Apps

Apps and Strategies for Financial Freedom: Ultimate Guide to Build Wealth

Explore the world of financial apps and discover the tools that can help you break free from financial constraints. reach financial freedom with the help of technology!

Advertisement

Achieving financial freedom is a dream shared by many. And with today’s technology, you can count on the best apps to build strategies. You can reach the so-wanted financial freedom!

Whether you’re burdened by debt or seeking to grow your wealth, the path to financial freedom requires strategic planning, discipline, and a commitment to long-term goals.

In this blog post, you’ll find tips to build strategies and find the best apps to help you reach financial freedom!

Wealth-Building Strategies

If your goal is to build wealth, you’ll need good planning. Choosing the right strategy is key to achieving any goal. So keep reading to learn our top tips for wealth-building:

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Budgeting

Budgeting is a fundamental wealth-building strategy that forms the cornerstone of financial success.

By creating a detailed budget, you gain a clear understanding of your income, expenses, and saving potential.

It enables you to allocate your resources wisely, prioritize essential expenses, and identify areas where you can cut back and save.

Saving

By regularly putting aside a portion of your income, you create a financial safety net and a strong foundation for the future.

Saving helps you be prepared for unexpected expenses, invest in opportunities, and avoid relying too much on borrowing money.

Investing

Exploring different investment options like stocks, bonds, real estate, or mutual funds gives you the opportunity to earn returns that outpace inflation and boost your wealth.

Investing requires some research, diversification, and a long-term mindset. It can offer you chances for capital growth, regular income, and the magic of compounding.

Best Apps for building wealth: achieve financial freedom

It’s time to change your life! Check these apps and take a new step towards a better financial future:

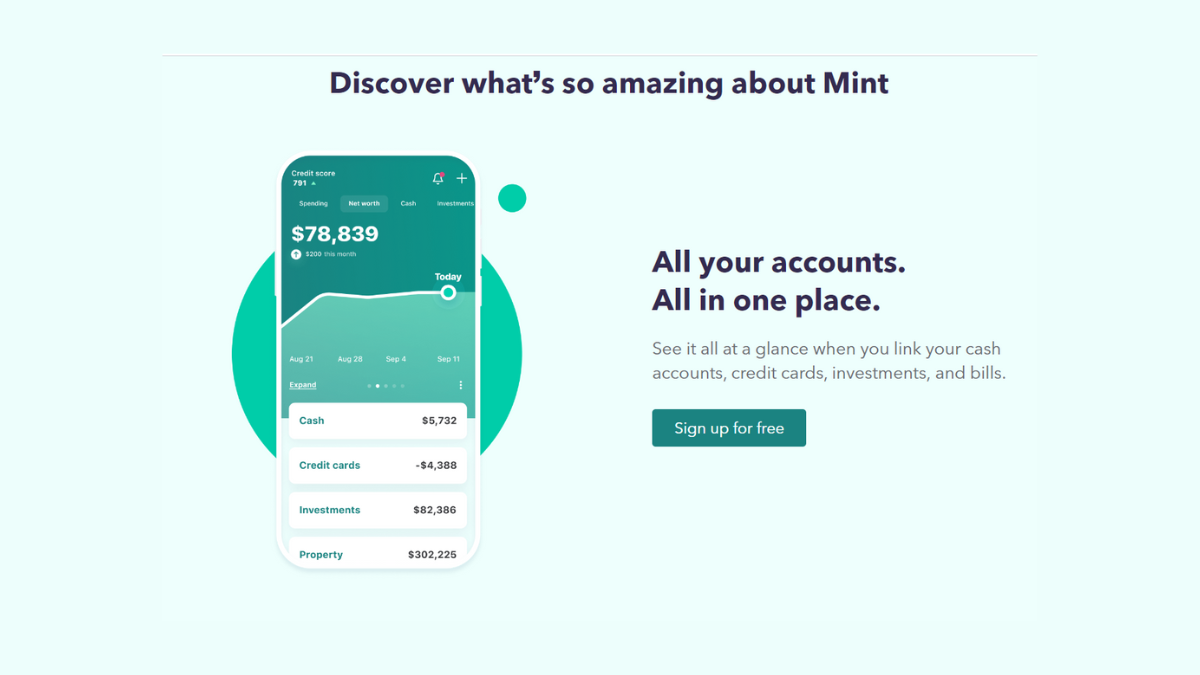

Personal Finance App: Intuit Mint

- Top Features: Intu Mint is your best friend when it comes to finances. It allows you to track your expenses, set budgeting goals, and receive personalized insights into your spending habits. The app also provides bill reminders, credit score monitoring, and investment tracking. Additionally, it offers a user-friendly interface and intuitive categorization of transactions.

