Credit Cards

What are the best cash back credit cards out today?

Find out the best cash back credit cards for your everyday purchases. We’ve compiled a list with the cards that offer top rated rewards to help you get more bang for your buck!

Advertisement

We’ll help you find the perfect credit card to reward your spending habits!

If you’re looking for a great way to save money on your everyday purchases, cash back credit cards are a fantastic option.

These cards offer rewards on all of your spending, which can add up to big savings over time. But finding the best cash back cards is not the easiest task.

Capital One Walmart Rewards® review

The Capital One Walmart Rewards® givest you up to 5% cash back at Walmart, unlimited 2% cash back at restaurants and travel, and convenient redemption options.

While looking for the right card for your needs might seem overwhelming, there are ways of narrowing down that search.

In this article, we’ll do all the heavy lifting for you and provide a list of some of the most interesting cards you can find today. That way, you can find the one that perfectly suits your everyday needs.

So keep reading the content below to get a better understanding of how cash back works and which cards will offer the most benefits.

We’ll cover their main features, as well as the pros of each card, to help you decide which option is best for you.

What exactly is cash back, and how does it work?

Cash back is a type of cash rebate that allows a customer to receive a portion of the money spent on a purchase as cash. It is typically offered by credit card companies as an incentive to use their product.

You can earn cash back in a variety of ways, but the most common is after you’ve made a purchase. Some cards will also allow you to redeem them for gift cards or merchandise.

But the best way to maximize your cash back is to redeem it for statement credits or direct deposits into your checking or savings account.

If you use your card regularly and pay off your balance in full each month, earning cash back on purchases is a great way to earn some extra money.

Keep reading to learn which are the best cash back cards.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Here’s 5 of the best cash back cards you can apply for

To help you choose the best credit card for your needs, we’ve compiled a list of the best cash back cards currently available. Our list includes a variety of options to suit a range of spending habits.

So whether you’re looking for a simple cash back card or one that offers more flexible rewards, be sure to check out our top picks below.

Chase Freedom Unlimited® Credit Card overview

The Chase Freedom Unlimited® Credit Card is one of the best cash back cards out there. With this card, you’ll earn 1.5% cash back on every purchase, with no limit to the amount you can earn.

Plus, there’s no annual fee, so you can keep earning cash back without having to worry about an extra fee eating into your rewards.

You also get a 0% introductory APR for 15 months on purchases and balance transfers. After that, the APR increases to a variable rate of 17.24% – 25.99%.

This is a great card that you can request online through Chase’s website. Just make sure you meet the eligibility requirements.

Chase Freedom Unlimited® review

Have you asked Santa Claus for a credit card with no annual fee and the best rewards rates on the market? Here it is! Read this review to see how it's true.

Wells Fargo Active Cash® Card overview

The Wells Fargo Active Cash® Card definitely earned its spot in this list for best cash back cards. It offers a very generous rewards program, with 2% cash back on all purchases.

There is no limit to the number of rewards you can earn, and they never expire so long as your account is active. You also get a $200 welcome bonus after you spend $1,000 on purchases in the first 3 months.

The annual fee is $0, so this card is a great choice for anyone who wants to earn cash back without worrying about maintenance fees.

The card also comes with cell phone protection, which reimburses you up to $600 if your cell phone is damaged or stolen.

Overall, the Wells Fargo Active Cash® Card is a great choice for anyone who wants to earn rewards on their everyday spending.

Wells Fargo Active Cash® Credit Card review

Find out how the Wells Fargo Active Cash® Card can help you get cash back on your purchases. Read our review to see if this card is right for you.

Citi® Double Cash Card overview

The Citi® Double Cash Card is a best-in-class cash back card that offers cardholders the opportunity to earn 2% cash back on all purchases, 1% when you buy and 1% as you pay.

There’s no limit to the amount of cash back you can earn, and you also don’t have to worry about an annual fee.

The Double Cash Card is best for people who want to maximize their cash back earnings and don’t mind keeping track of their expenses.

If you’re looking for a simpler way to earn rewards for your spending, the Double Cash Card is as straightforward as it gets.

Citi® Double Cash credit card review

With the contactless card it will get even easier to make your everyday expenses and earn 2% cashback. Check every benefit of using the Citi® Double Cash credit card.

Blue Cash Preferred® Card from American Express overview

The Blue Cash Preferred® Card from American Express offers one of the best cash back rewards programs available.

You’ll earn 6% cash back on eligible U.S. supermarket purchases (on up to $6,000 per calendar year, then it drops to 1%) and 3% cash back on selected U.S. gas stations. For all other purchases, you’ll earn 1%

While there’s a $95 annual fee, the rewards alone will offset the cost if you usually spend a lot of money on groceries.

Plus, there’s a current welcome bonus that will earn you $350 in statement credits for spending $3,000 within the first 6 months of membership.

You’ll need a credit score between good and excellent to apply, and make sure you read the card’s Terms, plus its Rates & Fees, before signing up.

