Loans

PNC Bank Personal Loans Review: Achieving Your Financial Goals!

Explore a world of financial possibilities with PNC Bank, offering competitive rates, no collateral demands, and an application process that puts you in control. Make your borrowing experience a breeze!

Advertisement

From consolidating debt to financing major purchases, explore the advantages of flexible borrowing!

Need a little extra money for your vacation? Or what about making a home improvement? Then discover the PNC Bank Personal Loans in this review and embark on the path to financial empowerment!

The PNC Bank’s Unsecured Installment Loans are designed to meet your diverse needs. They offer a seamless blend of competitive rates and transparent terms to help you achieve your goals!

- APR: Experience competitive fixed rates.

- Loan purpose: Whether it’s tackling high-interest debt, funding a major purchase, or planning a special event, PNC Unsecured Installment Loans offer financial flexibility to meet various needs.

- Loan amount: Tailor your borrowing to fit your goals with loan amounts ranging from $1,000 to $35,000.

- Credit needed: N/A.

- Terms: 6 to 60 months.

- Origination fee: No origination fees attached.

- Late fee: N/A.

- Early payoff penalty: Embrace financial freedom with PNC Unsecured Installment Loans, featuring no early payoff penalties.

PNC Bank Personal Loans: how does it work?

Whether you’re consolidating debt, funding a significant purchase, or realizing a lifelong dream, this PNC Bank Personal Loans review can help you get there!

At the heart of PNC Bank’s commitment to financial empowerment lies the realm of Personal Loans.

Specifically, their Unsecured Installment Loans offer borrowers a pathway to achieve their financial goals without the need for collateral.

Moreover, the process begins with a straightforward application, allowing you to choose loan amounts ranging from $1,000 to $35,000.

Besides, the fixed APR ensures predictability in your monthly payments, allowing for better financial planning. And the absence of origination fees further adds to the appeal.

Upon approval, PNC Bank streamlines the access to your funds. If you’re in immediate need, a visit to a local branch for the signing of loan documents allows for an instant disbursement of funds.

But, for those who prefer a more relaxed approach, the option to receive loan documents by mail is available.

Finally, with no prepayment penalties, the flexibility to pay off your loan early without additional costs is a tangible benefit.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Whether you’re navigating the waters of debt consolidation, planning a significant purchase, or funding a major life event, it’s important to review the benefits and drawbacks of the PNC Bank Personal Loans.

This will provide a roadmap to a future enriched with financial success and stability.

Benefits

- Financial flexibility

- Enjoy the freedom of borrowing without the need for collateral

- Loan amount that precisely fits your financial requirements

- Doesn’t burden borrowers with origination fees

- Absence of prepayment penalties

- Quick application process

Disadvantages

- Loan limits

- Branch visit requirement for immediate funds

- Not ideal for large-scale projects

Is a good credit score required for applicants?

While a good credit score can improve your chances of qualifying for more favorable terms, PNC aims to cater to a broad range of applicants.

PNC Bank Personal Loans application

So, ready to discover a clear pathway to financial empowerment? Then it’s time to review the steps to get your PNC Bank Personal Loans! PNC Bank provides borrowers with a user-friendly experience.

