Loans

How to get your Quick Capital Cash loan: get many offers with one application

Apply to a number of different lenders with a single online application.

Advertisement

Save a lot of time applying online in as little as 2 minutes

Looking for the most practical way possible to apply for loans? Well, you have come to the right place. Quick Capital Cash is the online loan aggregator you have been looking for. Below we detail the application process for you. Check it out!

Learn how to get your Quick Capital Cash loan online

Applying for a loan through Quick Capital Cash is one of the easiest things you can do when it comes to picking and choosing lenders. In the next few lines we break down the process in a few simple steps for you to follow through. Everything is done online and you may even get the money in your checking account in as little as one business day.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Applying Online for the Quick Capital Cash loan

Go to the Quick Capital Cash website. You will be filling in one information at a time, and once you are done, hit continue.

Right on the first, the first piece of information the website requires from you is how much you wish to borrow. Once you have entered that, click to continue.

On the second page you must enter your email address, and again click to continue. On the third page you will need to confirm your loan amount and select the purpose of your loan.

After that you must provide the habitual information such as full name, date of birth, phone number, driver’s license, social security number and home address.

Then you must enter your employment information and inform your primary source of income. The website will also ask you if you are in the military (remember, they do not allow people who are in the military), your employer name, net monthly income and employer phone number.

Once you finish that part, the website will ask you if you have $10,000 in unsecured debt and if you would like Quick Capital Cash partners to get in touch.

Then you will need to select your bank, its state (you can not apply if you are a resident in AK, NY, VT and WV), ABA routing number and your account number. Then hit submit and your application will be processed.

What about another recommendation: Next Day Personal Loan

Next Day Loan connects lenders with borrowers with a platform that works like a marketplace. Check different loan offers online with no impact on your credit score.

If you would like to know more, hit the link below and we will take you there.

Next Day Personal Loan review

Learn everything about the Next Day Personal Loan to ge the money you need with excellent conditions.

About the author / Danilo Pereira

Trending Topics

Citi® Diamond Preferred® review: long 0% intro APR

The Citi® Diamond Preferred® credit card offers a 21-month long 0% APR period, and this review will tell you everything about it.

Keep Reading

Cash App: how does it work?

Unlock the secrets behind the success of Cash App and learn how it works to simplify digital payments and even crypto investments.

Keep Reading

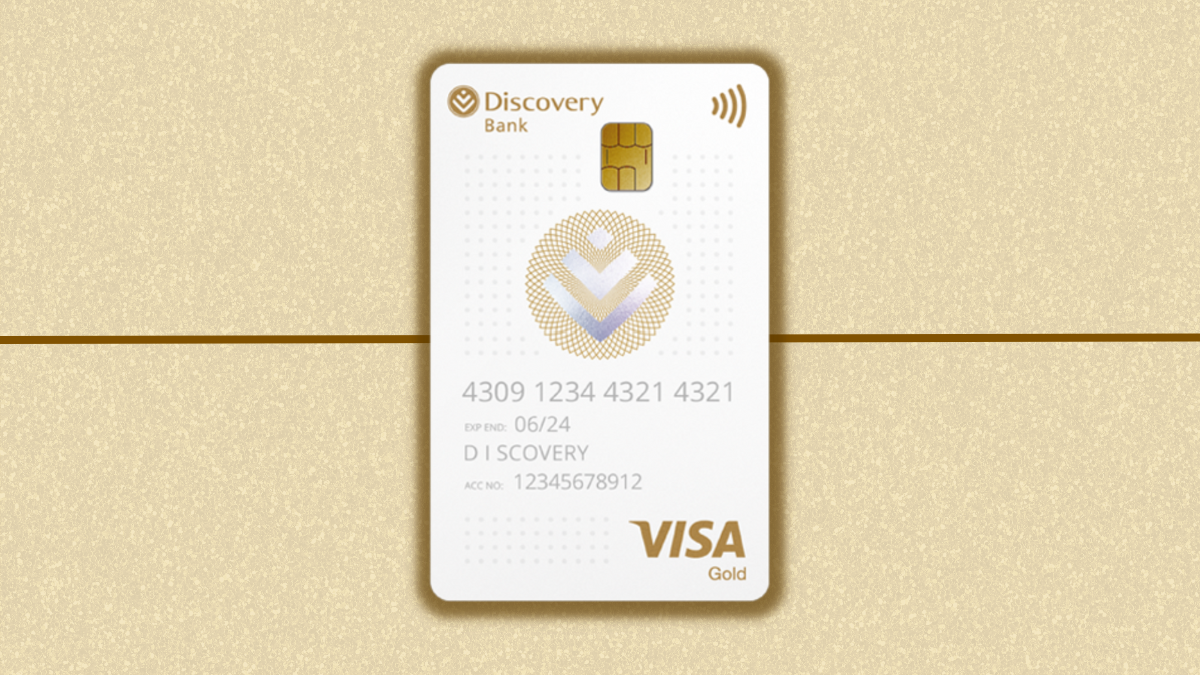

How to get your Discovery Bank Gold Card: online application

In this Discovery Bank Gold Card application guide you will learn how to get this awesome rewards card in just a few minutes.

Keep ReadingYou may also like

Amazon Rewards Visa Card review

Are you looking for a card that offers great rewards and simplifies your life? If so, the Amazon Rewards Visa Card may be perfect for you.

Keep Reading

BlueVine Business Checking Account review: perfect for Small Business Owners

In this BlueVine Business Checking Account review you will see how this is an excellent choice for small business owners.

Keep Reading

Exchange Bank Unsecured Personal Loan application

Learn everything about how the Exchange Bank Unsecured Personal Loan application process works and how you can apply.

Keep Reading