Are you in the market for a convenient and affordable way to consolidate your credit card debt and reach financial wellbeing?

The Happy Money Personal Loan can help you achieve a debt-free life with affordable and flexible debt consolidation loans to fit your budget!

Advertisement

Are you searching for a way to consolidate your credit card debt? Do you want to gain better control of your finances without having to worry about high-interest rates and unmanageable payments? A Happy Money Personal Loan is an excellent option that can help you get out of debt and become more financially secure. Learn how the loan works, how to apply, and pay off creditors — all with one low-rate payment!

Are you searching for a way to consolidate your credit card debt? Do you want to gain better control of your finances without having to worry about high-interest rates and unmanageable payments? A Happy Money Personal Loan is an excellent option that can help you get out of debt and become more financially secure. Learn how the loan works, how to apply, and pay off creditors — all with one low-rate payment!

You will remain in the same website

Do you need a way to consolidate your multiple bills into one easily manageable payment? If so, then a Happy Money personal loan may be the answer for you. Check its amazing benefits below!

You will remain in the same website

Yes, Happy Money is a legitimate business. It is a financial technology company that offers personal loans and credit card refinancing services to help people pay off debt and achieve financial wellness. The company has received investments from reputable venture capital firms, and it is registered with the appropriate regulatory authorities.

It depends on your individual financial circumstances, but generally, Happy Money has flexible eligibility requirements and considers factors beyond just credit scores when evaluating loan applications, such as employment history and income stability. This can make it easier for some borrowers to qualify for a personal loan compared to traditional lenders, but it ultimately depends on each applicant’s specific financial situation.

No, Happy Money does not offer cosigners or joint loans at this time. Happy Money’s personal loans are based on individual creditworthiness and financial history, and the borrower is solely responsible for the repayment of the loan.

If you’d like to learn how you can easily apply for a Happy Money Personal Loan, check out the following link for a complete walkthrough.

How to apply for Happy Money Personal Loan?

Learn all about the application process for the Happy Money Personal Loan and get the money you need to reach financial freedom!

But if you’re looking for a different type of personal loan, we suggest looking at Best Egg Personal Loan. With competitive rates, you can borrow up to $50,000 for a series of different purposes.

See the link below for more information about the Best Egg loan and how to apply for it online.

How to apply for Best Egg Personal Loan

Learn how to apply for the Best Egg Personal Loan and see why it’s one of the leading personal loan lenders today.

Trending Topics

MyPoint Credit Union Visa Card Review: Elevated Rewards!

Discover a world of possibilities in this MyPoint Credit Union Platinum Visa Card review. Elevate your experience with a generous credit line!

Keep Reading

Citi Rewards+® application process: how to get this card?

Check this Citi Rewards+® credit card application review. You can earn a welcome bonus of 20,000 points and many rewards!

Keep Reading

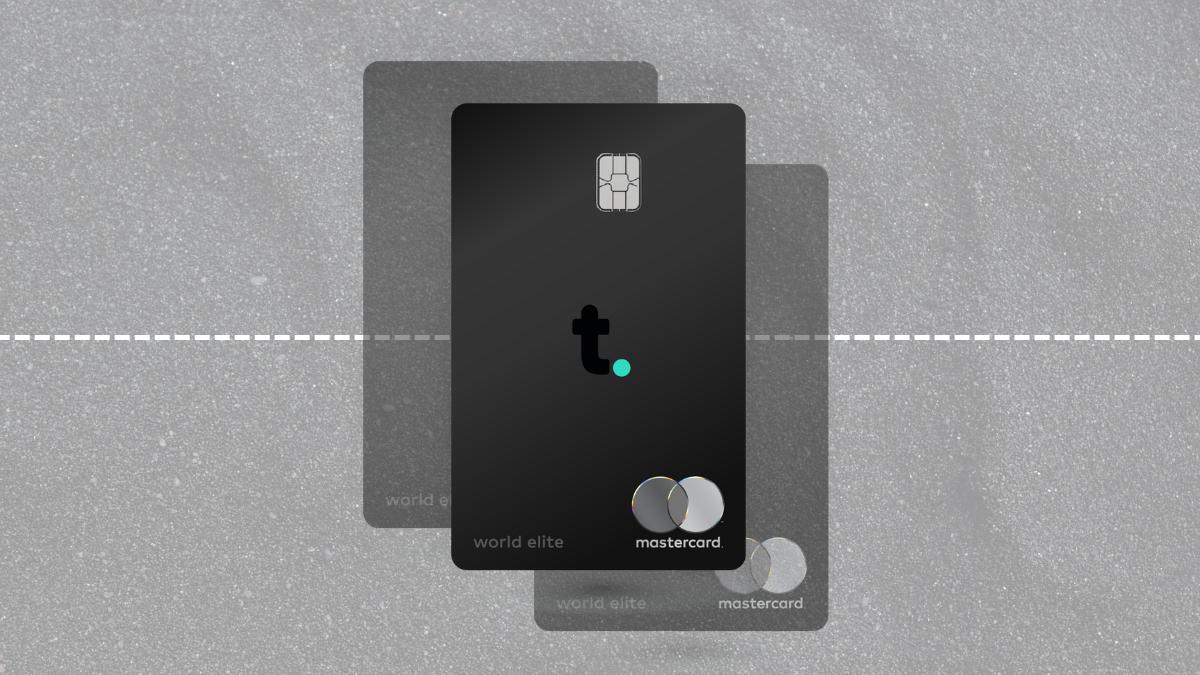

How to get your Tomo Credit Card

See how the Tomo Card application process works and how the company evaluates your financial profile in order to approve your request.

Keep ReadingYou may also like

ElectroFinance Lease review: get a lease easily

In this ElectroFinance Lease review you will see how this company makes it easier for you to access the electronics you need.

Keep Reading

Alliant Bank review: is it trustworthy?

Looking for a multifaceted bank with a wide range of products and services. Read this Alliant Bank review and learn all about it.

Keep Reading

African Bank Personal Loan application

The application process for the African Bank Personal Loan is quick, easy, and can get you the funds you need when you need them.

Keep Reading