Credit Cards

Super Value Titanium Card Review: Effortless Rewards!

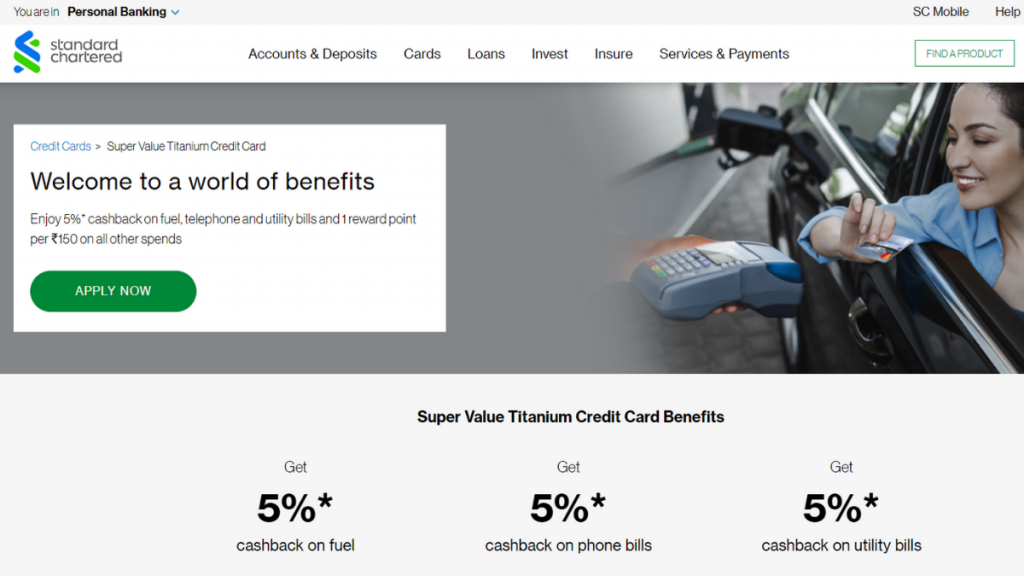

Fuel your savings with the Super Value Titanium Credit Card from Standard Chartered. With features like cashback on fuel and utility payments, this card is designed for your financial convenience!

Advertisement

Earn rewards on every spend, get a contactless card, and experience the convenience of secure online transactions!

Gear up for a thorough review of financial empowerment with the Super Value Titanium Credit Card from Standard Chartered. This card is a game-changer in a world where every expense counts!

As we navigate through the intricacies of this card, discover how it transforms your routine expenditures into substantial savings. Get a complete picture of the value it adds to your financial portfolio!

- Credit Score: Good to excellent.

- Annual Fee: Initial annual fee of INR 750. Then, the renewal fee will be from the second year onward.

- Intro offer: N/A.

- Rewards: Reap the rewards with a solid 5% cashback on fuel, phone bills, and utility payments, rendering this card a pragmatic selection for your day-to-day expenditures. Additionally, for every INR 150 spent on other purchases, you accumulate 1 reward point, allowing you to redeem points for vouchers, discounts, and other enticing offers.

- P.A.: N/A.

- Other Fees: N/A.

Super Value Titanium Card: how does it work?

