Credit Cards

African Bank Black Card Review: Discover the Elegance of Banking!

With the African Bank Black Credit Card you enjoy global acceptance, and revel in up to 62 days interest-free credit. This is your gateway to a world of exclusivity and sophistication! Learn more!

Advertisement

Earn while you spend, enjoy transparent pricing, and embrace a card that reflects your cosmopolitan lifestyle!

If you’re looking for a premium credit card that doesn’t cost a fortune in fees, it’s time to review the details of the African Bank Black Card. A financial masterpiece that transcends conventional expectations!

With interest-free credit on purchases, customizable transaction limits, and instant card issuance, the African Bank Black Card transcends the conventional boundaries of credit cards! Learn more!

- Credit Score: Though not specified, a premium card such as this usually requires a good to excellent score.

- Annual Fee: Monthly service fee of R65.00, totaling to an annual fee of R780.00.

- Intro offer: N/A.

- Rewards: The main rewards program for this card is the chance to earn interest on a positive balance.

- P.A.: N/A.

- Other Fees: Additional fees include a card replacement fee of R130.00 and an initiation fee of R140.00.

African Bank Black Card: how does it work?

Issued by one of the leading financial institutions in South Africa, this credit card is a testament to financial sophistication. So, keep reading and reviewing the details of the African Bank Black Card.

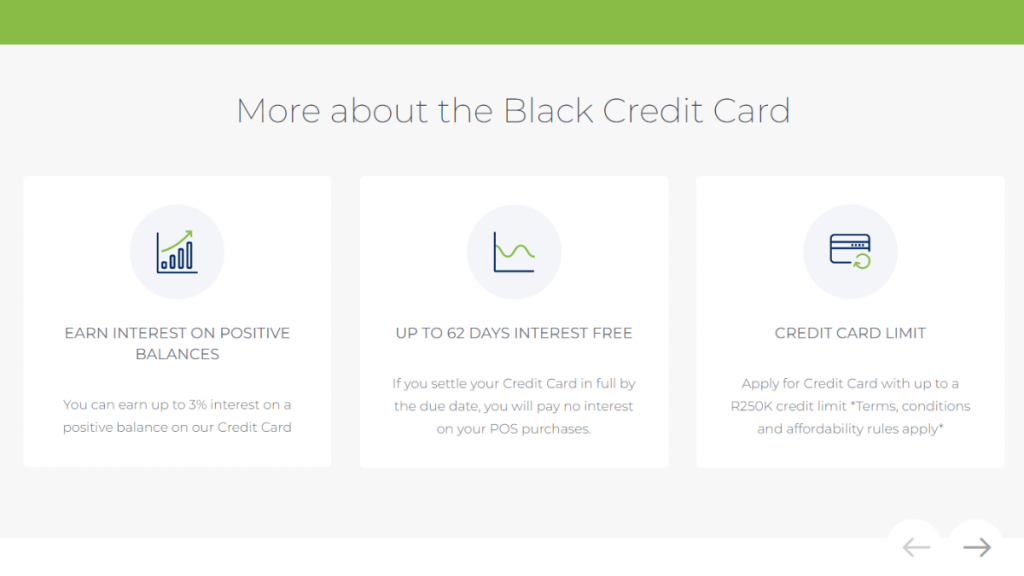

One of the standout features is the ability to earn up to 3% interest on a positive balance, turning your routine purchases into a means of increasing your financial assets.

Furthermore, beyond the earning potential, the card ensures a seamless and secure transaction experience.

Accepted globally at all Visa-affiliated merchants and ATMs, it provides the flexibility to use your card wherever your travels take you.

Moreover, the card offers up to 62 days of interest-free credit on point-of-sale and online purchases, empowering you with financial flexibility and peace of mind.

Besides, managing your card is easy through a range of free online and mobile services. It provides instant gratification, with personalized and embossed cards issued immediately upon approval.

In terms of eligibility, applicants need to be at least 18 years old and provide proof of income, ensuring a stable financial standing. But, the application process can be completed online in a few minutes.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Although the African Bank Black Credit Card offers a wide range of possibilities to enhance your lifestyle, it’s essential to review the pros and weigh the drawbacks to make an informed decision.

Benefits

- Transform your financial landscape into potential growth with 3% interest on a positive balance;

- 62 days of interest-free credit;

- Personalized and embossed cards were issued promptly;

- Seamlessly engage with a credit card that embraces global acceptance;

- Enjoy the convenience of complimentary online and mobile services.

Disadvantages

- Absence of an introductory bonus;

- Monthly service fee;

- Prospective cardholders should take note of the initiation fee.

Is a good credit score required for applicants?

As mentioned before in this review, the specific credit score requirements for the African Bank Black Credit Card aren’t explicitly disclosed.

However, creditworthiness is typically a crucial factor in the approval process for credit cards. So, it’s important to maintain a positive credit history to increase your chances of getting this card.

Learn how to apply and get the African Bank Black Card

Securing your very own African Bank Black Card involves a straightforward and hassle-free step-by-step you can review below.

From gathering the necessary documents to navigating the online application, each step brings you closer to a credit card that unlocks a spectrum of benefits.

Learn how to get this credit card online

So, the application process is designed for ease, allowing prospective cardholders to initiate their path to exclusivity. Find out now!

- Navigate the website: Explore the official African Bank website by navigating to the dedicated “Credit Cards” section, where a wealth of comprehensive details about the African Bank Black Credit Card awaits your review.

- Application form: Start the application process seamlessly by simply selecting the “Apply Now” button, setting in motion the steps to unlock the potential of this exclusive financial tool.

- Review and submit: Provide your personal information, contact details, and financial specifics through the intuitive online application form. Once you’ve completed the form, submit it, propelling your application forward for consideration by the bank.

- Wait for approval: If your application is approved, the final step is a visit to any African Bank branch, where you can collect your personalized card on the spot.

What about another recommendation: Check out the Super Value Titanium Card!

If you think the African Bank Black Card isn’t really the right choice for you, then review the Super Value Titanium Card and check out its competitive advantages! You can get both savings and spending power.

Earn rewards, enjoy cost-effective transactions, and revel in the convenience of a credit card tailored for the practical consumer. Further, uncover the details of its rewards program, fee structure, and exclusive features!

Super Value Titanium Card Review

Discover the power of savings in this Super Value Titanium Card review! Enjoy 5% cashback on fuel, phone bills, and utility payments!

About the author / VInicius Barbosa

Trending Topics

Delta SkyMiles® Platinum American Express Card review: Elite Perks and Miles Boosts

In this Delta SkyMiles® Platinum American Express Card review you will learn about this card's travel rewards, elite perks, and more!

Keep Reading

Rescue One Financial Review: Escape Debt’s Grip!

Review the Rescue One Financial Loans and say goodbye to financial stress with personalized solutions and debt reduction!

Keep Reading

How to get your Chase Ink Business Preferred Credit Card: online application

In this Chase Ink Business Preferred Credit Card application guide, we are going to show you how to get this card quickly.

Keep ReadingYou may also like

Cigna Health Care Insurance Plans: Transforming Lives

Get the facts about how Cigna Health Care Insurance Plans can improve your life with its full range of coverage options.

Keep Reading

Watch UFC live online on your smartphone or tablet!

Want to watch UFC fights anytime, anywhere? Our blog post highlights the must-have mobile apps to watch UFC online on mobile apps!

Keep Reading

Upgrade Bitcoin Rewards Visa review: earn 1.5% cash back in the form of bitcoin

In this Upgrade Bitcoin Rewards Visa review you will see how you can earn 1.5% cash back in the form of bitcoin.

Keep Reading