Credit Cards

ANZ Rewards Black Card Review: Decoding Luxury!

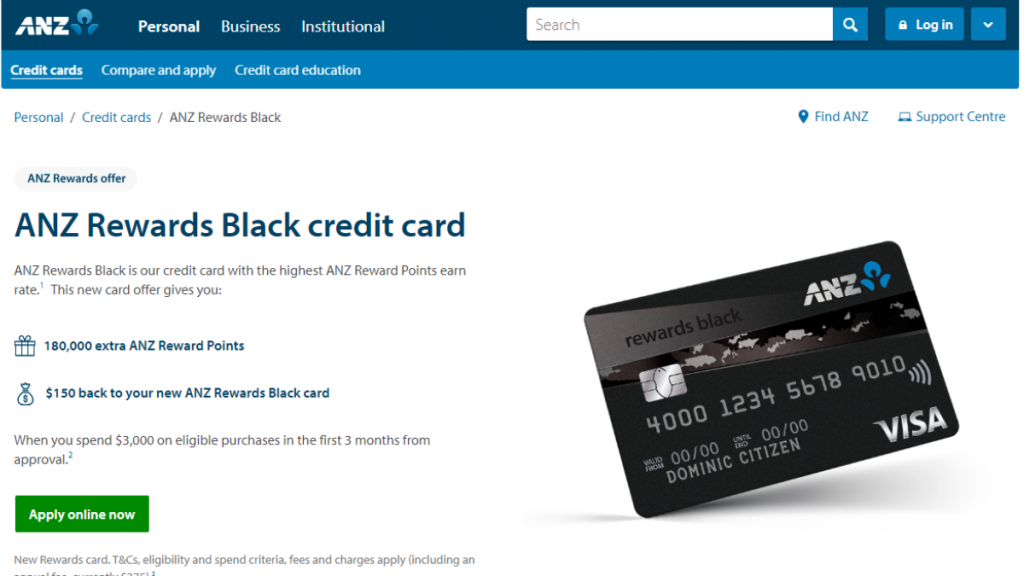

Discover the power of rewards with the ANZ Rewards Black credit card. Earn up to 2 ANZ Reward Points per $1 spent, plus a generous introductory bonus! This card is designed for those who seek more!

Advertisement

From uncapped points to exclusive experiences, this card offers more than just credit!

If you seek a blend of elegance and incentives, now is the moment to review the ANZ Rewards Black Card in-depth. Discover the intricacies of a credit card that goes beyond mere transactions!

With a lavish welcome bonus, a high points rate, and a suite of exclusive features, the ANZ Rewards Black credit card promises a journey of opulence for those seeking an elevated credit card experience.

- Credit Score: Applicants generally need to possess a favorable credit score.

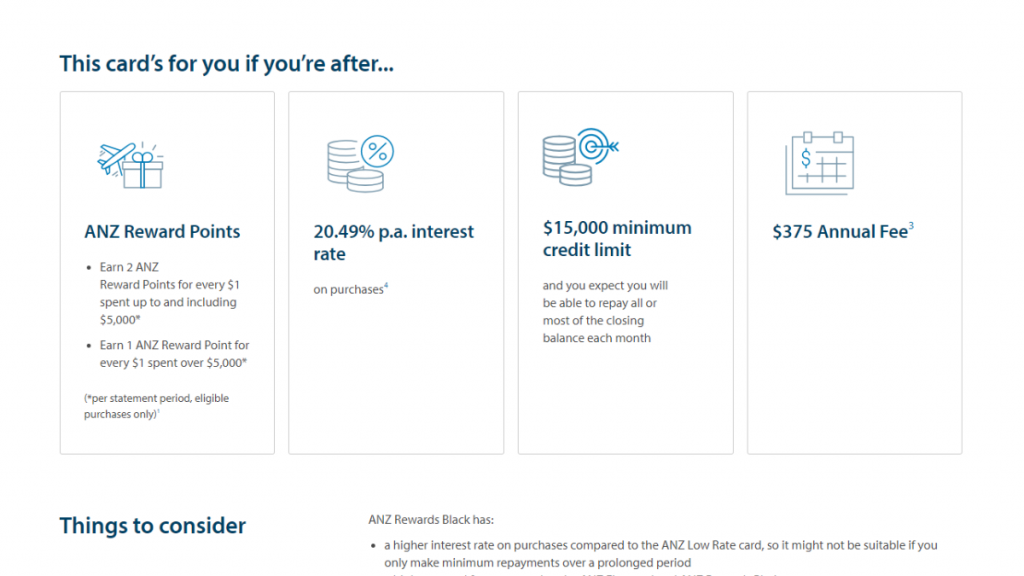

- Annual Fee: The card comes with a comprehensive annual fee of $375.

- Intro offer: Fresh cardholders stand to gain a noteworthy bonus of 180,000 ANZ Reward Points along with a $150 cashback, provided they engage in eligible purchases amounting to $3,000 within the initial 3 months from approval.