- Is it free? Yes, Intu Mint is free to use. You can download the app without any upfront cost and access its core features at no charge.

- Reasons to get it: Intu Mint can be a valuable addition to your financial toolkit for several reasons. Firstly, its comprehensive expense tracking and budgeting features help you gain a clear understanding of your spending patterns and make informed decisions. Also, by setting budgeting goals and receiving alerts, you can stay on track and avoid unnecessary expenses. Overall, Intu Mint simplifies financial management, promotes financial discipline, and empowers you with the tools to work towards financial freedom.

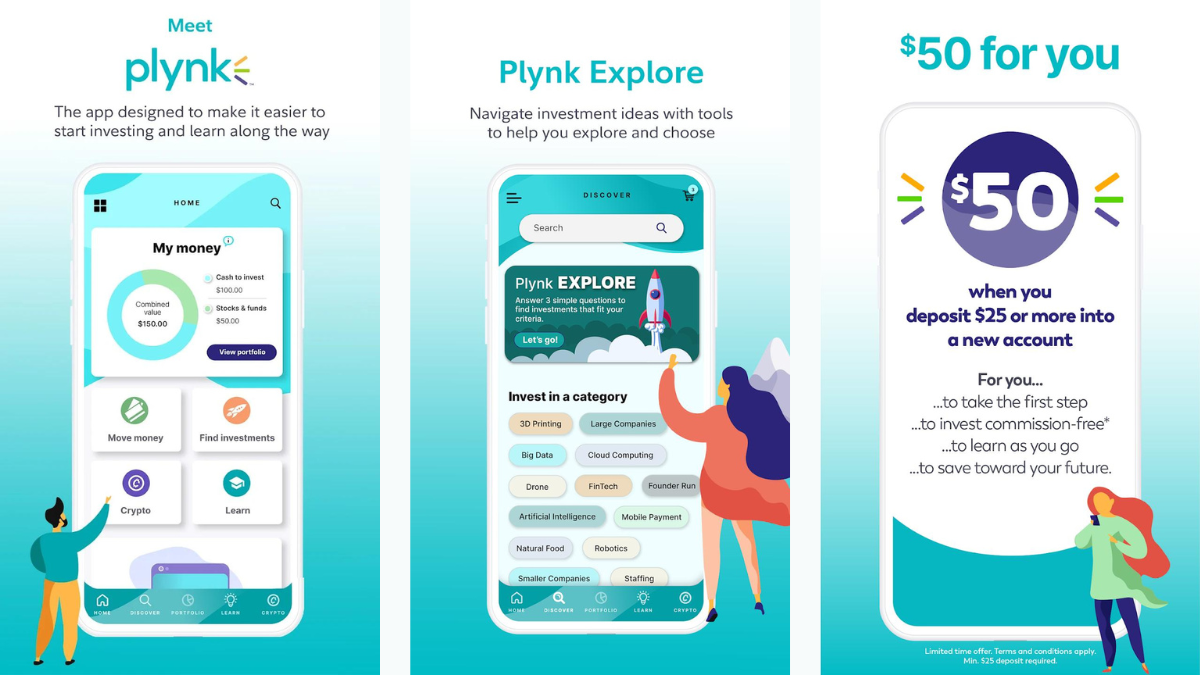

Investment App for beginners: Plynk

- Top Features: Plynk is the helping hand you are looking for to invest like a pro, even if you’re just starting. This innovative platform is tailored especially for novice investors, providing a range of investment options such as stocks, mutual funds, ETFs, and even cryptocurrencies. Recognizing the importance of education, Plynk goes the extra mile by offering insightful content on investing and informative newsletters every month.

- Is it free? You can download the Plynk app and use its major features for free. However, extra features may require a subscription. Also, you need a minimum of $1 for investing, and the app will charge the usual fees for trading operations.

- Reasons to get it: Plynk is a cutting-edge investment app designed for individuals seeking a seamless entry into the world of finance. The user-friendly interface is very intuitive, making it easier for beginners to navigate the investment world.

