Loans

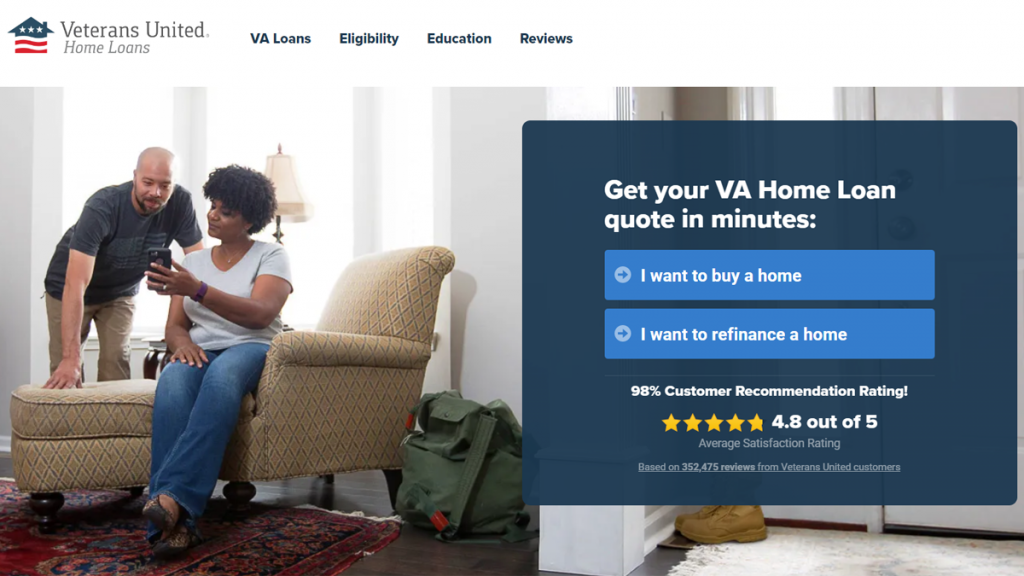

Veterans United Home Loans application

Make your home-buying journey a success with Veterans United Home Loans. Our step-by-step guide to the Veterans United Home Loans application process makes it simple and stress-free.

Advertisement

Veterans United Home Loans: Simplifying the Homebuying Experience from Application to Closing!

Take a closer look at Veterans United Home Loans’ application process. This way you can feel confident and prepared when you’re ready to apply for your next home loan.

Buying a home can be an exciting and fulfilling experience, but it can also be overwhelming. That’s where Veterans United Home Loans comes in a hassle-free process!

So keep reading to learn more about this top veterans lender.

Learn how to get this Veterans United Home Loans online

Forget about outdated and complicated ways of applying for a loan. With Veterans United Home Loans, you’ll have a modern and easy-to-go online application process.

To begin, potential borrowers can start the application process online or by calling a loan officer directly.

There is a form on the website to advance the process. The form is extremely intuitive, being a multiple-choice question for the page.

With a few clicks, you will have completed the form. Then, you’ll receive a thoughtful call from one of the Veterans United Home Loans officers.

The loan officer will then help the borrower determine what type of loan is best for their situation and provide guidance on the next steps.

Once the borrower has completed their application and provided all necessary documentation, Veterans United Home Loans will begin the underwriting process.

This involves reviewing the borrower’s credit score, income, and debt-to-income ratio to determine their eligibility and loan terms

Throughout the process, borrowers can track their application progress and communicate with their loan officer using Veterans United Home Loans’ online tools.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

How to get this loan using the app

Currently, there is no information about making the VA loan application using a mobile app.

However, Veterans United Home Loans does offer a mobile-friendly website that you can access from a smartphone or tablet for easy and convenient application and account management.

What about another recommendation: GoVA Loans

Both of these companies offer loans specifically tailored to veterans and active-duty military members. However, what sets the two apart?

Firstly, Veterans United Home Loans is one of the largest VA loan providers in the country and offers various types of loans, including fixed-rate, adjustable-rate, and jumbo loans.

Additionally, their application process is known for being incredibly user-friendly, with most applications receiving a decision within 24 hours.

On the other hand, GoVA Loans offers competitive rates and quick closing times with easy-to-meet eligibility requirements.

Regardless of which company you ultimately decide to go with, you can rest assured that both Veterans United Home Loans and GoVA Loans have your best interests at heart.

Learn how to apply for the GoVA Loans!

See how you can apply for the GoVA Loans in our easy step-by-step guide!

Trending Topics

US Bank Secured Visa® Credit Card review

Check our US Bank Secured Visa® Credit Card review to learn how you can build and establish a healthier credit score for yourself!

Keep Reading

Group One Platinum Card review: $750 credit limit to shop at Horizon Outlet

Would you like to have a high credit limit to shop at Horizon Outlet with 0% APR? If you do, read this Group One Platinum Card review!

Keep Reading

CrowdStreet Investing review: profit with real estate

Do you want to focus on private real estate investing? Check out our CrowdStreet Investing review to learn more about this great platform!

Keep ReadingYou may also like

How to cancel your credit card without harming your credit score

Learn how to cancel your credit card without hurting your credit score. We'll show you the steps to take and the mistakes to avoid.

Keep Reading

VivaLoan: many offers with one application process

In this VivaLoan application guide you will learn how to use this tool to find lenders willing to provide you with funds.

Keep Reading

Bank of America® Customized Cash Rewards credit card review

We'll show you in this Bank of America® customized cash rewards review how to earn extra cash back with this credit card.

Keep Reading