Blue Cash Preferred® Card from Amex review

In this Blue Cash Preferred® Card from American Express review, we’ll look over the features, perks and drawbacks of one of the best rewards cards available in the market

Capital One Quicksilver Cash Rewards Credit Card overview

The Capital One Quicksilver Cash Rewards Credit Card is undoubtedly one of the best cash back cards on the market.

With no annual fee and a simple rewards structure, it’s a great choice for anyone who wants to earn cash back on their everyday spending.

The card offers a very competitive rewards rate. You’ll earn 1.5% cash back on all of your purchases, with no limits or rotating categories to keep track of.

That means you can earn cash back on everything from your groceries to your monthly utility bills.

Another great feature of the Capital One Quicksilver Cash Rewards Credit Card is its sign-up bonus. When you spend $500 in the first 3 months, you’ll earn a $200 cash back bonus.

That’s a solid return on your investment, and it can help offset the cost of any big purchases you need to make in the short term.

What is the advantage of cash back for your financial life?

Now that you know what are the best cash back cards, how about a deeper dive into the advantages of having a cash back credit card?

Follow the link below to learn why cash back is such a popular rewards category and what you can do to maximize your earnings without overspending your money.

What is the advantage of cash back for you?

Cash back rewards offer a variety of advantages for your financial life. Find out what they are and how to make the most of them! Read on for more.

About the author / Aline Barbosa

Trending Topics

OpenSky® Plus Secured Visa® Credit Card online application: Improve your credit easily

Follow our OpenSky® Plus Secured Visa® Credit Card application guide to get this card and start improving your credit.

Keep Reading

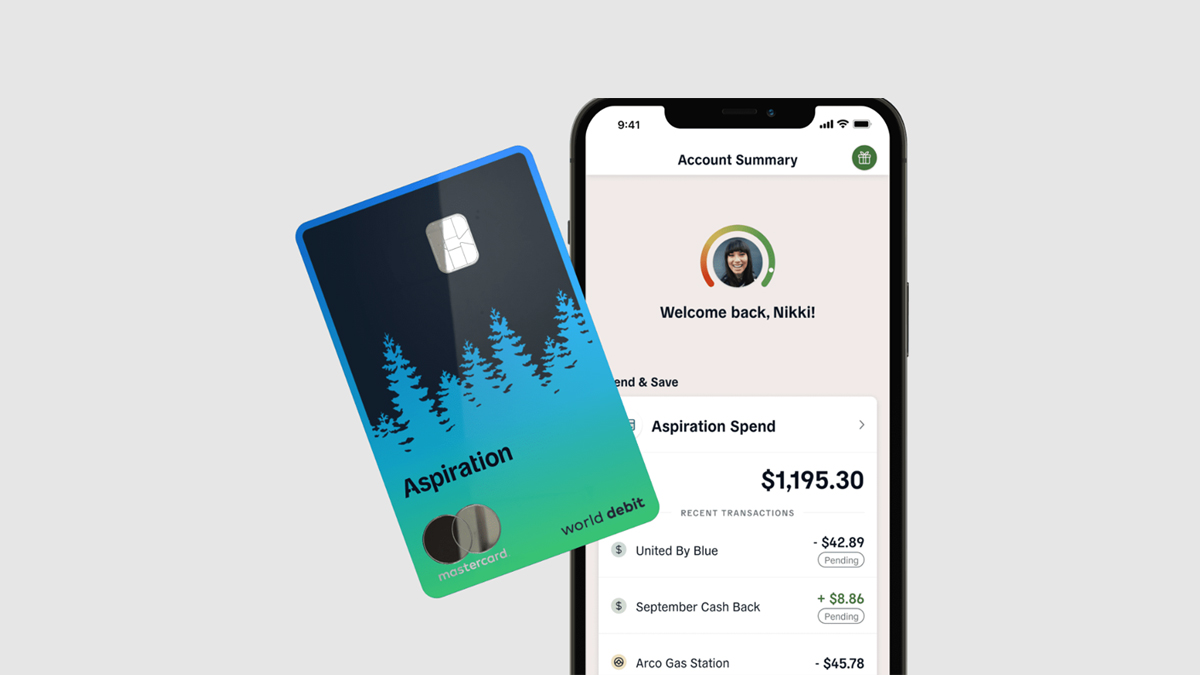

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

How to Watch NHL Games for Free Online

Get in the game with our guide and learn how to watch NHL games online for free on your mobile device. Discover the top streaming options!

Keep ReadingYou may also like

The best apps to watch NBA games online

Are you an NBA fan? Don't miss out on our list of must-have apps, and watch live NBA games online with highlights on the go.

Keep Reading

Find out which are the best useful apps for iOS!

Don't miss out on the best apps for iOS! Explore our selection to supercharge your Apple device with powerful tools and entertainment options!

Keep Reading

Mission Money Visa® Debit Card review

If you’re looking for an easy and fee-free debit card to add to your wallet, the Mission Money Visa® Debit Card is a fantastic option!

Keep Reading