Credit Cards

Total Visa® Credit Card review

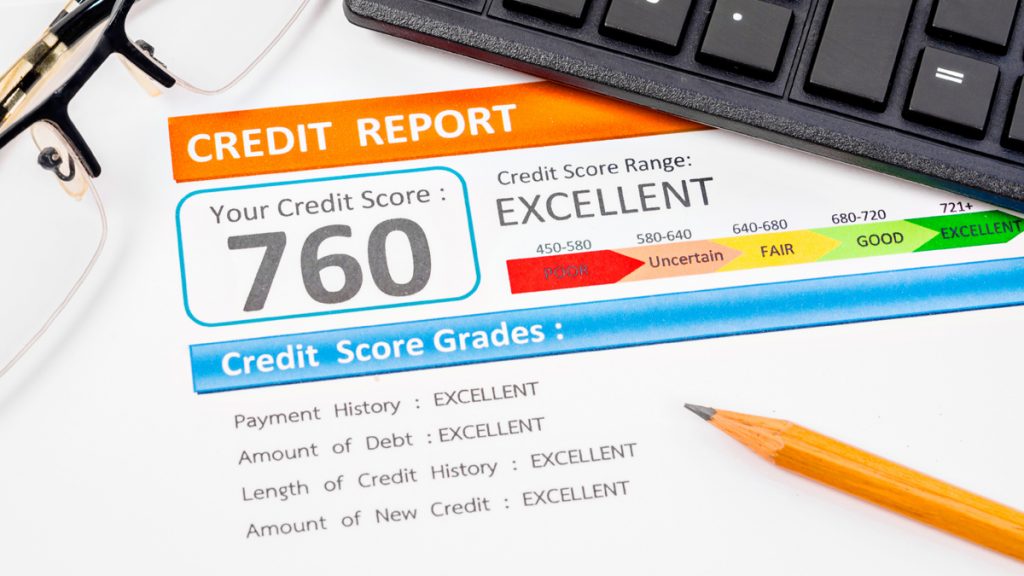

If you’re looking for an unsecured credit card that will help you repair your score and give you the purchasing power you need, then check out this Total Visa® Credit Card review.

Advertisement

Total Visa® Credit Card: Get a true Visa credit card even if you have poor credit!

Do you want a credit card but don’t have great credit? You’re in luck! The Total Visa® Credit Card is perfect for people who are looking to improve their credit scores. With this card, you’ll be able to start building your credit history and get on the path to a better financial future.

With responsible use, you can repair your damaged score in just a few months. Not only that, but you’ll be able to enjoy the purchasing power of a real Visa credit card. So don’t let the mistakes of the past get in the way of a better future. Read our full Total Visa® Credit Card review to learn how this card can help you achieve your financial goals.

How to get the Total Visa® Card?

Learn how to apply for a Total Visa® Card and get the purchasing power of a Visa card while you improve your credit score!

Check the card’s most prominent features below and keep reading to learn everything you need to know about this product. That way you can make an informed decision and see if this is the credit card you’ve been looking for.

- Sign-up bonus: There is no sign-up bonus.

- Annual fee: $75 during the first year and $48 after that.

- Rewards: There are no rewards with this card.

- Other perks: Monthly payment reports to credit bureaus.

- APR: 34.99%.

Total Visa® Credit Card: is it a good card?

Issued by The Bank of Missouri, the Total Visa® Credit Card has nationwide Visa coverage and you can use it to make purchases online and in-store. Since it’s an unsecured card, you won’t have to worry about putting down a security deposit in order to use it.

This is a card designed to help people with a less-than-perfect score to get their finances on track. So while it doesn’t offer a sign-up bonus or rewards on purchases, it reports all monthly payments to the three main credit bureaus in the U.S. That said, with responsible use, you’ll be able to rebuild your credit rating in no time.

You’ll need a checking account to apply for this card, and the initial credit limit is $300. All credit levels are welcome to apply, and the application process is simple – you get to know if the card is available to you within seconds.

The part where the Total Visa® Credit Card falls short is the amount of fees the company charges its cardholders. Meaning you’ll have to pay a one-time program fee of $89 to open your account. Then, a $75 annual fee during the first year of use (which is assessed as soon as the card’s issued to you, reducing your credit limit to $225), and $48 every year after that.

During the second year, you’ll also have to pay a monthly fee of $6.25. That accrues to $123 in fees every year you keep the card. The card’s regular APR is also one of the highest in its segment, at 34.99%.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Total Visa® Credit Card: should you get one?

While the card does a good job at helping customers repair their damaged score, there are also a few disadvantages of owning a Total Visa® Credit Card. See the pros and cons next so you can decide if this product is the right one for you.

Benefits

- All credit types are welcome to apply;

- Doesn’t require a security deposit;

- Reports all payments to credit bureaus.

Disadvantages

- There are a lot of fees;

- Doesn’t offer sign-up bonuses or rewards on purchases;

- High APR;

- Charges $89 for opening an account.

What is the required credit score?

Since this is a card made to help people rebuild their scores, all credit levels are welcome to apply. However, the institution takes more than your score into consideration for approval. However, the Total Visa® Credit Card has a fast and easy application process and you can learn if you’ve got the card in just a few seconds.

Total Visa® Credit Card application

If you’re interested in getting your financial life back on track, follow the link below to learn how to apply for a Total Visa® Credit Card. It’s easy, fast and you can do it from the comfort of your home.

How to get the Total Visa® Card?

Learn how to apply for a Total Visa® Card and get the purchasing power of a Visa card while you improve your credit score!

About the author / Aline Barbosa

Trending Topics

TFG Account online application: easy steps!

Find out how the TFG Money Account can fit into your financial strategy with our review, and learn about the online application. Read on!

Keep Reading

Milestone® Mastercard® Credit Card review

If you’re looking for an unsecured card to help you improve your credit rating, check out our Milestone® Mastercard® Credit Card review!

Keep Reading

Discover it® Student Cash Back credit card application

We'll tell you how to apply for a Discover it Student Cash Back credit card and get rewards in every purchase.

Keep ReadingYou may also like

Merit Platinum Card application

The Merit Platinum Card application process is simple, and you can do it online in just a few minutes. Read on to learn how to do it!

Keep Reading

MyLoan review: Up to R250,000!

If you need to borrow up to R250,000 with good loan terms and a trusted platform, read our MyLoan Co review to learn more!

Keep Reading

Ink Business Cash® Credit Card review: enjoy zero annual fee

In this Ink Business Cash® Credit Card review you will see how this card gives you an excellent welcome bonus, and much more!

Keep Reading