Reviews

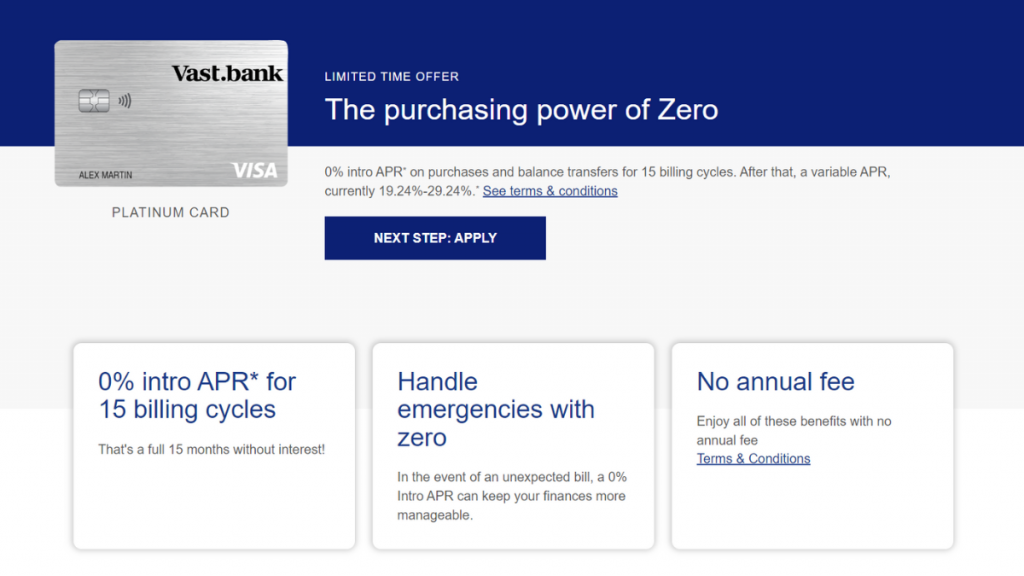

Vast Platinum Credit Card Review for My Unique Outlet Shoppers

Is the Vast Platinum Credit Card your ultimate shopping companion for My Unique Outlet? Find out in our in-depth review, uncovering savings, perks, and more!

Advertisement

Elevate Your Shopping Game: Vast Platinum Credit Card review

Introducing the Vast Platinum Credit Card – your golden ticket to limitless shopping adventures at My Unique Outlet! Read our Vast Platinum Credit Card review to learn more!

Moreover, in this review, we’ll explore the myriad benefits and exclusive perks that come with this prestigious card, designed to elevate your retail experience to unprecedented heights!

- Credit Score: Accepts all types of credit scores;

- APR: 0% intro APR for the first 18 billing cycles on purchases and balance transfers for new cardholders, 18.24% to 29.24% after;

- Annual Fee: There is no annual fee, but there is a monthly membership fee of around $19.95;

- Fees: You’ll need to pay late payment fees if you don’t make your repayments on time. And there can be some other fees, such as an application processing fee;

- Welcome bonus: There is no welcome bonus for this card;

- Rewards: There are no rewards programs.

Vast Platinum Credit Card: how does it work?

Are you ready to unlock a world of luxury and savings?

The Vast Platinum Credit Card offers an unrivaled fusion of convenience and rewards, making it the ultimate companion for the savvy shopper.

Moreover, from its low APR and flexible payment options to its generous discounts at My Unique Outlet, this card promises to revolutionize the way you shop.

So, Join us as we delve into the extraordinary features of this credit card and discover how it can transform your retail therapy into an unforgettable journey.

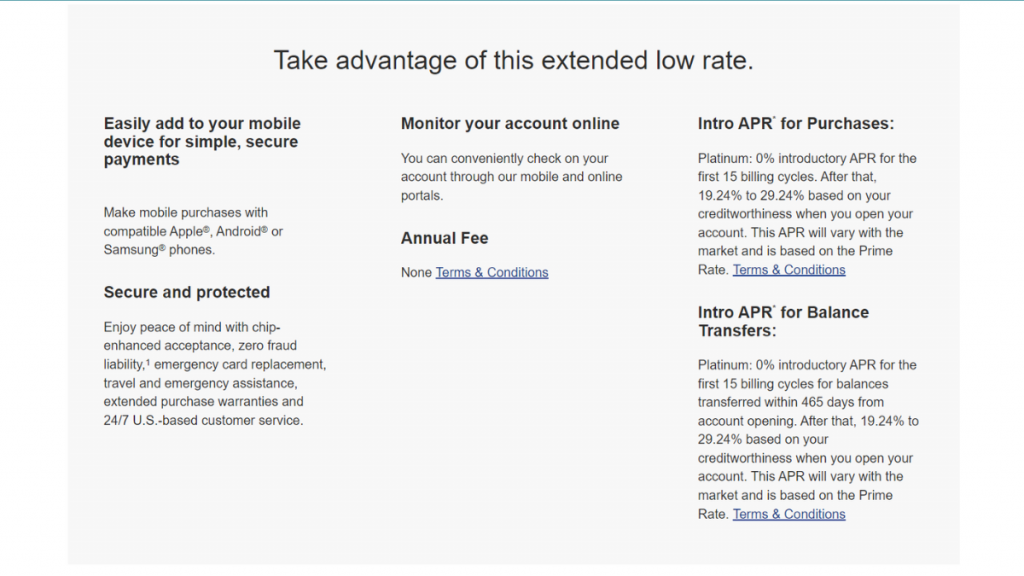

In addition, this card offers a 0% intro APR period to its new cardholders for up to their first 15 billing cycles on purchases and balance transfers!

