Loans

Applying for Zippyloan: multiple offers with one application

In this Zippyloan application guide you will learn how to get a number of different loan offers with a single online form.

Advertisement

Zippyloan: apply in minutes and get a fast approval

This platform allows you to have lenders competing for your business by filling in a single application form. Check out our Zippyloan application guide.

Whether you are looking for a short-term or long-term loan, Zippyloan will help you find the right lender for your needs. Read our application guide and get your loan today!

How to apply for Zippyloan

Before we dive into the step-by-step of the Zippyloan application process, let’s review some of the platform’s requirements you must meet to increase your chances of getting your loan.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Eligibility requirements

Zippyloan does not have a number of different requirements you must meet to be eligible. However, you must be able to provide proof of regular income.

Also, some lenders may use their own methods for confirming your income, check your employment and credit standing, and whatever else they see fit.

Apply online by filling up the form

On Zippyloan’s main page, select the cash amount you will need, enter your ZIP Code and email address. Then, hit “Get started”.

After that, you will arrive on another page where you must select the purpose of your loan, your credit type, first and last name, as well as your date of birth.

Once you have filled in those fields, click on “continue to step 2”. Now you must enter your employment details.

Enter your primary source of income, your monthly income, how and how often you receive your pay, and the date of your next payday.

After doing that, hit “continue to step 3”. Then, on the next page, enter your phone number, home address, driver’s license number and state, as well as your Social Security number.

Further below, you must enter your deposit information. This includes your bank name, routing and account numbers. Do not forget to check both boxes at the bottom of the page.

The first box confirms that you are not a robot, and the second confirms that you agree to the Privacy Policy, E-Consent and Terms of Use of the platform

Submit and wait for your loan offer

Once you have filled in all the details, you can hit the giant “Submit Request” button at the bottom of the page. Congratulations! You will get your loan offers within seconds.

Another recommendation: Clear Money Loans

If you still can not quite find the right loan offer for your needs, how about trying a different loan aggregator?

Clear Money Loans is going to match you with lenders just like the previous platform.

However, since it is a different platform, we are also talking about different lenders. This means you will get access to offers you haven’t seen yet.

As soon as you submit your application lenders will be competing for your business.

This is a much more efficient way of shopping for loans, and you can borrow up to $35,000.

Sounds interesting? Then hit the link below and we will tell you everything you need to know.

Clear Money Loans review: get a loan easily

Read this Clear Money Loans review to find out how to get multiple loan offers through a single online application form.

About the author / Danilo Pereira

Trending Topics

Mission Money Visa® Debit Card review

If you’re looking for an easy and fee-free debit card to add to your wallet, the Mission Money Visa® Debit Card is a fantastic option!

Keep Reading

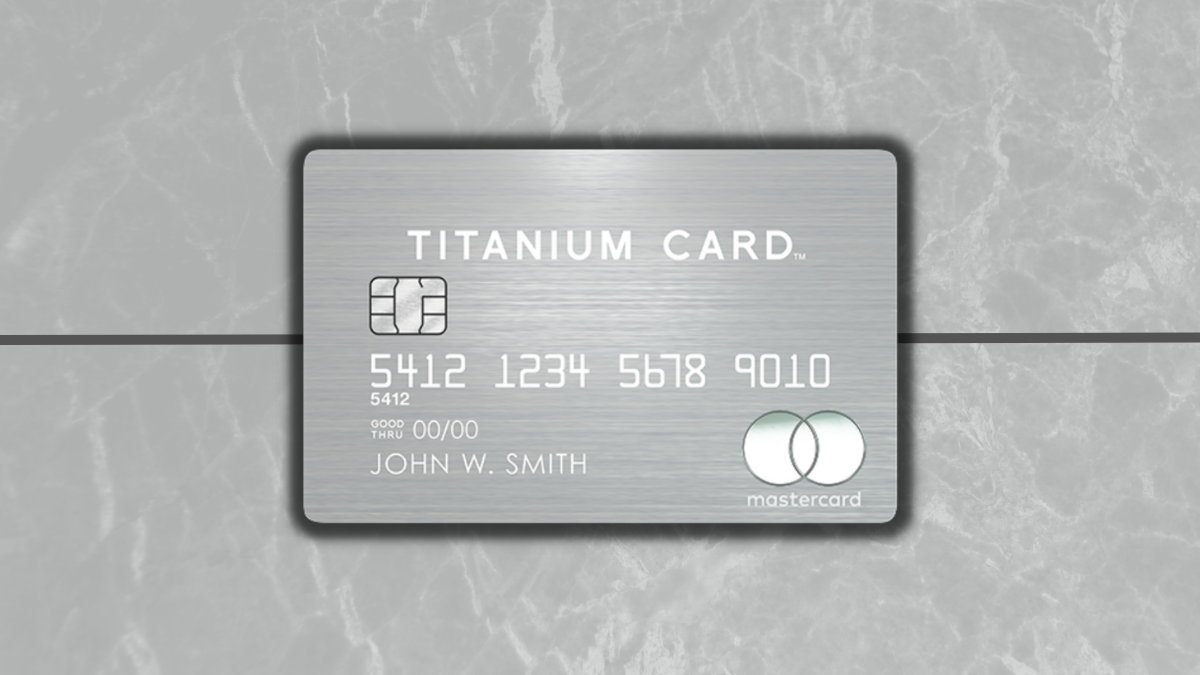

Mastercard® Titanium Card™ application

Learn how easy and secure the Mastercard® Titanium Card™ application process is and take a step towards luxury with a few simple clicks.

Keep Reading

Delta SkyMiles® Platinum American Express Card online application

The Delta SkyMiles® Platinum American Express Card application is simple! Keep reading to learn how to get this card in just a few minutes.

Keep ReadingYou may also like

United℠ Explorer card review: Get useful perks!

In this United℠ Explorer card review you will learn about this card's rich rewards and extremely handy perks. Check it out!

Keep Reading

Sanlam Personal Loans review: get a loan easily

If you are looking for a loan that you can use for multiple purposes, this is for you. Here is our Sanlam Personal Loans review.

Keep Reading

How to get your Chase Ink Business Preferred Credit Card: online application

In this Chase Ink Business Preferred Credit Card application guide, we are going to show you how to get this card quickly.

Keep Reading