Aspire Credit Card, you’ll unlock a world of advantages, including cashback rewards, travel insurance, and attractive discounts. So, what about checking out all the details about this card?

Get a firsthand look at the features and benefits of the FNB Aspire Credit Card and make an informed decision! Your journey to enhanced financial choices and more rewarding credit cards begins now!

How to get your FNB Aspire credit card

Earn high rewards on spending with this credit card. Follow our FNB Aspire credit card application guide and get yours today!

About the author / VInicius Barbosa

Trending Topics

PREMIER Bankcard® Mastercard® Credit Card review

Are you looking for a product to help you fix your score? Then look at what the PREMIER Bankcard® Mastercard® Credit Card has to offer.

Keep Reading

How to apply for Upstart Personal Loans: fast approval!

Apply for Upstart Personal Loans today for fast approval and even faster funding. Get access to funding in as little as one business day.

Keep Reading

How to manage money stress-free in a marriage

Managing money in a marriage can be difficult. These tips will help you work together to achieve your financial goals. Read on for more!

Keep ReadingYou may also like

How to get your CIBC Aventura® Visa Infinite Card: online application

In this CIBC Aventura® Visa Infinite Card application guide, we'll show you how to get this card and start enjoying its awesome travel perks.

Keep Reading

Destiny Mastercard® Card application

Wondering how to get a Destiny Mastercard® Card? We will tell you everything you need to know about the application process.

Keep Reading

OpenSky® Plus Secured Visa® Credit Card online application: Improve your credit easily

Follow our OpenSky® Plus Secured Visa® Credit Card application guide to get this card and start improving your credit.

Keep Reading