Credit Cards

Altitude® Go Visa Signature® Credit Card review

Learn about what the US Bank Altitude® Go Visa Signature® Credit Card has to offer and why it may be the perfect credit card for your everyday needs!

Advertisement

Altitude® Go Visa Signature® Credit Card: Go further with a card that matches your style!

The US Bank Altitude® Go Visa Signature® Credit Card is designed to help you enhance your rewards while keeping things simple. With this card, you can earn 4 points on all eligible dining experiences, plus 2 points on gas and grocery purchases – all with no annual fee!

- Credit Score: Excellent.

- APR: The card offers a promotional 12-month period of 0% on purchases and balance transfers. A variable 19.24% – 28.24% applies after that.

- Annual Fee: Save even more with a $0 annual fee to this card.

- Fees: Max late fee up to $41. Cash advance fee is $10 or 5%.

- Welcome bonus: Earn 20,000 bonus points (worth $200) once you spend at least $1,000 during the first 90 days of card membership.

- Rewards: You’ll get a great rewards rate with 4x points on dining (including takeout and delivery services). 2x points at grocery stores (and grocery delivery), gas stations (and EV charging stations) and popular streaming platforms. All other eligible purchases will give back a 1x flat rate.

How to apply and get a Altitude® Go Credit Card

Learn how you can easily apply online for an US Bank Altitude® Go Visa Signature® Credit Card and start earning valuable rewards on your daily expenses!

For those times when you need a little extra help, US Bank offers 0% intro APR on both balance transfers and purchases for the first 12 billing cycles after account opening. So you can get the most out of your card and start earning rewards today!

To learn all the ins and outs of the Altitude® Go Visa Signature® Credit Card, keep reading our review. We’ll tell you exactly why this might be the perfect card to help you upgrade your daily spending.

Altitude® Go Visa Signature® Credit Card: how does it work?

The US Bank Altitude® Go offers flexibility and rewards that can help make your life a breeze! With no annual fee, an introductory APR of 0% and the ability to earn exquisite points on everyday expenses, you can only win with this card.

Every time you swipe your Altitude® Go Visa Signature® Credit Card, you’ll be racking up rewards points. You can easily redeem them online for whatever benefits you the most. From gift cards to money directly into your account.

As a new cardholder, you’ll also be able to enjoy a bountiful intro offer worth $200 in redemptions. To keep you entertained all year round, US Bank even provides a yearly $15 streaming bonus you can use at the most popular streaming platforms available.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

The US Bank Altitude® Go Visa Signature® Credit Card certainly has some great features. But do its drawbacks make it worth your while? Compare them below for a better understanding.

Benefits

- You’ll earn one of the best rewards rate on dining experiences in the market;

- You’ll be rewarded for daily expenses with no limits or restrictions;

- Earn and save at the same time, including internationally, with no annual and foreign transaction fees;

- Get a $15 annual streaming bonus to keep you entertained;

- If you need a little hand with big purchases or credit card debt, the 12-month 0% APR will truly help you.

Disadvantages

- This is a card that’s not available to most applicants as it requires an excellent score;

- The regular APR you might end up with can be incredibly high.

Is a good credit score required for applicants?

Yes. While US Bank takes much more than your score into consideration, you’ll have a better shot at approval if your score is above 750. However, it’s important to note that only an excellent score is no guarantee you’ll get this card.

Learn how to apply and get a Altitude® Go Visa Signature® Credit Card

If you believe you are able to qualify for this card, the application process is as simple as it can be. Check the following link to learn more details about it and how you can get your Altitude® Go Visa Signature® Credit Card today!

How to apply and get a Altitude® Go Credit Card

Learn how you can easily apply online for an US Bank Altitude® Go Visa Signature® Credit Card and start earning valuable rewards on your daily expenses!

About the author / Aline Barbosa

Trending Topics

Delta SkyMiles® Gold American Express credit card application

Applying for a Delta SkyMiles® Gold American Express credit card can give you travel benefits. Learn how to get this card!

Keep Reading

How to Prepare Financially for a Big Trip

Traveling requires more than booking flights and hotel reservations. Read on and find out how to prepare financially for a big trip.

Keep Reading

American Express® Serve® Cash Back card review

Read this American Express® Serve® Cash Back card review and learn how this card allows you to avoid overdraft fees, bounced checks and more.

Keep ReadingYou may also like

How to join and start banking with Bank of America?

In this Bank of America application guide, we will show you how you can join it and start banking with this world-class bank.

Keep Reading

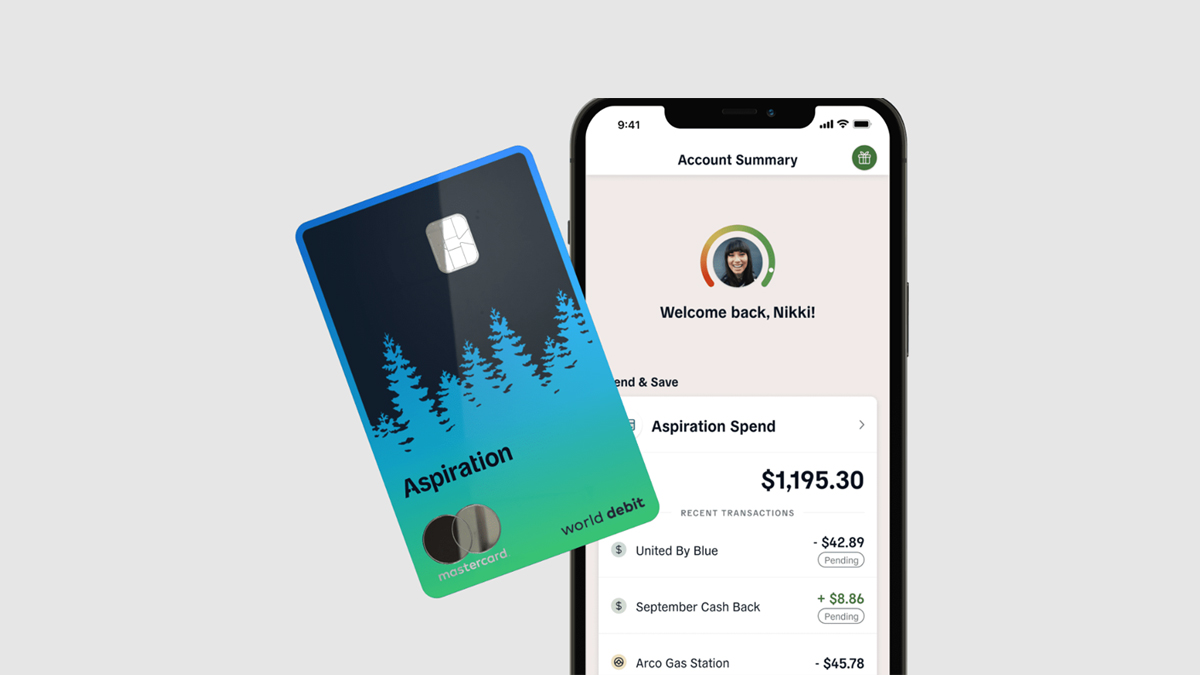

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

Bloomingdale’s American Express® Card application: Get your Amex credit card!

Looking for a credit card with high rewards and no annual fee? Get one with our Bloomingdale’s American Express® Card application guide.

Keep Reading