Account (US)

Marcus Savings Account application

The Marcus Savings Account offers an APY well above the national average and requires no minimum deposit to open. Plus, you won’t have to worry about fees. Learn how to apply today!

Advertisement

Marcus Savings Account: The perfect place to park your money!

The Marcus Savings Account offers a fast application process and you can open an account in minutes. With this account, you’ll earn higher interests than the national average by over 4x. There are no monthly fees or minimum deposit requirements for application either, so you’ll be able to earn without worrying about paying any charges.

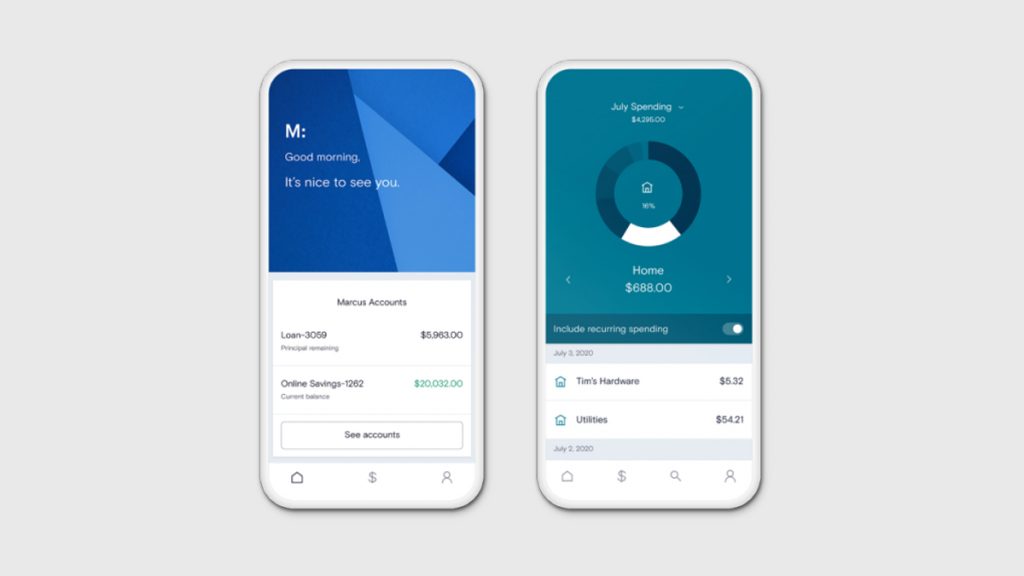

All credit scores are welcome to apply since Goldman Sachs doesn’t perform any credit checks for their savings accounts. You’ll be able to count on great customer service 24/7 and manage your account through an intuitive mobile app.

Marcus doesn’t have in-network ATMs, but you can freely move your money around between different accounts anytime you want. You can even set up same-day transfers up to $100,000. If you want to learn more about the Marcus Savings Account application process, keep reading the content below.

Learn how to apply online

The online Marcus Savings Account application is quick and you can have a functioning savings account in under a few minutes. First, you’ll need to access their official website and select “savings” on the top menu. Then, click on “high yield savings” to read more about what this account has to offer.

After that, you can click on “open an account” and fill out the online form with your personal and contact information. Read their eSign Agreement and their Privacy Policy before checking the box and clicking on “continue”.

Once you’re done with that part, you’ll need to verify your identity by writing down the code sent to you via email or text. Then you have to link your checking account from an external bank to transfer funds and you’re all set.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Learn how to apply using the app

If you’d like to open an account via mobile app, you can. First you need to download it for free at the App Store or Google Play and repeat the steps described above. The process is simple, intuitive and takes less than five minutes for completion.

What about another recommendation: Aspiration Plus Account

If you’re unsure about opening a Marcus Savings Account or if you’d just like to look at other options before settling, we’ve got you covered. Meet the Aspiration Plus Account: an eco-friendly institution that offers high APY earnings for a small monthly fee and some spending requirements.

With this account, not only you’ll see your money grow significantly, but you’ll also help the planet while doing so. Check some of its features below and follow the link under them if you want to learn more about the Aspiration Plus Account application process.

- APY: Up to 5%.

- Fees: $7.99 per month or $5.99 if you pay annually.

- Advantages: Up to 10% cash back on selected merchants.

How to get the Aspiration Plus Account?

Check our easy guide for you to open your Aspiration Plus Account today!

About the author / Aline Barbosa

Trending Topics

Sanlam Personal Loans application: quick Funding

In this Sanlam Personal Loans you will learn how to get your loan within just a few minutes. Read on and find out how!

Keep Reading

American Express Cash Magnet review: a simple flat-rate cash-back card

In this American Express Cash Magnet review you will learn about this card's awesome features, such as a $200 welcome bonus and 1.5% cashback.

Keep Reading

BankAmericard® credit card review: enjoy a 0% intro APR!

In this BankAmericard® credit card review you will see how this card can help you reduce or eliminate debt with a long 0% APR period.

Keep ReadingYou may also like

Discover it® Secured Card application process

Learn the application process for the Discover it® Secured Card and enjoy double cash back rewards at the end of your first year!

Keep Reading

Marcus Savings Account review

Higher than average APY and no monthly fees! Read our Marcus Savings Account review to learn all you need to know about this account.

Keep Reading

How to open the Juno Checking Account? Learn how to start banking with Juno

Learn how to open a Juno Checking Account and start earning cash back at incredible rates on cash and crypto purchases.

Keep Reading