Moreover, you’ll be able to save a lot of money on interest with this intro APR feature for purchases and balance transfers.

Also, this card has no annual fee. However, you’ll need to pay a membership fee to enjoy this card’s perks and features.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Even though this card offers incredible perks, there are also some downsides, as with any other card. For example, you’ll need to pay a monthly membership fee and a foreign transaction fee.

Therefore, you can check out our list below to understand more about this card’s pros and cons. Also, you’ll be able to see if this can be the card for your needs or not!

Benefits

- There is no annual fee;

- New cardholders will benefit from a 0% intro APR period of their first 15 billing cycles on purchases and balance transfers;

- You’ll be able to apply for this card even with a fair or a not-so-good credit score;

- Your credit score can increase if you make all your monthly payments on time.

Disadvantages

- You’ll need to pay a $19.95 monthly membership fee to use this card;

- You can only use this card at the My Unique Outlet online;

- There is a foreign transaction fee of 3%;

- There are no rewards or welcome bonuses.

Is a good credit score required for applicants?

There is a chance for you to get approved even with poor credit for this card.

However, you’ll be able to try out the application process with any type of score.

Moreover, you’ll even be able to get considered if you have poor credit.

However, they may perform a hard credit check during the application process to get this card.

So, make sure that you can handle this on your score before you complete the application.

In addition, this card will analyze other factors and requirements during the application process to see if you’re fit to get approved.

Learn how to apply and get the Vast Platinum Credit Card

Before you learn all about how to apply for this card, you’ll need to know some information.

So, you need to know that you need to go to the official website and look for the card’s terms and conditions to see if you really want to apply for this card at the moment.

Also, you need to make sure you understand that this card offers many perks. However, you can only use it at the My Unique Outlet.

Moreover, you need to make sure you know all about the fees you need to pay to enjoy this card’s perks, including the membership fee.

So, after you’ve learned and are aware of this card’s terms and fees, you can read our tips below to see how you can apply for this card easily!

Learn how to get this credit card online

You’ll be able to get this card online through the official website. So, you’ll need to go to the website and find the Vast credit card you want.

Then, if you don’t already have a Vast Bank account, you’ll need to create an open one before you apply for any of the cards.

So, after that, you’ll be able to learn more about the card you want and start the application process.

Moreover, make sure that you meet all the requirements before you apply. For example, you’ll need to live in the U.S. and meet some other requirements.

Then, you’ll be able to provide the personal information required to get this card.

So, after all of this, you’ll be able to wait for a quick response on whether you got the card or not.

How to get this card using the app

You’ll be able to download Vast Bank’s mobile app to use it to manage your finances through Vast Bank.

However, to complete the application process, you’ll need to go to the official website online.

So, you can read our topic above to follow our tips and apply online!

What about another recommendation: Bloomingdale’s American Express® Card

And if you’re looking for a more luxurious store card, we can help you find it! For example, you can try applying for Bloomingdale’s American Express® Card!

Moreover, with this incredible American Express Card, you’ll be able to get the best perks for shopping at Bloomingdales!

Also, you’ll be able to get up to 3x points at Bloomingdales and 6x points on shoes, cosmetics, and more!

Moreover, you’ll even be able to try to qualify for this card with only a fair credit score.

In addition, as a new cardholder, you’ll get incredible welcome bonuses! Moreover, you’ll be able to get all these perks and features for no annual fee!

Therefore, if you want to learn more about this card’s perks and how to apply for it, we can help! So, read our blog post below to learn more!

How to get your Bloomingdale’s Amex card?

Looking for a credit card with high rewards and no annual fee? Get one with our Bloomingdale’s American Express® Card application guide.

About the author / Victória Lourenço

Trending Topics

Oportun Personal Loans application

Learn how the Oportun Personal Loans application process works and have access to funds fast to cover whatever you may need them for!

Keep Reading

Aspiration Plus Account application

Learn everything you need to know about the Aspiration Plus Account application process and start earning interests right away!

Keep Reading

Chase Sapphire Reserve review: earn points on travel and dining

In this Chase Sapphire Reserve review you will learn about this card's incredible bonus, benefits and perks. Check it out!

Keep ReadingYou may also like

SoFi Personal Loans review

Check out our SoFi Personal Loans review and learn how to get your lowest rate today with no hidden fees and fast pre-approval!

Keep Reading

How to join Spring Bank with an online application?

In this Spring Bank application guide you are going to learn how to start banking with this bank to help society and the environment.

Keep Reading

How to get your Standard Bank World Citizen Credit Card: online application

In this Standard Bank World Citizen Credit Card application guide, we will show how you can get this card that gives you tons of benefits.

Keep Reading