Enjoy no monthly account fees and no minimum balance requirement with Capitec Tax-free Savings

Capitec Tax-free Savings Account: Earn Tax-Free Interest on Your Savings of Up to R36,000

Advertisement

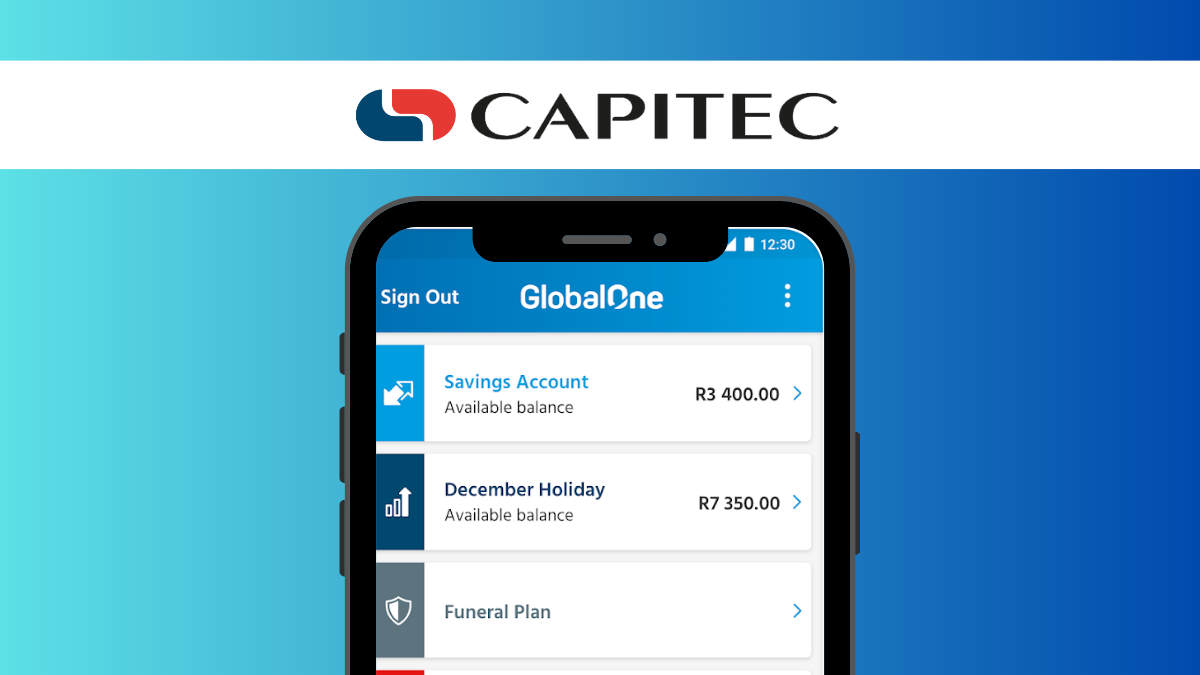

Capitec Tax-free Savings Account is perfect for anyone who wants to save money and earn tax-free interest. This account allows you to save up to R36,000 per year without being taxed on the interest you earn. It also comes with no monthly account fees and no minimum balance requirement, making it an affordable and accessible option for everyone.

Capitec Tax-free Savings Account is perfect for anyone who wants to save money and earn tax-free interest. This account allows you to save up to R36,000 per year without being taxed on the interest you earn. It also comes with no monthly account fees and no minimum balance requirement, making it an affordable and accessible option for everyone.

You will remain in the same website

Have a look at these benefits that the Capitec Tax-free Savings Account gives you access to.

You will remain in the same website

Any South African citizen who has a valid South African ID number and is at least 18 years old can open a Capitec Tax-free Savings Account.

You can save up to R36,000 per year in a Capitec Tax-free Savings Account. Any amount over R36,000 will be taxed.

The Capitec Tax-free Savings Account offers tiered interest rates that depend on the balance amount in the account. Interest rates start at 3.50% for balances of R0 to R24,999 and increase to 6.25% for balances of R150,000 or more. This system means that account holders can earn more interest on their savings as their balance increases. However, it’s important to note that interest rates are subject to change and affected by various factors such as economic conditions and decisions made by the Reserve Bank. The tiered interest rate system provides a great opportunity for individuals to save and earn more on their savings over time.

No, there are no monthly account fees or minimum balance requirements associated with a Capitec Tax-free Savings Account.

Yes, you can withdraw money from your Capitec Tax-free Savings Account at any time. However, keep in mind that if you withdraw more than R36,000 in a year, you will not be eligible for tax-free interest on the excess amount.

Ready to start earning tax-free interest on your savings with Capitec’s Tax-free Savings Account? Click the link below to access our application guide and apply in just a few minutes.

How to open your Capitec Tax-free Savings Account

Earn tax-free returns and get flexible investment terms by following our Capitec Tax-free Savings Account application guide.

If you’re searching for a credit card that offers cashback, consider the African Bank Gold Credit Card.

This premium option provides a range of benefits to its users, making it a competitive choice.

With a monthly account fee of R23.00 and a credit limit of up to R90,000.00, the Gold Credit Card is a great option for those who want to maximize their benefits.

To learn more about this credit card, click on the link below and discover all the features it has to offer.

How to get your African Bank Gold Credit Card

In this African Bank Gold Credit Card application guide we will show you how to get this card fast so you can start enjoying its benefits.

Trending Topics

Credit One Bank® Platinum Visa® for Rebuilding Credit application

Learn how to apply for the Credit One Bank® Platinum Visa® for Rebuilding Credit Card and get your credit on track today!

Keep Reading

3Commas Crypto Trading review: learn everything about this trading platform

This 3Commas Crypto Trading Platform review will show how it can help you manage portfolios, trade in multiple exchanges, and more.

Keep Reading

Juno Checking Account review: is it trustworthy?

This Juno Checking Account review will show you how you can earn 5% cash back on cash purchases and 10% cash back on crypto purchases.

Keep ReadingYou may also like

Citi® Double Cash credit card application

If you're wondering how to apply for the Citi® Double Cash credit card, check this content and you'll find everything you need to know.

Keep Reading

Capital One Walmart Rewards® credit card review: Get up to 5% cash back at Walmart

If you're a frequent shopper at Walmart, read this Capital One Walmart Rewards® review to see all the benefits of having this card!

Keep Reading

CashUSA loans review

Don't waste your time looking for a loan when you can read this CashUSA loans review and learn how to easily get a personal loan.

Keep Reading