Credit Cards

Merit Platinum Card application

Applying for this card is quick and it doesn’t require any credit checks. See below how the process works so you can request yours today!

Advertisement

Merit Platinum Card: A series of exclusive benefits with no credit checks!

Having a bad credit score can limit a lot when it comes to finances. In this Merit Platinum Card application, we’ll show you an interesting alternative to that.

While you work your way up, it can be hard to have access to credit again without having to pay an ungodly amount of fees.

This card is not a Visa or Mastercard, but provides customers with purchasing power all the same.

For $14.77 a month, you’ll have access to an unsecured $750 credit line to shop at the Horizon Outlet online store. The card charges no APR, and there’s no activation fees.

Unfortunately, as of January of 2022, the card no longer reports monthly payments to credit bureaus.

That means it’s not a card meant for credit building. However, it offers 24/7 credit monitoring and identity theft insurance up to $1,000,000.

You’ll also have access to other membership benefits, like roadside and legal assistance. Plus, the Merit Platinum provides a prescription discount plan for drugstore purchases.

If you’d like to know more about how the Merit Platinum Card application process works, check the content below.

We’ll provide a complete walkthrough process so you can easily request your card.

Learn how to get this credit card online

The Merit Platinum Card online application is very easy, and you can have a response in minutes.

Just make sure you have your details in order. You’ll also need to be over 18 years old, have a credit/debit card and a valid checking or savings account.

First, access Merit’s official website. On the homepage, you’ll be able to notice a blank field requiring your email and zip code.

Fill out these out and check the boxes below. It’s also important to read their Fees, Rates, & Cost Disclosure before continuing.

Click on “continue activation process” and that will take you to the next page. Now, you must create your profile by entering your personal information where it’s required.

Then, inform Merit of your contact details, such as address and phone number.

After that, you need to provide them with your financial information. Once you’ve done that, you can click on “submit my profile”.

In the next page, you’ll have to inform your SSN and provide your credit or debit card information for billing.

Finally, you can click on “activate my card now” and that is it.

Merit might require you to confirm your credit card details, but you should readily receive all the necessary info to your new Merit Platinum Card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How to get this card using the app

Unfortunately, there is no mobile app available for this card. Therefore, you can’t go through with the Merit Platinum Card application on an application.

To request the card, you’ll have to follow the steps described on the topic above.

What about another recommendation: Group One Platinum Card

Horizon Card Services offers a series of different cards for your convenience.

If the Merit is not what you’re looking for, we recommend you take a look at the Group One Platinum Card.

The card also offers an unsecured credit line to shop at the Horizon Outlet and doesn’t require any credit checks.

Follow the link below to learn more about its features, perks and benefits.

Group One Platinum Card review

Get a life-long 0 % APR and a high initial credit limit with the Group One Platinum Card.

About the author / Aline Barbosa

Trending Topics

Blue Sky Financial Loans review: get a loan easily

In this Blue Sky Financial Loans review you will learn about how this incredible tool helps you find just the right loan for you.

Keep Reading

How to join and start banking with Crescent Bank?

Read this Crescent Bank application guide and learn how to join this bank to achieve your financial goals easily.

Keep Reading

Binance Crypto Card application process: use crypto in everyday purchases!

In this Binance Crypto Card application guide we are going to show you how to get this card to make real-world transactions with crypto.

Keep ReadingYou may also like

Delta SkyMiles Reserve Business review: 60,000 bonus miles and luxury travel benefits

The Delta SkyMiles Reserve Business credit card gives you access to airport-lounges and much more, as you can see in this review.

Keep Reading

United Gateway℠ Credit Card review

Pay no annual fee and earn 3X miles on groceries. Check this United Gateway℠ Credit Card review and see how it works!

Keep Reading

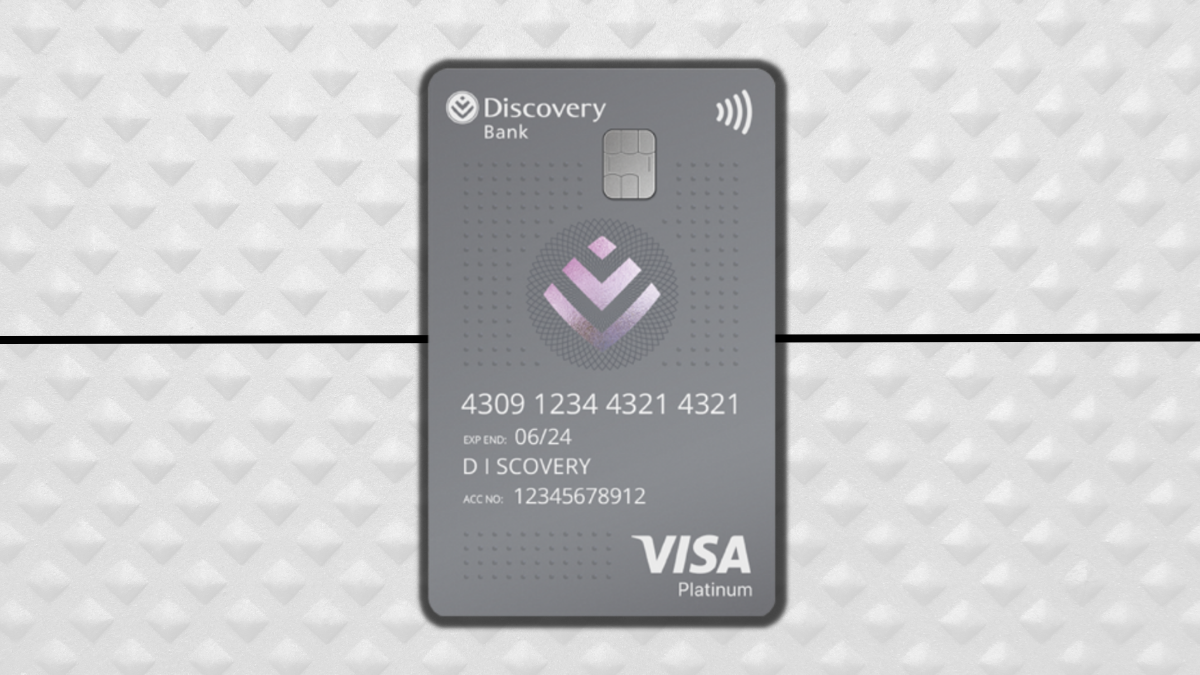

Discovery Bank Platinum Card application: Flexible credit facilities

In this Discovery Bank Platinum Card application guide you are going to learn how to get this card in just a few minutes.

Keep Reading