Credit Cards

Discover it® Secured or Discover it® Cash Back? Choose the best!

Wondering whether you should apply for the Discover it® Secured or the Discover it® Cash Back credit card? Check out this head-to-head comparison to see which one is better for you.

Advertisement

Discover it® Secured vs. Discover it® Cash Back: comparison and info.

Have you heard about Discover it® Secured or Discover it® Cash Back credit cards? Before getting a new credit card, it’s important to compare all the options available to your financial profile. You want to make sure it fits all your daily needs and that the pros outweigh the cons.

Discover Bank review: is it trustworthy?

Discover Bank is one of the best options for online banking today in the US, and this review will show you why. Find out if Discover Bank is for you.

If, after doing your research, you find yourself wondering whether you should get a Discover it® Secured or Discover it® Cash Back card, this article will help with your decision.

Discover it® Secured

- Credit Score Needed: All credit levels are welcome to apply.

- Standard Variable APR: 24.49% on purchases.

- Is there an annual fee?: No.

- What is the welcome bonus: Discover’s current offer matches all cash back you’ve earned at the end of your first year as a card member.

- Are there any rewards?: You can earn 2% cash back at restaurants and gas stations up to $1,000 each quarter. Earn 1% on all other purchases.

Discover it® Cash Back

- Credit Score Needed: You’ll need at least a good credit score to apply.

- Standard Variable APR: Discover offers a 0% introductory APR for 15 months. After that period, it’s a variable between 13.49% to 24.49%.

- Is there an annual fee?: There is none.

- What is the welcome bonus: You will also get a cash back match at the end of your first year of account opening.

- Are there any rewards?: This card gives all cardholders a 5% return on daily purchases each quarter up to $1,500. After reaching that amount, it drops to a flat 1% rate. All other purchases earn 1% back.

All you need to know about the Discover it® Secured card

If you’re looking for a credit card to help you rebuild or establish your credit history, the Discover it® Secured Credit Card is a solid alternative.

Unlike most secured cards, you won’t have to worry about monthly or annual fees. Plus, this is one of the few secured cards that offer cash back rewards on things you actually spend money on, like gas and restaurants.

The initial security deposit is a minimum of $200. That amount is refundable once you close your account in good standing. Plus, it’ll also work as your credit limit.

Discover makes automatic credit reviews after your 7th month as a member to see if you’re ready to upgrade to an unsecured card, thus returning your security deposit.

Responsible use and on-time payments will help you boost your score periodically since the issuer reports all payments to the three main credit bureaus in the country.

While the card has a relatively high variable APR, carrying a balance on a secured card should never be an option regardless. That is because you’d be basically paying interest on a loan to yourself.

You can apply for this card even with a limited credit history. To encourage you to do so, Discover offers a pretty interesting welcome bonus! The bank will match all cash back you’ve earned during your first year.

If you’re still on the fence between the Discover it® Secured or Discover it® Cash Back cards, check some of the secured benefits below.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Benefits

- Reports all monthly payments to Equifax, Experian and TransUnion;

- Get 2% cash back on U.S. restaurants and gas stations up to $1,000 in combined purchases, plus 1% on everything else;

- There’s no membership, monthly or annual fees;

- Get a cash back match at the end of your first year as a card member;

- Low security deposit to open the account, and it’s refundable;

- Possibility to upgrade to an unsecured card after 7 months of responsible use.

- See if you pre-qualify without harming your credit score.

Disadvantages

- The biggest disadvantage to this card is its high APR at 24.49% variable.

Discover it® Secured Card application

Applying for the Discover it® Secured Card is easy and can help you build your credit history. Read on to learn more about this card's features and how to apply today.

All you need to know about the Discover it® Cash Back card

The Discover it® Cash Back Card’s most attractive feature is its high rewards rate. With this card, you’ll get a 5% return on eligible – and quarterly – purchases up to $1,500.

The downside is that you need to activate those bonus categories each quarter to earn the highest return. Plus, once you reach the spending caps, the rate drops to a flat 1%.

The card also offers the standard Discover welcome bonus of dollar-for-dollar cash back match at the end of your first year, which is a solid intro offer.

You won’t have to pay for an annual fee and still get a lengthy 0% introductory APR for 15 months on purchases and balance transfers. After that period, the APR varies between 13.49% and 24.49%, and you’ll have to pay a 5% fee for balance transfers.

The application process is simple, and you can do it online, but you’ll need at least a good credit score to become eligible. Since this is not a secured card, you won’t have to put down a deposit. The bank determines your credit limit based on your creditworthiness.

To help you choose between the Discover it® Secured or Discover it® Cash Back, check out some of the Cash Back’s pros and cons below.

Benefits

- You’ll get a great introductory APR with this card, with 0% for 15 months on purchases and balance transfers;

- The rewards rate is one of the best in the market. Get a 5% return on different categories each quarter upon activation;

- There are no annual or foreign transaction fees. That makes this a great card for international purchases or taking it abroad with you;

- As a welcome bonus, Discover will match all cash back you’ve earned during your first year as a new member.

