Credit Cards

4 best prepaid cards to control your budget

In this article you are going to learn about some of the best prepaid cards to control your budget.

Advertisement

Looking for a card that’ll help you control your budget better? Here are our picks for the best prepaid cards

Prepaid cards make it easy for you to pay for purchases without opening a credit card or bank account and are a great tool to control your budget. Let’s see what else they got!

They work like a debit card, allowing you to pay bills, set up direct deposit, and use mobile check deposit. Additionally, they provide the same FDIC insurance coverage of up to $250,000 that protects your deposits in case your bank fails.

Opting for a prepaid card over other types of plastic is a low-risk way to manage your money. Parents can use prepaid cards to teach their kids about money before adding them as authorized users to their credit card.

Choose the best zero APR credit card for you!

Are you looking to save some money and enjoy the convenience of a credit card with no interest? Zero APR credit cards are a great way to do that!

And if you struggle to stick to a budget, a prepaid card can help monitor your spending with the goal of eventually transitioning to a credit or debit card.

If you’re considering opening a prepaid card, there’s a wide variety of options available.

To simplify the selection process, we have compiled a list of the best prepaid cards for you. Below, we’ve provided everything you need to know before signing up.

Without further ado, let’s dive into our list of the best prepaid cards to control budget (in no particular order).

American Express Serve FREE Reloads

The American Express Serve FREE Reloads card is an excellent choice for frequent prepaid debit card users who need to reload their card regularly. It is an excellent prepaid card to control your budget.

With over 45,000 locations available, cardholders can easily add money to their card without incurring any fees.

Additionally, the card offers access to over 30,000 fee-free ATMs, which is a valuable benefit for cardholders who need to withdraw cash frequently.

The card offers a range of reload options, including direct deposit and bank account transfers. However, there are some cons to consider, such as a monthly fee of $6.95 (except in New York, Texas, or Vermont), and a 10-day wait time for mobile check deposits unless a fee is paid.

The card does not offer any rewards or major benefits. Despite these drawbacks, the Amex Serve FREE Reloads card may be the best option for those without a checking account.

Additionally, the card allows you to create free sub-accounts for family members, which is a useful feature for managing family finances.

American Express Serve® FREE Reloads application

Learn all the details about the American Express Serve® FREE Reloads Card application process and how you can request yours.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

FamZoo Prepaid Debit Card

FamZoo is an excellent choice for parents looking to teach their tweens and teens about money management.

The card offers up to four prepaid cards at no charge, making it easy for parents to manage their children’s finances.

Additionally, parents can activate automatic transfers and control card use to encourage smart spending and saving habits.

The card has several benefits, including the ability to tie transfers to allowances and chores or even create a non-monetary rewards system.

Parents can also lock and unlock cards and encourage their kids to save with interest payments from the parent’s account.

Moreover, the card offers access to fee-free ATMs. There are some cons to keep an eye on. For example, the $5.99 monthly fee (which you can reduce if you pay in advance) and a $4.95 fee to load cash onto the card at participating retail locations.

While the FamZoo Prepaid Debit Card isn’t the only card that offers sub-accounts, it provides a comprehensive set of features that can help parents teach their children how to manage their money effectively.

Hence, it made it to our list of the best prepaid cards to control your budget.

How to get your FamZoo Prepaid card

In this FamZoo Prepaid card application guide you will learn how to get this card within minutes to start teaching your kids about money!

Walmart MoneyCard

For those who frequently shop at Walmart, the Walmart MoneyCard may be the best choice for a prepaid debit card.

The card offers multi-tiered cash-back options, which means you can earn money while you shop.

Additionally, free reloads are available, and if you load enough money every month, you can avoid paying the monthly fee altogether. That’s why it is such a great prepaid card to control your budget.

The card has several benefits, including 3% cash back at Walmart.com, 2% back at Walmart fuel stations, and 1% back at Walmart stores.

Moreover, the card offers 2% annual interest on a linked savings account. You’ll also get overdraft protection of up to $200 with opt-in and eligible direct deposit.

However, you should take the card’s cons into account as well. For instance, cashback has a cap of $75 per year. Also, the standard monthly fee is $5.94 if you don’t load $500 or more each month.

Additionally, all ATM withdrawals incur a $2.50 fee, and mobile check deposits may take up to five days to process.

Despite these downsides, the Walmart MoneyCard is one of the few reloadable cards that offer rewards, even though there is an annual cap.

The annual rewards are enough to cover the monthly fee, even if you can’t waive it. Nonetheless, the fees you’ll have to pay if you need to access your cash through ATMs are a major downside to consider.

Walmart MoneyCard application

Learn about the eligibility requirements and how the Walmart MoneyCard application process works so you can request your card today!

Bluebird by American Express

Bluebird by American Express is an excellent choice for those seeking a prepaid debit card with an impressive combination of savings, convenience, and benefits.

Cardholders can expect to pay fewer fees, including no monthly fee and free ATM access. Additionally, the card offers a range of no-cost extras.

They include purchase protection, roadside assistance, and Amex Offers, which make it an attractive option.

The card has several benefits. They include access to more than 30,000 fee-free ATMs and free cash reloads at Walmart locations.

Not to mention direct deposit, debit card transfers to other Bluebird account holders, and mobile check deposits.

