Credit Cards

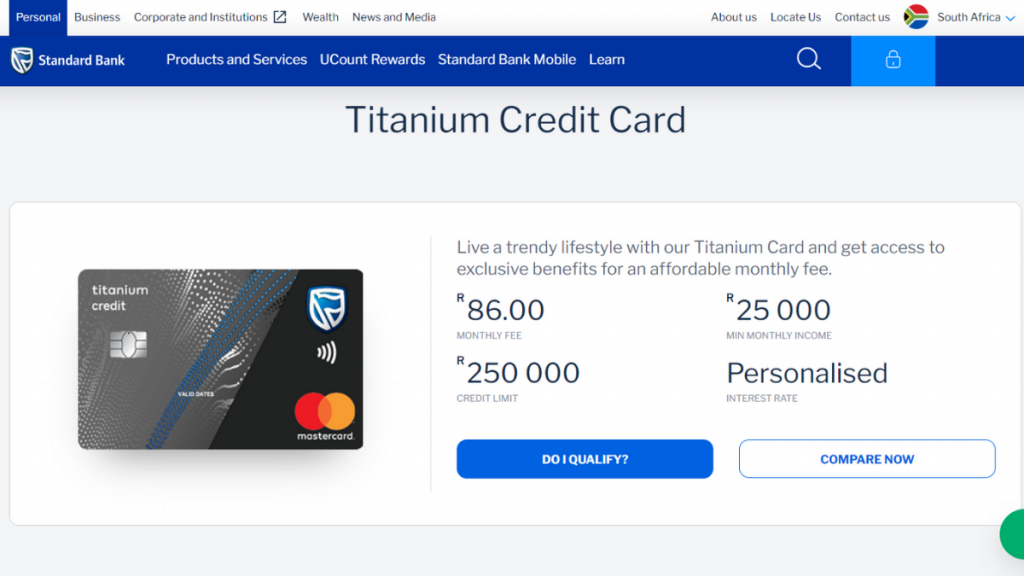

Standard Bank Titanium Card Review: Luxury Meets Affordability!

The Standard Bank Titanium Card offers a world of travel perks, lifestyle rewards, and digital convenience. And you can apply online in just a few minutes! Your gateway to financial sophistication is just a swipe away!

Advertisement

Explore the perks, from exclusive travel benefits to lifestyle rewards, and elevate your financial journey!

If you’re looking for a credit card that offers luxury and sophistication, review the Titanium Card, a premium financial tool from the leading African financial institution, Standard Bank.

Explore the exclusive benefits and lifestyle perks, and discover all the features of the Standard Bank Titanium Card today. Weigh the advantages and drawbacks and find out if this is the right card for your lifestyle.

- Credit Score: Though not specifically stated, the credit score for premium cards like the Standard Bank Titanium Card should be good to excellent;

- Annual Fee: Budget-friendly fee of R86;

- Intro offer: N/A;

- Rewards: The Titanium Card offers a range of rewards, including up to 5% cashback on Booking.com, free basic travel insurance for flight ticket purchases, lifestyle discounts, and more. You can earn up to 25% cash back on purchases!

- P.A.: N/A.

- Other Fees: Beyond the annual fee, the card comes with an initiation fee of R180.

Standard Bank Titanium Card: how does it work?

Although the Standard Bank Titanium Credit Card may seem high-end, only when you review all of its details can you decide if this credit card is the right fit for your lifestyle.

To start, be mindful of a reasonable monthly fee of R86. While it’s budget-friendly, there might be other credit card options on the market where the annual fee doesn’t apply.

However, the Standard Bank Titanium Card does give you a credit limit of R250,000 and a personalized interest rate, providing financial flexibility tailored to your needs.