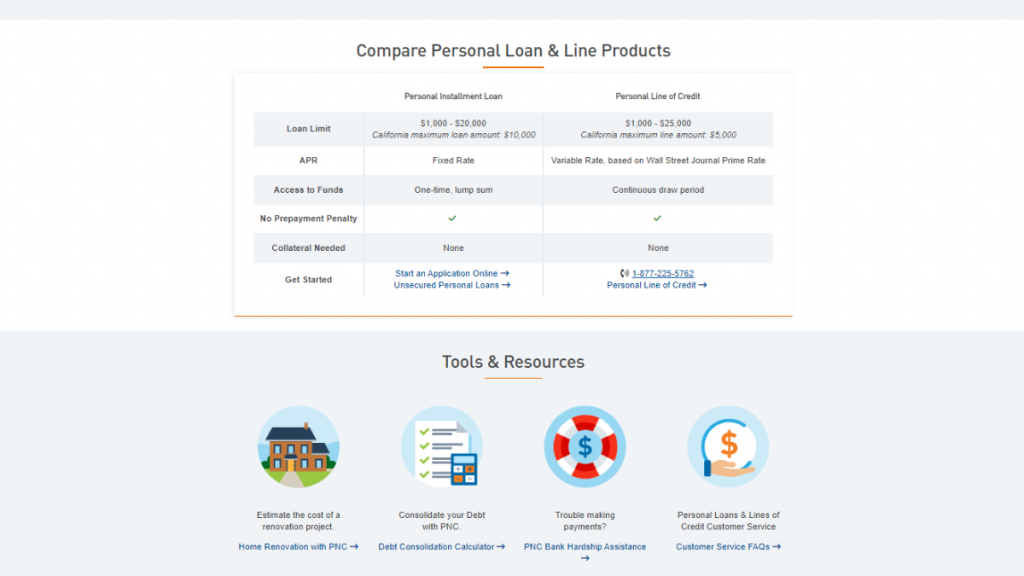

However, please note the only way to apply online is if you choose the Personal Installment Loan since there’s no online process available for the Personal Line of Credit.

- Visit the PNC website: First, open your web browser and navigate to the official PNC Bank website. Then, select the “Personal” tab on the main menu and click on “Products & Services”. Finally, click on “Personal Loans and Lines of Credit”.

- Choose Unsecured Installment Loan: When you access the PNC Bank Personal Loans to review the options, start by typing your Zip Code. Then, select the Unsecured Installment Loan.

- Application process: Once the page loads, click on “Apply Now”. If you’re a new customer, you may need to create an online account with PNC Bank. If you’re an existing customer, log in using your credentials. Finally, complete the online application form, supplying essential personal information such as your name, address, Social Security Number, and employment details.

- Submit the form: Once you’ve reviewed and confirmed all the information, submit your application. If your application is approved, you may receive an immediate decision, or PNC Bank might contact you for further details.

What about another recommendation: Rescue One Financial Loans!

If you want to review alternatives to PNC Bank Personal Loans, consider the offerings from Rescue One Financial Loans. Rescue One Financial stands out for its tailored loan options.

With competitive rates and flexible terms, Rescue One Financial Loans provide an alternative pathway to achieve your objectives. Find out how they stack up against PNC Bank Personal Loans below!

Rescue One Financial Review: Escape Debt's Grip!

Review the Rescue One Financial Loans and say goodbye to financial stress with personalized solutions and debt reduction!

About the author / VInicius Barbosa

Trending Topics

FB&T Personal Loan application

Learn how the FB&T Personal Loan application process works and how you can get a loan that fits your financial needs perfectly.

Keep Reading

JetBlue Plus Card review: get yearly points bonus!

In this JetBlue Plus Card review you will see how you can earn generous rewards with this airline credit card, plus a nice welcome bonus.

Keep Reading

How to open your Bask Bank Mileage Savings account

In this article, we will show you how you can easily open your Bask Bank Mileage Savings account and start saving.

Keep ReadingYou may also like

3Commas Crypto Trading review: learn everything about this trading platform

This 3Commas Crypto Trading Platform review will show how it can help you manage portfolios, trade in multiple exchanges, and more.

Keep Reading

Ink Business Cash® Credit Card application: Unbeatable Rewards!

Looking to get a cashback business card? Read this Ink Business Cash® Credit Card application guide and get yours in a few minutes.

Keep Reading

PREMIER Bankcard® Mastercard® Credit Card review

Are you looking for a product to help you fix your score? Then look at what the PREMIER Bankcard® Mastercard® Credit Card has to offer.

Keep Reading