Credit Cards

American Express® Platinum Edge Review: earn points on purchases!

Get ready to maximize your savings with the American Express® Platinum Edge Credit Card! With this card, you enjoy a $0 annual fee in the first year and $200 travel credit! Learn more!

Advertisement

Elevate your finances and travel experiences! Enjoy benefits, perks, and more!

Source: The Post New

Ready to transform your financial landscape while embarking on exciting travel adventures? Explore how the American Express® Platinum Edge can transform your financial journey in this in-depth review!

This credit card opens the door to a world of unparalleled benefits, rewards, and savings. Explore the remarkable features and advantages of this card to help you harness its potential!

- Credit Score: Good to excellent.

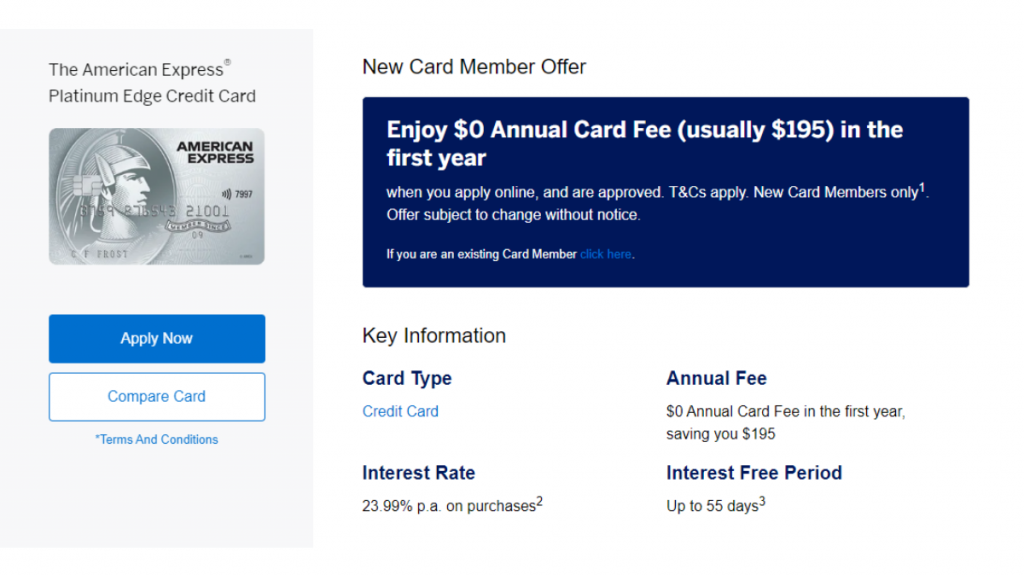

- Annual Fee: During the initial year, the card presents a unique offer with a $0 annual fee. Following the initial year, the annual fee stands at $195.

- Intro offer: Fresh applicants who apply online and receive approval can relish the advantage of a $0 annual card fee in the inaugural year.

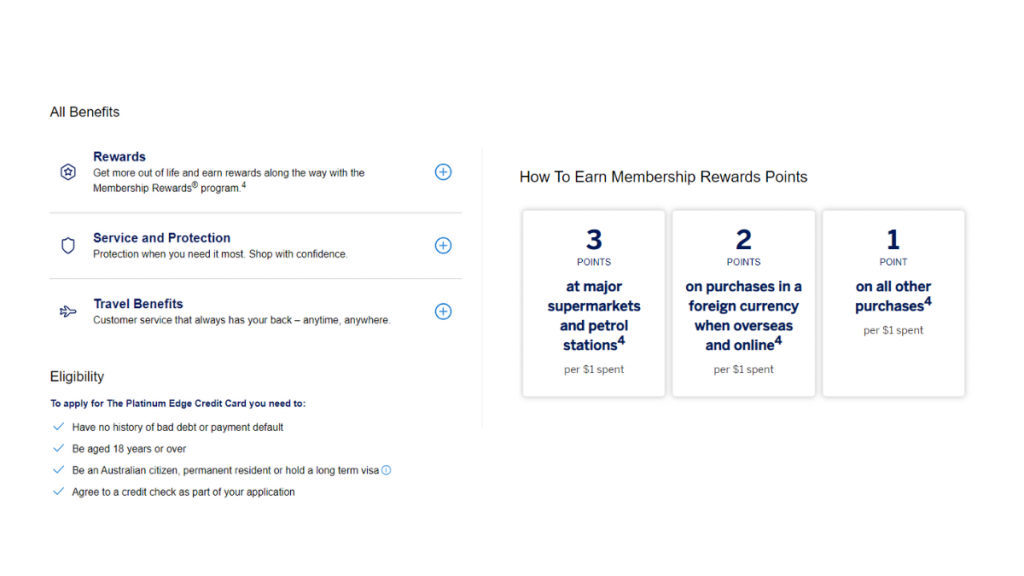

- Rewards: Get 3 points every time you spend $1 at major supermarkets or even petrol stations. Besides, you get 2 points on purchases in a foreign currency every time you spend $1 overseas and online. Lastly, you earn 1 point for every $1 spent on all other purchases.