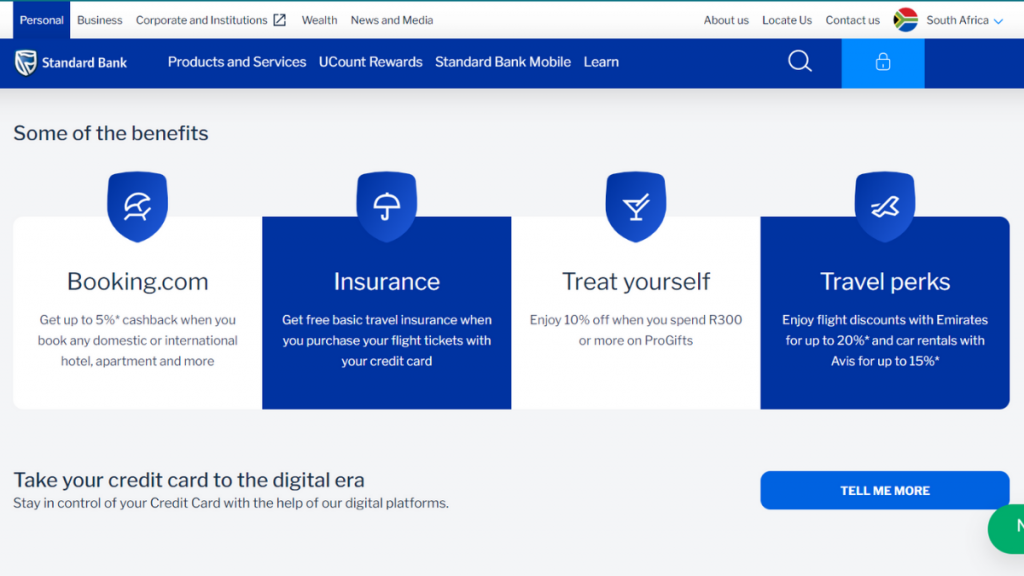

Additionally, you get perks like up to 20% off on Emirates flights, exclusive discounts on international car rentals with Avis, and complimentary lounge access at Bidvest Premier and Standard Bank Fluent Lounges.

Enjoy lifestyle perks, too, such as discounts at the Wine-of-the-Month Club and the opportunity to double UCount Rewards Points on every purchase!

This will elevate your lifestyle without straining your finances!

Lastly, manage your credit card seamlessly through Standard Bank’s digital platforms, embracing the convenience of the digital era. In essence, the Titanium Card offers an array of tempting perks!

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant benefits and disadvantages you may find

Now, it’s time to review the advantages and weigh the cons of the Standard Bank Titanium Card. Only then will you be able to make an informed decision on whether or not to apply.

Benefits

- Revel in interest rates tailored just for you;

- Experience a significant credit ceiling of R250,000;

- Double up on UCount Rewards points for added perks;

- Unlock up to a 20% discount on Emirates flights and savings on international car rentals;

- Treat yourself to free visits to lounges, both domestic and international;

- Seamlessly manage your card with the convenience of digital tools.

Disadvantages

- Pay a monthly fee of R86;

- For card initiation, an upfront fee of R180 is necessary;

- There’s no typical introductory promotion offered;

- Meet the minimum monthly income requirement for eligibility;

- Note that lounge access is limited.

Is a good credit score required for applicants?

While the specific credit score requirements for the Standard Bank Titanium Card aren’t explicitly outlined, having a good credit score is generally advantageous for credit card applicants.

Learn how to apply and get the Standard Bank Titanium Card

Embark on a seamless financial journey as we review the straightforward application process for the Standard Bank Titanium Credit Card. You can be done in minutes!

From accessing the official website to understanding eligibility criteria, this review unfolds the key details to ensure a smooth and successful application!

Learn how to get this credit card online

So, navigating the path to acquiring this premium card is a breeze, and in this guide, you’ll explore every simple step.

- Explore Standard Bank’s official website: Begin your journey by navigating to the authorized website. Whether you’re a returning user or a newcomer to online banking, take your first step by logging in or registering.

- Navigate to the Titanium Credit Card: Explore the main menu under “Products and Services,” select the option to view all available credit cards, and click on the Standard Bank Titanium Credit Card.

- Application form: Click on “Do I qualify?” on the card’s dedicated webpage to secure a free quote. Ensure a seamless application by furnishing accurate and up-to-date personal information.

- Submit the form and anticipate approval: Furthermore, with your details securely submitted, send off your application online. The bank will meticulously review your application, and upon approval, the coveted Standard Bank Titanium Credit Card will soon be in your hands.

What about another recommendation: Check out the Super Value Titanium Card!

Looking for something else? Then review the Super Value Titanium Card as a viable alternative to the Standard Bank Titanium Card! Indeed, it offers a unique set of benefits tailored for savvy spenders.

With a focus on maximizing value, the Super Value Titanium Card provides exclusive cashback rewards on everyday expenses! Intrigued? Then check out all the details to see if it’s the right choice for you!

Super Value Titanium Card Review

Discover the power of savings in this Super Value Titanium Card review! Enjoy 5% cashback on fuel, phone bills, and utility payments!

About the author / VInicius Barbosa

Trending Topics

J.P. Morgan Reserve Card review: a top-tier card

Read this J.P. Morgan Reserve Card review and find out how this top-tier card allows you to earn points at a high rate.

Keep Reading

Easy-to-use photo and video editing apps on the go!

Ever wondered how photos and videos undergo stunning transformations? Read on to see the best photo and video editing apps!

Keep Reading

How to get your Huntington Bank Voice Rewards credit card with an online application

Read this Huntington Bank Voice Rewards credit card application guide and learn how to get this card to start earning 3x points per dollar.

Keep ReadingYou may also like

Chase Freedom Unlimited® review

Looking for a credit card with many benefits and no fees? It exists! Read this Chase Freedom Unlimited® review to see how it works.

Keep Reading

Deserve® EDU Mastercard for Students application process

Deserve® EDU Mastercard for Students has an online application, and you can get 1% cashback on all of your purchases for no annual fee.

Keep Reading

Applying for Manor Park Funding: quick online application

In this Manor Park Funding application guide, you will learn how to use this incredible platform to find the loan you need.

Keep Reading