US

Rescue One Financial Review: Escape Debt’s Grip!

Discover how Rescue One Financial Loans can help you tackle debt. You can lower payments, enjoy expert guidance, and more! A debt-free future is just a click away. Learn more!

Advertisement

Tailored debt relief programs, lower credit card payments, and your path to financial freedom!

Feeling like the weight of debt is an insurmountable burden in your life? Then, explore this comprehensive review on Rescue One Financial and unveil debt relief programs that have transformed lives.

With expert guidance and a commitment to personalized solutions, Rescue One Financial paves the way to lower credit card payments, reduced stress, and, ultimately, greater financial peace.

- APR: N/A.

- Loan purpose: Credit card debt, personal loans, medical bills, or other forms of unsecured debt.

- Loan amount: The company offers a range of loan amounts.

- Credit needed: Rescue One Financial is committed to helping individuals with varying credit scores.

- Terms: Loan terms at Rescue One Financial are designed to align with the client’s financial goals, offering a variety of term lengths to ensure manageable monthly payments.

- Origination fee: N/A.

- Late fee: N/A.

- Early payoff penalty: Don’t impose early payoff penalties.

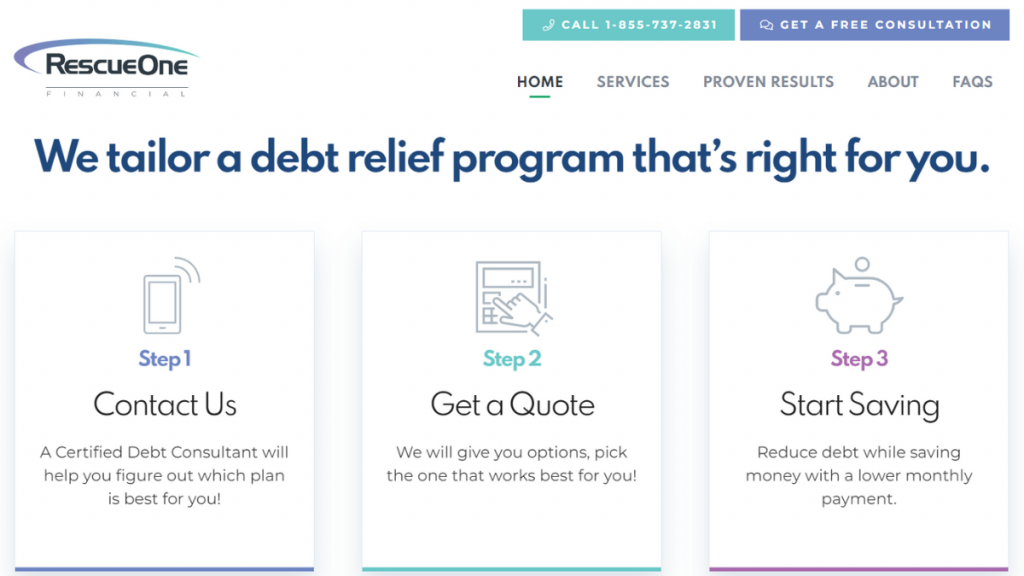

Rescue One Financial: how does it work?

In this Rescue One Financial review, you’ll uncover the workings of a partner in debt relief. Firstly, it operates on a simple yet effective principle: personalized financial solutions for people burdened by debt.

It begins by connecting clients with Certified Debt Consultants who assess their unique financial situations. Furthermore, these experts help clients choose the most suitable debt relief plan.

The company then helps clients by negotiating with creditors to reduce interest rates, making monthly payments more manageable.

Moreover, Rescue One Financial’s focus on credit card debt, personal loans, medical bills, collections, and certain student loans provides a comprehensive solution for various forms of unsecured debt.

Besides, with flexible loan terms and no early payoff penalties, Rescue One Financial empowers clients to regain control of their finances. The result? A clear path to financial freedom!

Through partnerships with major banks and credit card companies, it helps clients achieve financial goals. Their proven program typically enables clients to become debt-free in 24-48 months!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

When it comes to finding relief from the burden of debt, Rescue One Financial shines as a beacon of hope, but it’s important to carefully review the pros and cons before you apply.

Although their commitment to personalized solutions and transparent guidance sets them apart in the world of debt relief, you should weigh all the possibilities to make a smart financial decision.

Benefits

- Personalized debt relief solutions;

- Reduced credit card payments;

- Transparency and trustworthiness;

- No early payoff penalties.

Disadvantages

- Services may not be suitable for every financial situation;

- Participating in a debt relief program can have a short-term impact on your credit score.

Is a good credit score required for applicants?

So, Rescue One Financial doesn’t explicitly require a good credit score for applicants.

They offer solutions designed to accommodate a wide range of credit profiles, including those working to rebuild their credit.

Rescue One Financial application

Rescue One Financial Loans offers an online application process that streamlines the journey to debt relief that you can review now!

So regain control of your finances from the comfort of your home!

- Visit the website: Firstly, begin your journey by visiting the official Rescue One Financial website. There, click on “View Services” to find a wealth of information about their debt relief programs.

- Request a quote: Once you’ve familiarized yourself with the company’s services, click on “Free Consultation” and fill out the information required. Rescue One Financial’s online application is designed to be user-friendly. The application will typically include details such as your contact information, the types and amounts of debts you wish to address, and your financial goals.

- Begin your journey to financial freedom: When your application is submitted, Rescue One Financial will work to create a debt relief plan that suits your unique needs. Their goal is to negotiate with creditors and provide solutions that help you reduce your debt and enjoy a more manageable financial future.

What about another recommendation: SoFi Personal Loans!

While Rescue One Financial provides a solid platform for debt relief and personalized solutions, it’s essential to explore and review alternative options before making your financial decision.

Also, the SoFi Personal Loans stand as a compelling alternative, offering unique benefits that may align closely with your financial aspirations. Curious to learn more? Then, click below to explore a full review!

Learn hwo to apply for a SoFi Personal Loan!

Get step-by-step instructions on how to apply for the SoFi Personal Loans. Learn about the eligibility requirements and more!

About the author / VInicius Barbosa

Trending Topics

What is a crypto card?

Read on and find out exactly what is a crypto card, and whether they present the best opportunity for your financial growth.

Keep Reading

Chase Freedom Unlimited® or Chase Freedom Flex℠? Choose the best card!

Chase Freedom Unlimited® or Chase Freedom Flex℠, which one is better? In this post, we’ll break down their features to help you choose.

Keep Reading

Free Audio Books to Listen: A Comprehensive Guide to Accessing Engaging Content!

Discover the secret to enjoying the best audiobooks free to listen! Your gateway to a world of engaging narratives absolutely free!

Keep ReadingYou may also like

First Progress Platinum Elite Mastercard® Secured application

Learn everything you need to know about the First Progress Platinum Elite Mastercard® Secured Card application process and apply today!

Keep Reading

Wise Debit Card application

Check this walkthrough of the Wise Debit Card application process and learn how to easily request your multi-currency card online.

Keep Reading

Absa Student Credit Card online application

Looking to get a student credit card that helps you build credit? With this Absa Student Credit Card application guide you can!

Keep Reading