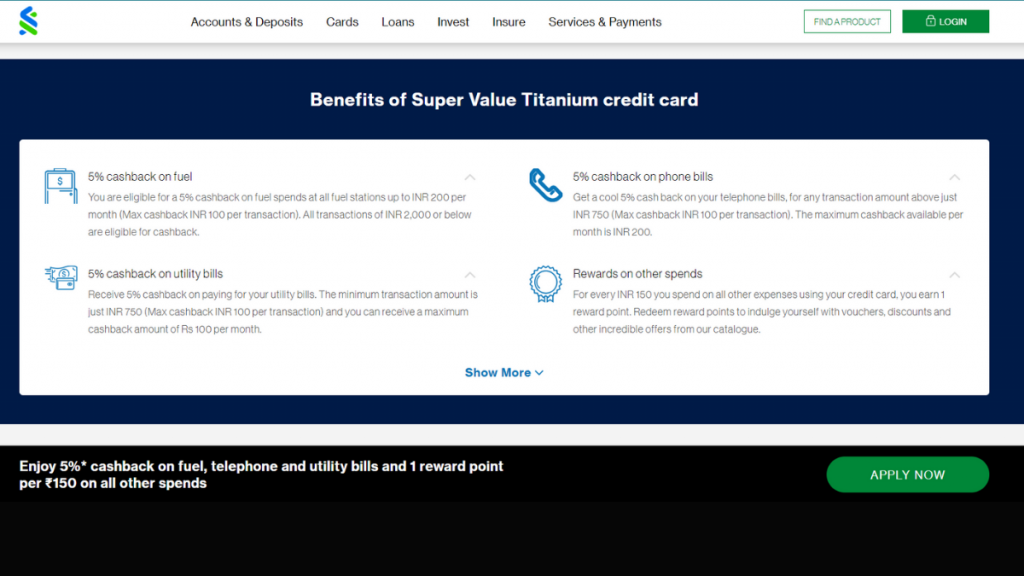

The Super Value Titanium Card from Standard Chartered is designed to be your key to unlocking substantial savings on everyday expenses, and you can review its main features now.

Firstly, its cashback program stands out, offering 5% on fuel. Besides, you also get cashback on phone bills and utility payments. This transforms routine transactions into opportunities for financial rewards.

However, note that the cashback benefits extend to fuel transactions of INR 2,000 or below, utility bills above INR 750, and phone bills exceeding the same threshold.

In addition to the cashback benefits, delve into a rewarding program where each expenditure of INR 150 on miscellaneous purchases adds up to earn you 1 valuable reward point.

Later, you can redeem these reward points for a variety of options.

Moreover, the card incorporates features such as contactless payments and balance transfers of up to INR 5,00,000 into convenient EMIs with zero fees.

However, acquiring the Super Value Titanium Card mandates that applicants uphold a stable monthly income of at least INR 55,000. Additionally, exercise caution regarding the annual fee set at INR 750.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

If you think the Super Value Titanium Credit Card is ideal for you, a thoughtful review of both sides of the coin is required to make an informed choice.

So, weigh the benefits and drawbacks of this card and decide if it’s indeed tailored to your lifestyle and preferences.

Benefits

- 5% cashback bonanza on utility bills, fuel and more;

- For every INR 150 spent on other purchases, earn reward points;

- Contactless payments;

- User-friendly mobile app;

- Priority Pass membership for some customers.

Disadvantages

- Challenging eligibility criteria;

- Annual fee and renewal fee;

- Regional restrictions.

Is a good credit score required for applicants?

So, for the Super Value Titanium Credit Card, a good credit score, typically acknowledged as 700 or higher, increases the likelihood of approval.

Learn how to apply and get the Super Value Titanium Card

Feeling ready to get your Super Value Titanium Card? Financial decisions are at our fingertips in the digital age, and obtaining this credit card is no exception.

Whether you’re drawn to the enticing cashback benefits or the prospect of a comprehensive rewards program, the online application ensures a hassle-free way to access this card!

Learn how to get this credit card online

So, let’s delve into the intricacies of initiating your application for the Super Value Titanium Credit Card.

- Visit the bank’s official website: Firstly, visit the authorized website, find your way to the “Cards” segment, opt for the Super Value Titanium Card, and click to review its details.

- Start the application process: If you’re sure this is the right card, click “Apply Now” and provide the required personal details. This includes your name, contact information, date of birth, and residential address.

- Submit documents: Upload the necessary Know Your Customer (KYC) documents, which may include proof of identity, address, and income.

- Approval: After submitting your application, await the bank’s response. The application will be processed, and you will be notified of the next steps upon approval.