- Rewards: Using the ANZ Rewards Black card, individuals can accumulate 2 ANZ Reward Points for each $1 spent up to $5,000 and subsequently earn 1 point for every $1 spent beyond the $5,000 threshold. The rewards program offers flexibility, allowing points to be redeemed for digital gift cards, cashback, or converted to airline partner points for travel.

- P.A.: 20.49% p.a.

- Other Fees: At a yearly cost of $65 per additional cardholder, individuals can opt to include supplementary cardholders. Meanwhile, cash advances and balance transfers attract an interest rate of 21.99% p.a.

ANZ Rewards Black Card: how does it work?

Although the ANZ Rewards Black presents itself as a premium card, it’s important to review its features and benefits carefully. After all, this card might not fit everyone’s financial lifestyle.

At the heart of this credit card is a compelling rewards program that kicks off with a remarkable welcome bonus.

The enticing offer of 180,000 ANZ Reward Points and $150 back for qualifying initial expenditures within the first 3 months sets the stage for a credit card journey steeped in opulence.

Moreover, the card has an uncapped points system, where cardholders have the freedom to maximize their points potential on a variety of eligible purchases.

The inclusion of ANZ Instalment Plans further adds a layer of financial flexibility, allowing for customized repayment options on specific transactions.

However, the card does come with a higher annual fee, set at $375, compared to some other cards. So balancing this cost with the benefits becomes crucial for those considering this premium card.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

As you dive further into this review, the allure of the ANZ Rewards Black credit card grows increasingly irresistible. So, let’s explore some pros and drawbacks before applying.

Benefits

- Enjoy a substantial welcome bonus;

- Elevated points accumulation rate;

- Flexible repayment with instalment plans;

- Benefit from an uncapped points system;

- Unlock exclusive experiences with an invitation-only program;

- Enjoy complimentary insurance;

- Security shield against fraud;

- Seamlessly integrate your card with digital wallets;

- Cashback and redemption options;

- Access a Personal Concierge available 24/7.

Disadvantages

- Relatively higher annual fee;

- Limited travel benefits;

- Eligibility criteria;

- The annual charge for extra cardholders.

Is a good credit score required for applicants?

So, prospective applicants aiming to secure the ANZ Rewards Black credit card generally must boast a robust credit standing.

Moreover, a favorable credit score signals to lenders that an individual has a track record of prudent credit management, portraying them as a lower risk for potential payment defaults.

Learn how to apply and get the ANZ Rewards Black Card

Now you have read all this review and know exactly what the ANZ Rewards Black Card can offer you, it’s time to uncover the application process.

But don’t worry, you can even do it online.

Learn how to get this credit card online

So, embark on a voyage to enhance your credit card journey with the ANZ Rewards Black! It’s a simple and straightforward process.

- Access the ANZ website: Start by visiting the official ANZ website and click on the “Personal” option on the menu. Then, head to the “Credit Cards” segment and pinpoint the ANZ Rewards Black card.

- Explore the details: Next, click on the ANZ Rewards Black Card and review its features to make sure you’re eligible. Click on “Apply online now”.

- Online application: Take a quick survey and enter your personal and financial details. Be thorough and provide all necessary details, ensuring there are no discrepancies in the information provided.

- Review and submit the application: Before finalizing your application, meticulously review all the entered information to ensure accuracy. Confirm that everything is accurate, and make any necessary corrections.

- Await your approval: After submitting your application, ANZ will review the information provided. Upon approval, the ANZ Rewards Black will be on its way to you.

What about another recommendation: Check out the American Express® Platinum Edge!

So, for those seeking an alternative that seamlessly blends luxury with rewards, the American Express® Platinum Edge credit card emerges as a compelling choice.

If you want to review a viable option for the ANZ Rewards Black, just check out the link below. Indeed, the Platinum Edge is a prestigious card that offers a unique proposition with a myriad of benefits!

American Express® Platinum Edge Review

Discover the ultimate travel card in this review, the American Express® Platinum Edge! Get travel credit and earn rewards with every swipe!

About the author / VInicius Barbosa

Trending Topics

Petal® 1 Visa® or Petal® 2 Visa®: which card is better?

Unsure if you should get a Petal® 1 Visa® or Petal® 2 Visa®? Check out this comparison to help make your decision.

Keep Reading

How to get your Cash Passport Platinum Mastercard®: online application process!

Follow our Cash Passport Platinum Mastercard® application guide and get this card which offers competitive exchange rates for travelers.

Keep Reading

Bank of America® Premium Rewards® Elite review

Looking for a high rewards rate on dining and travel? Check out this Bank of America® Premium Rewards® Elite review!

Keep ReadingYou may also like

How to join SDFCU checking account?

Do you need an account with no monthly fees and no minimum balance to earn perks? Read on to learn how to join the SDFCU checking account!

Keep Reading

Serve® Pay As You Go Visa® Prepaid Card application

Check out this article to learn how easy the Serve® Pay As You Go Visa® Prepaid Card application process is and get yours today!

Keep Reading

How to choose the best credit card to travel?

If traveling seems too expensive to you, that's because it is. However, with the best credit cards for travel you can make it affordable.

Keep Reading