- P.A.: Up to 55 interest-free days; after that, 23.99% p.a.

- Other Fees: Beyond the annual fee, it’s important for cardholders to remain vigilant about the potential for supplementary charges, including foreign transaction fees, late payment fees, and cash advance fees.

American Express® Platinum Edge: how does it work?

When you explore this American Express® Platinum Edge review, you’ll delve into a credit card that not only transforms your financial journey but also unveils pathways to exceptional travel adventures.

With this card, you can expect to enjoy a $0 annual fee in the first year, an introductory offer that presents substantial savings, and an impressive rewards program that earns you points on every purchase.

The card’s annual fee, interest rate, and other fees should also be considered in your financial planning.

However, the standout feature lies in the $200 annual travel credit that opens the door to unforgettable domestic and international trips.

Additionally, the card provides complimentary travel insurance, making it an ideal choice for jet-setters and those seeking to elevate their financial and travel experiences.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

In summary, the American Express® Platinum Edge offers compelling benefits for those who prioritize savings, travel, and rewards in their financial strategy, and you can review some of them now.

Benefits

- Cost-effective entry point to premium benefits;

- Captivating introduction featuring a $0 annual fee in the inaugural year;

- Travel credit;

- Rewarding points program;

- Travel Insurance for cardholders, their partners, and dependent children;

- Versatile points redemption;

- The inclusion of extra cards without any additional charges.

Disadvantages

- Relatively high interest rate;

- Credit score prerequisites;

- Starting from the second year, the annual fee comes into effect.

Is a good credit score required for applicants?

Individuals interested in applying for the American Express® Platinum Edge Credit Card typically need a credit score falling within the good to excellent range to secure approval.

Moreover, a strong credit history and a responsible financial track record are important factors for consideration.

Learn how to apply and get the American Express® Platinum Edge

So, acquiring the American Express® Platinum Edge Credit Card is a straightforward process that you can review now. Besides, doing it online is both convenient and efficient.

Learn how to get this credit card online

Whether you’re a seasoned traveler or simply seeking to enhance your financial well-being, this guide will walk you through the steps to secure this card online!

- Gather required documents: Firstly, to complete your online application, you’ll need to provide certain documents and information, such as details of your income, expenses, and debts.

- Access the official website: After gathering the necessary documents, go to the American Express® website and find the Credit Cards section. Then, click to view all the options available.

- Online application: Once you’ve located the American Express® Platinum Edge Credit Card, simply click on the “Apply Now” button. Enter the information required.

- Submit application: After completing the online application and agreeing to the credit check, submit your application for review.

- Approval: Once your application is approved, you’ll swiftly acquire your freshly minted American Express® Platinum Edge Credit Card.

What about another recommendation: Virgin Australia Velocity Flyer Card!

With competitive points earning rates on everyday spending and the ability to redeem those points for flights, the Virgin Australia Velocity Flyer Card is another great choice!

Curious to review more features about the Virgin Australia Velocity Flyer Card and how it stacks up against the American Express® Platinum Edge Credit Card? Then explore a complete guide below!

Virgin Australia Velocity Flyer Review

Explore this review of the Virgin Australia Velocity Flyer Credit Card! Enjoy exclusive perks, and pay no annual fee for the first year!

About the author / VInicius Barbosa

Trending Topics

ACE Flare® Account review: Get a convenient debit card a high-yield savings option

In this ACE Flare® Account review you will learn about this account's convenient debit card and high-yield savings option.

Keep Reading

Capital One Quicksilver Student Cash Rewards Card application

Learn the easy application process for the Capital One Quicksilver Student Cash Rewards Card and start building your credit today!

Keep Reading

How to get your BankAmericard® credit card

In this BankAmericard® credit card application guide we are going to show you how to get this card to start reducing debt today!

Keep ReadingYou may also like

Financial planning for beginners: an easy guide

Learn how to plan for the future, whether it is for the long or short term. With our tips on financial planning for beginners, you can do it!

Keep Reading

Quick Capital Cash review: get approved in as little as one business day

Read this Quick Capital Cash review to learn how you can get access to multiple lenders through a single online application.

Keep Reading

Gap Good Rewards Mastercard® Credit Card application

Learn all about the application process for the Gap Good Rewards Mastercard® Credit Card and what benefits you can enjoy once approved.

Keep Reading