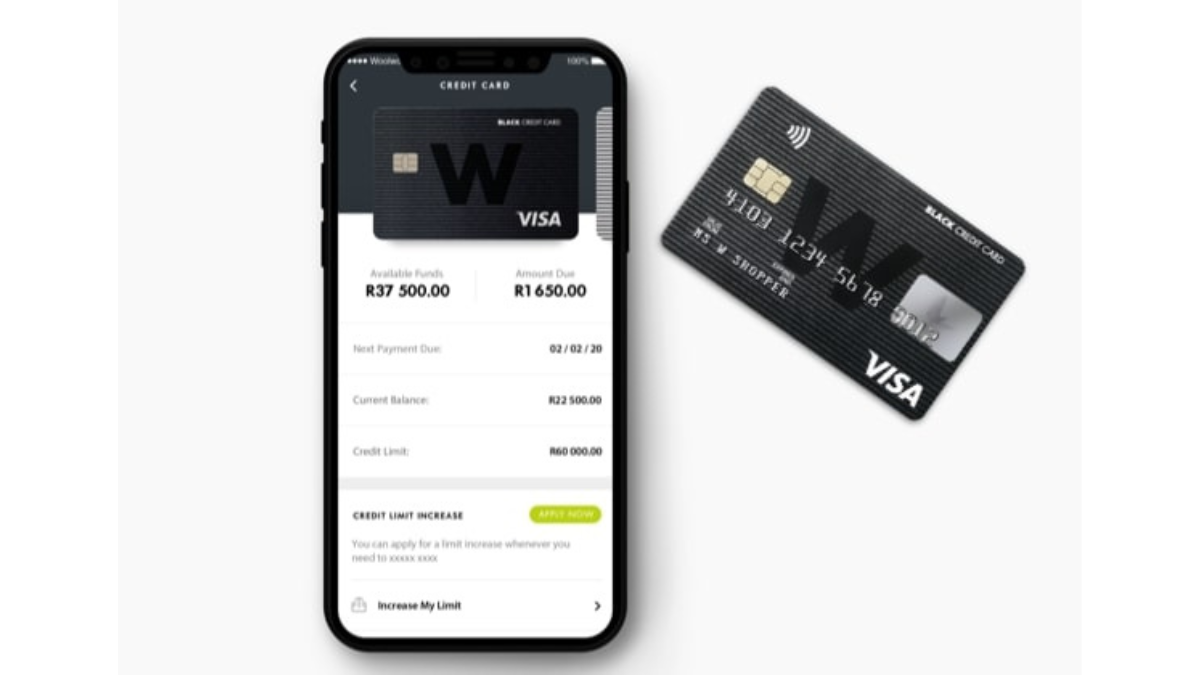

What about another recommendation: Check out the Woolworths Black Card!

After this comprehensive review, do you know if the Super Value Titanium Card is right for your lifestyle? Then, meet the Woolworths Black Credit Card!

Indeed, with a dedicated focus on enhancing your lifestyle, the Woolworths Black Credit Card presents an intriguing option for those who want to merge financial prudence with exclusive privileges.

Whether you’re a savvy shopper, a culinary enthusiast, or someone who appreciates the finer things in life, discover all the features the Woolworths Black Card has to offer!

Woolworths Black Review: Unveiling the Excellence

Elevate your shopping game! Discover the advantages that go beyond ordinary credit cards in this Woolworths Black review.

About the author / VInicius Barbosa

Trending Topics

PCB Secured Visa® card application

Apply for your PCB Secured Visa® to enjoy the benefits of having a credit card. And don't worry about your credit score.

Keep Reading

PenFed Gold Visa® credit card review: One of the lowest purchase APRs in the market

Would you like to enjoy one of the lowest purchase APR in the market? If you do, read this PenFed Gold Visa® review!

Keep Reading

BadCreditLoans application: Get multiple loan offers

In this BadCreditLoans application guide, you will learn how to use this platform to find just the right loan for your needs within minutes.

Keep ReadingYou may also like

Mission Lane Visa® Credit Card application

Learn all about the Mission Lane Visa® Card application process and how this credit card can set you on the right credit-building path.

Keep Reading

Credit One Bank® Platinum Rewards Visa with No Annual Fee review

This Credit One Bank® Platinum Rewards Visa with No Annual Fee credit card review is what you need to see if this card is for you.

Keep Reading

X1 Card application: learn how to get this credit card!

Navigate all of the steps in the X1 Card application process with our comprehensive, step-by-step guide. Read on and learn how to get yours!

Keep Reading