Disadvantages

- The biggest disadvantage is that you need to activate your quarterly bonus categories to earn the 5% cash back rate;

- After you reach the $1,500 spending cap, the 5% categories drop to a flat 1% return;

- You need a credit score of at least 700 to become eligible for this card.

Discover it® Cash Back application

Learn how the Discover it® Cash Back application process works so you can apply for it and enjoy the many benefits this card has to offer. Read on to learn more!

Discover it® Secured or Discover it® Cash Back: which is the right choice?

Even though both Discover cards offer many benefits to their cardholders, they are not for the same public. You could get a secured card if you have a good credit score to help you manage your expenses.

However, if your score is less-than-perfect at the moment, you won’t be able to qualify for a Discover it® Cash Back card.

So “the right choice” is a relative term in this case. To figure out which card to choose between the Discover it® Secured or Discover it® Cash Back, you need to evaluate your current financial conditions.

If you need a little helping hand with your score, the secured option is your best bet. But if you already have a good or excellent score and want to take advantage of the high cash back rewards, the Discover it® Cash Back is the best option for you.

And if you are a student that’s just starting to build your score, Discover has an option for you as well. With the Discover it® Student Cash Back credit card, you’ll have the chance to build a strong rating while getting a series of exclusive benefits.

To learn more about this card, follow the link below and read our full review!

Discover it® Student Cash Back credit card review

This post will show you everything about the Discover it® Student Cash Back credit card.

About the author / Aline Barbosa

Trending Topics

TrueAmericanLoan application process: Find just the right loan!

In this TrueAmericanLoan application, you will learn how to use this platform to start getting multiple loan offers within minutes.

Keep Reading

Discover it® Student Chrome application: how to get your student credit card

Learn how the Discover it® Student Chrome application process works and how this card can help you with your college expenses!

Keep Reading

Choose the best zero APR credit card for your needs

Explore all your options for finding a zero APR credit card and come away with the best deal that suits your financial needs and lifestyle!

Keep ReadingYou may also like

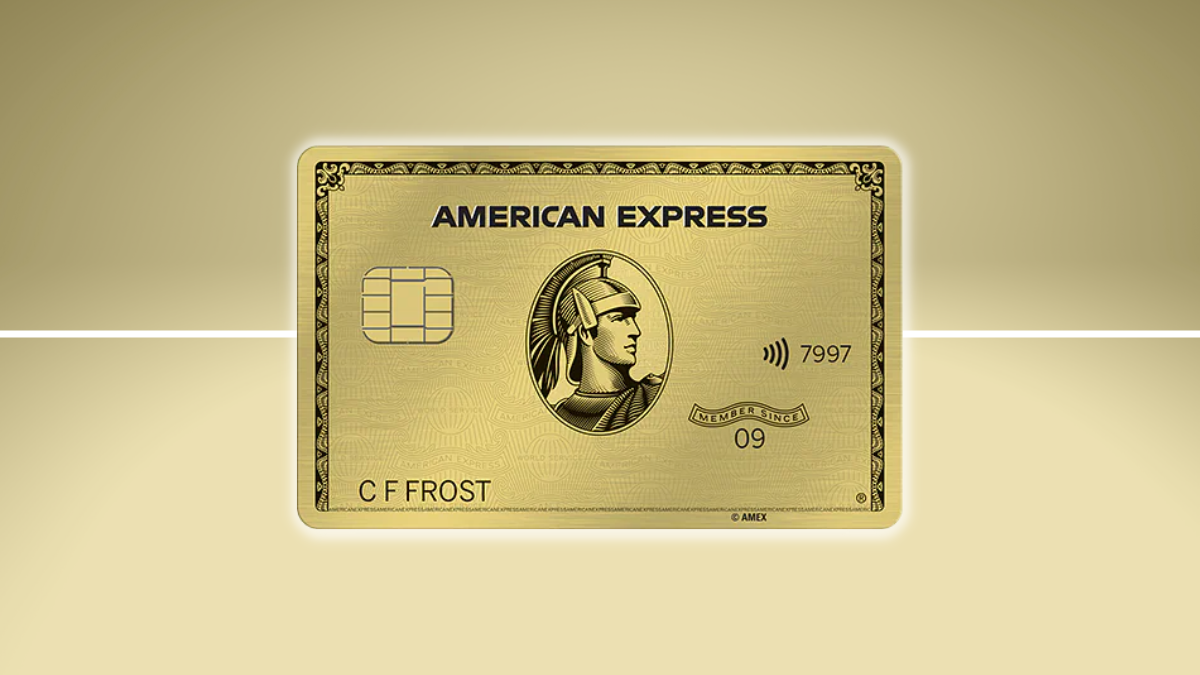

American Express® Gold Card application guide

This American Express® Gold Card application guide will show you how to get this card that gives you dining and travel benefits.

Keep Reading

Veterans United Home Loans application

Looking to buy a home with a VA loan? Our guide to the Veterans United Home Loans application process will help you get started.

Keep Reading

Application for the Mogo card: how does it work?

The Mogo debit card will give you sustainable benefits for a $0 annual fee. This post will show you how you can easily open your account.

Keep Reading