Debit Cards

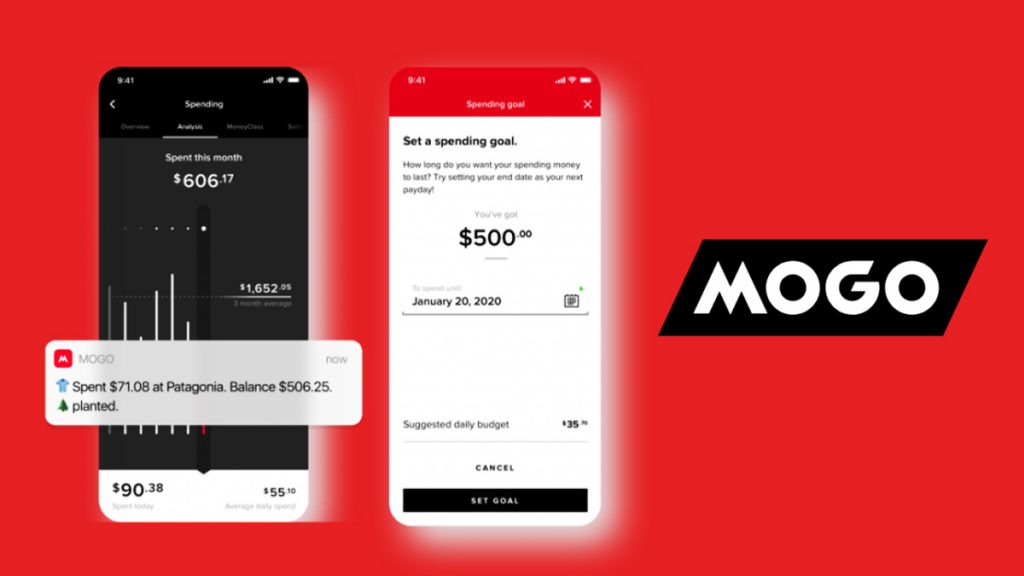

Mogo debit card review: the best environmental card

Do you care about the future? If you so, let Mogo help you take action against climate change. Read this review to learn how this debit card is taking care of the environment.

Advertisement

Mogo debit card: offset your carbon footprints and earn crypto rewards.

The Mogo debit card will give you a different relationship with the way you spend your money.

This reloadable card not only offers excellent service but also cares about the environment and will help you to fight climate change.

If you’re tired of the old way of banking is time to keep up with the revolution of online not-banks. Most traditional banks do not offer benefits when you use your debit card.

So, if you’d like to learn a new way of spending your money with a debit card that gives you rewards, keep reading this article to see what the Mogo debit card has to give.

Learn how to get the Mogo debit card

The Mogo debit card will give you sustainable benefits for a $0 annual fee. This post will show you how you can easily open your account and start using your card.

- Credit Score: Mogo will not inquiry your credit score

- Annual Fee: It will cost you $0 per year.

- Regular APR: N/A

- Welcome bonus: There is no sign-up bonus.

Rewards: 1 tree plus 50 Green Satoshis per purchase.

Mogo debit card: is it a good card?

With this fresh wave of online banks, Mogo stands out. This debit card is offered by Mogo Finance Technology, that provides financial management products and tolls since 2015.

The company is very aligned with the new generation’s urge to take action against climate change. So, instead of cash back, they give you trees and green satoshis as a reward.

Also, their mobile app is very useful to help you save money. Transfer the amount you intend to use and manage your expenses with financial insights. The annual fee to enjoy all of these benefits is $0.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Mogo debit card: should you get one?

Mogo is an excellent way to manage your money. If your debit card doesn’t offer the best features, you can enjoy Mogo’s mobile app, and earn rewards for using a debit card. Check some of the pros and cons:

Pros

- Control your expenses with a reloadable card. You can’t overspend or create debt.

- For every purchase, Mogo will help you give back to mother nature by planting a free for you.

- Green Satoshis is a sustainable cryptocurrency, and you’ll earn 50 of them every time you use your debit card.

- The mobile app has an efficient and very pleasant design, which makes it pretty intuitive to use and enjoy a lot of handy functions, like budgeting, protecting your card, controlling your money, etc.

Cons

- It is not a credit card, so it will not build your credit.

- No welcome bonus.

- Your funds are not covered with CDIC insurance, so it is not a good idea to deposit a high amount.

What is the required credit score?

Don’t worry about your credit score. Mogo is a debit card, and you will not get a credit line. You can open your account even with an average credit score or an inexistent credit score.

Mogo debit card application

If you’d like to enjoy all these benefits, you can apply for this card online. It is easy and you can do it from your cellphone.

So, to add this beautiful card to your wallet, read the following article that will show you how to do it.

Learn how to get the Mogo debit card

The Mogo debit card will give you sustainable benefits for a $0 annual fee. This post will show you how you can easily open your account and start using your card.

About the author / Aline Barbosa

Trending Topics

The Post New recommendation – Buy On Trust Lending

See how Buy On Trust Lending can help you upgrade your electronic devices even if you have a low or no credit score!

Keep Reading

Delta SkyMiles® Blue American Express Card application

The Delta SkyMiles® Blue American Express Card lets you earn miles quickly, so you can enjoy more of what you love. See how to apply!

Keep Reading

The Platinum Card® from American Express review: Luxury Travel, Dining, and more

In this The Platinum Card® from American Express review you are going to learn about this card's exclusive lounge access and more!

Keep ReadingYou may also like

BankProv review: is it trustworthy?

This BankProv review presents this innovative bank that specializes in intelligent financial solutions for state-of-the-art businesses.

Keep Reading

JetBlue Card application process: rewards at a high rate

In this JetBlue Card application guide,, we will show you how to get this card today and start earning 3 points per dollar with JetBlue.

Keep Reading

Bank of America® Travel Rewards Card review

Are you looking for an exceptional travel rewards card? Then check out our Bank of America® Travel Rewards Card review!

Keep Reading