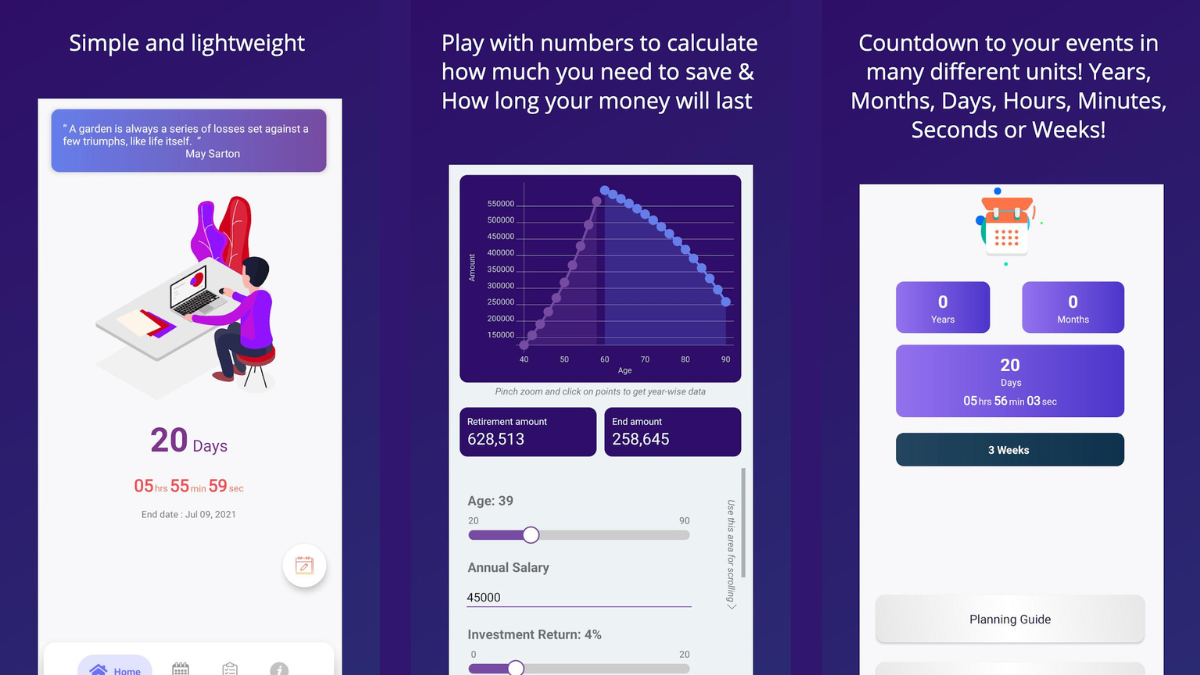

Retirement Planning App: Retirement Countdown

- Top Features: Retirement is something that most people start thinking about when it’s already too late. With the Retirement Countdown mobile app, you’ll have the support you need to be successful in your later years. Set the age you want to retire, and the app calculates how many working days you have until there. Also, you’ll know how much of your income you must save and invest to retire with a good amount to cover your monthly expenses and live a comfortable life.

- Is it free? Yes, it is free for both Android and iOs users. Save your money for more important things, like retirement!

- Reasons to get it: A mobile app for retirement planning can be highly beneficial. It offers convenience, organization, and empowerment in managing your retirement goals. With a retirement planning app, you can easily track your savings progress, set financial targets, and receive personalized insights to make informed decisions.

Your finances are a very important part of your life. In fact, it’s what will ensure that all other areas of your life are supported. Thus, you can enjoy the best moments with your family and dear friends, with health, good food, and leisure.

That’s why we’re here to help you better understand how to manage your finances. We have lots of content to help you. Continue reading The Post New.

Trending Topics

Moving to the U.S.? Here’s how to set up your finances!

One of the most important steps you can take is to learn how to set up your finances if you’re a new U.S. resident! Read on to learn more.

Keep Reading

Discovery Bank Platinum Card review: A High-End Credit Card

Are you all about health and fitness? Read this Discovery Bank Platinum Card review and discover a card made for you.

Keep Reading

Discover it® Secured or Discover it® Cash Back? Choose the best!

Read this comparison to find out which card offers more benefits to your daily life: the Discover it® Secured or Discover it® Cash Back.

Keep ReadingYou may also like

Petal® 1 Visa® or Petal® 2 Visa®: which card is better?

Unsure if you should get a Petal® 1 Visa® or Petal® 2 Visa®? Check out this comparison to help make your decision.

Keep Reading

Capital One Walmart Rewards® application: get up to 5% cash back on Walmart purchases

Learn how the application for the Capital One Walmart Rewards® works. It gives you up to 5% cash back on Walmart purchases and more.

Keep Reading

First Progress Platinum Select Mastercard® Secured Credit Card review

Read this First Progress Platinum Select Card review to learn how you can increase your score with the help of this credit card.

Keep Reading