Get much more value on everyday expenses with a truly rewarding credit card!

Blue Cash Everyday®: Make the most of your daily spending with unlimited rewards!

Advertisement

If you think American Express credit cards are for travel only, you don’t know this card. We recommend you take a look at the amazing benefits this blue card will give you if you take it to the grocery store with you. You’ll earn up to 3% cash back on everyday expenses, and will pay nothing for it. Zero annual fees to get a lot of rewards! Check our comprehensive review to learn more.

If you think American Express credit cards are for travel only, you don’t know this card. We recommend you take a look at the amazing benefits this blue card will give you if you take it to the grocery store with you. You’ll earn up to 3% cash back on everyday expenses, and will pay nothing for it. Zero annual fees to get a lot of rewards! Check our comprehensive review to learn more.

You will remain in the same website

If you’re on the hunt for a reliable, simple cash back card that can give you rewards with no-hassle redemption and value beyond your everyday purchases, the Blue Cash Everyday® Card from American Express is the perfect candidate. Check a few of its impressive list of benefits below!

You will remain in the same website

To become eligible for a Blue Cash Everyday® Card, you need to have a credit score of 700 and more. You also need a high, steady income. Other requirements include a valid SSN or ITIN, be over the age of majority and a U.S. citizen or permanent resident with a valid address.

With the Blue Cash Everyday® Card, you won’t have to worry about maintenance or annual fees. However, there are a couple of other fees you should be aware of. For cash advances, you’ll have to pay a 5% fee (with a $10 minimum). There’s also a 2.7% foreign transaction fee for international purchases, and a late fee up to $40 max.

New cardmembers can enjoy a promotional introductory 0% APR for 15 months on purchases and balance transfers. Once that period ends, the variable APR ranges between 18.24% – 29.24% based on your overall creditworthiness.

If you meet the requirements and would like to apply for the Blue Cash Everyday® Card, you can do so easily and online. Check the following link for a comprehensive walkthrough of the entire process.

How to get the Blue Cash Everyday® Card?

Read this post to learn how to apply for a Blue Cash Everyday® Card and enjoy all of its amazing benefits. Put this Amex in your wallet and use it every day.

But if you want to check out another cash back credit card before making a final decision, we can help. The Citi Custom Cash℠ rewards all cardholders with a high rate on eligible purchases and charges no annual fee.

To learn more about what the Custom Cash℠ has in store and how you can apply for it, check the link below.

How to apply for Citi Custom Cash℠ credit card?

This post will tell you how to apply for the Citi Custom Cash℠ online in just a couple of minutes. Read on and learn how to get your cashback credit card!

Trending Topics

Best cards for people with no credit

Here you'll find the best cards if you have no credit history. Build score with a good card. Some have even cash back rewards and no fees.

Keep Reading

Bank of America® Customized Cash Rewards for Students review

If you want to earn cashback on everyday purchases, check out this Bank of America® Customized Cash Rewards for Students review.

Keep Reading

Avant Credit Card review

Learn why Avant is considered by many one of the best credit building products available in the market in our Avant Credit Card review.

Keep ReadingYou may also like

How to choose the best credit card to travel?

If traveling seems too expensive to you, that's because it is. However, with the best credit cards for travel you can make it affordable.

Keep Reading

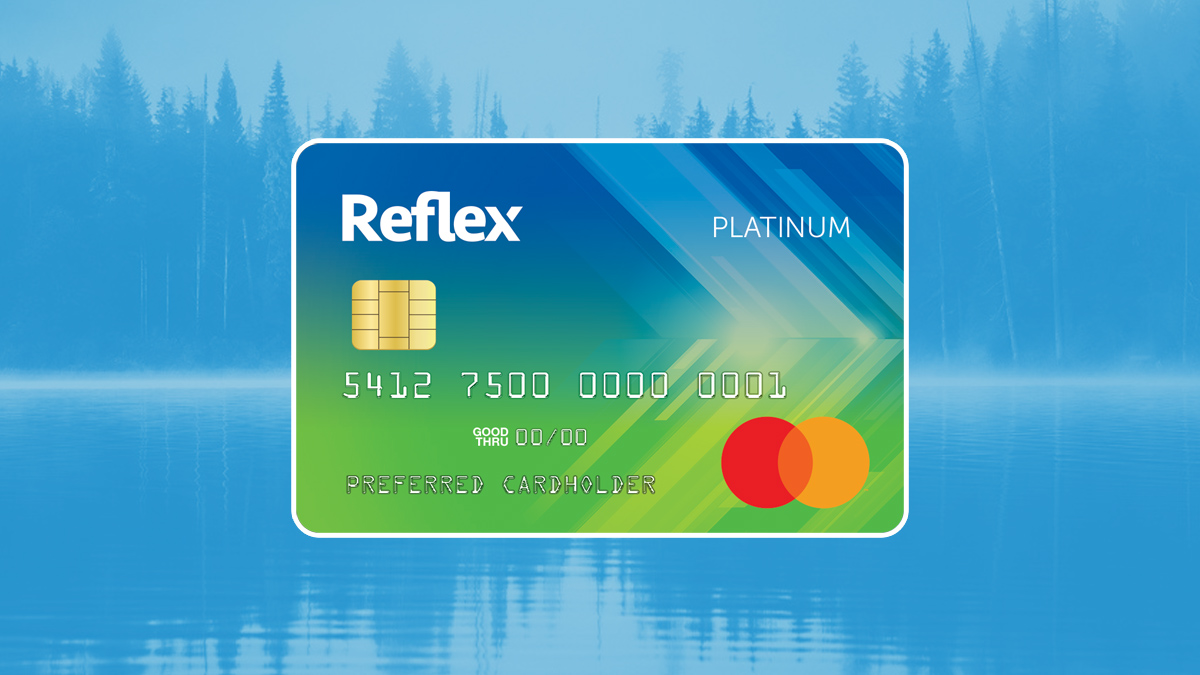

Reflex Mastercard® Card application

Learn all about the easy and fast application process for the Reflex Mastercard® Card and get a card that can help you get financially fit!

Keep Reading

Make extra money from home: 5 smart ways to do it!

Need to make some extra money from home? In this article, we bring practical ideas for making money from home.

Keep Reading