Cardholders can also create sub-accounts for family members, each with their own card which ties to the main account.

There are some cons to consider. For example, the lack of rewards and the possibility of incurring a fee for cash reloads at other retailers.

Additionally, mobile check deposits may take up to 10 days to process unless a fee is paid. Despite these drawbacks, Bluebird charges fewer fees than most prepaid debit cards.

This makes it an excellent choice for those on a tight budget. It’s also good if you’re looking to avoid paying for debit card access.

The card’s sub-account feature is particularly useful for managing family finances effectively.

Which one is the best prepaid cards to control budget

Bluebird by American Express is the best overall choice when it comes to prepaid debit cards. The card has no monthly fee and provides cardholders with free access to over 30,000 ATMs.

Additionally, the card offers several complimentary benefits, including purchase protection and roadside assistance.

The card also provides several other free features. They include direct deposits, debit card transfers to other Bluebird account holders, and mobile check deposits.

Although it does not have a rewards program, the absence of fees for activation, maintenance, and online purchases more than compensates for it.

Moreover, family members can enjoy the freedom of having their own cards with sub-accounts that link to the primary account. This feature is especially useful for managing family finances effectively.

In conclusion, Bluebird is a straightforward and convenient option for those seeking a prepaid debit card. We highly recommend it as a smart choice for anyone looking for a no-fuss, low-cost option.

On the following link, you can read a full review of this card’s features and learn how to apply for it!

BlueBird Amex debit card review: No bank account?

See how the BlueBird Amex debit card allows you to have access to it even if you do not have a bank account.

About the author / Danilo Pereira

Trending Topics

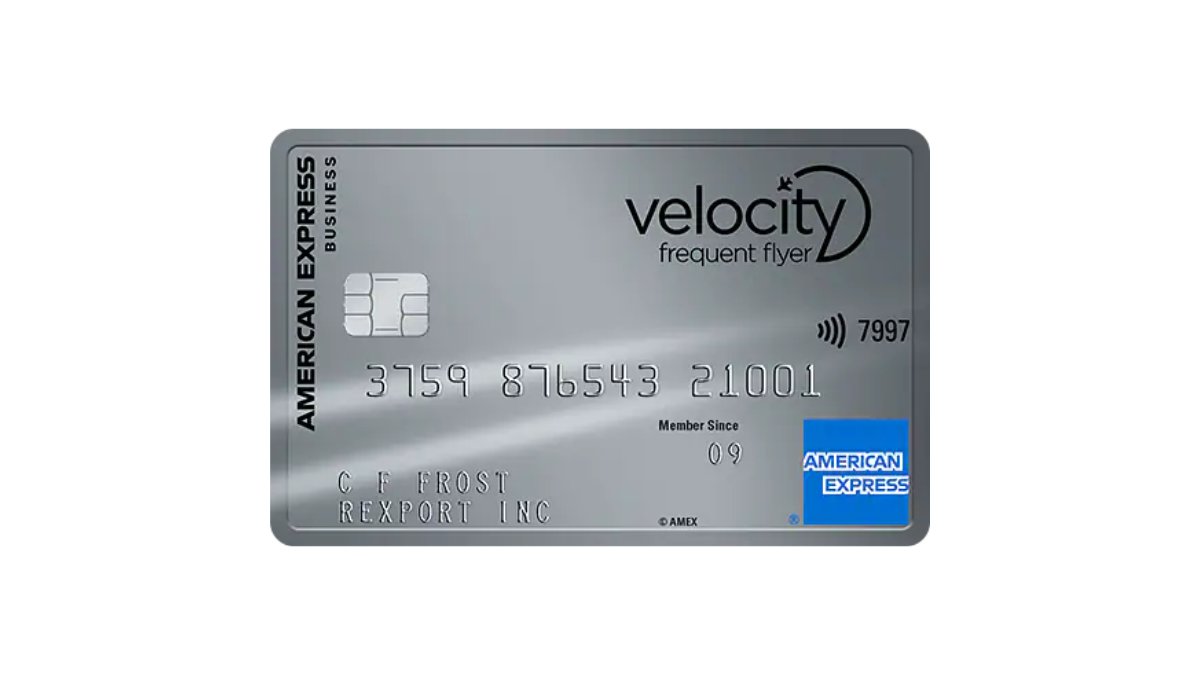

American Express® Velocity Business Card Review: Earn more

Soar into the world of business travel! Explore every feature of the American Express® Velocity Business Card in this review. Earn points!

Keep Reading

Discover it® Secured Card application process

Learn the application process for the Discover it® Secured Card and enjoy double cash back rewards at the end of your first year!

Keep Reading

Pelican Pledge Visa Card Review: Leverage Your Savings!

Unlock financial possibilities with the Pelican Pledge Visa, and review a secured credit card designed to build your credit.

Keep ReadingYou may also like

How to open your Novo Business Checking Account easily

In this Novo Business Checking Account application guide, you will learn how to open this account in just a few minutes.

Keep Reading

Total Visa® Credit Card review

Learn how to get the purchasing power of a real Visa card even if you have a bad score in this Total Visa® Credit Card review.

Keep Reading

The best apps to watch NBA games online

Are you an NBA fan? Don't miss out on our list of must-have apps, and watch live NBA games online with highlights on the go.

Keep Reading