Finances

The best personal finance books for beginners

If you're looking for the best personal finance books to read this year, look no further! We've compiled a list of the top books to help you manage your money and reach your financial goals.

Advertisement

These books will teach you how to budget, save, and invest your money like a pro

Personal finance books can help you manage your money more efficiently. If you’re new to finances, it’ll allow you to learn the basics. Like why you should always pay yourself first and how to pay down debt.

They can teach you how to handle your money with confidence and how to spend smarter. And it doesn’t stop there! Once you learn the basics, you can learn how to invest, manage, save for the future and much more.

Learn how to start your own emergency fund fast

Do you have an emergency fund? It is important to have one and you can start building yours with these tips. Read more below!

The best personal finance books can ultimately help you avoid common pitfalls when it comes to money. It can also help you foster a healthier relationship with your finances.

They can’t exactly be considered light reading, but your wallet will thank you in the long run.

So, are you ready to take control of your finances and prepare for the future? Read on to learn what are our top picks for the best personal finance books for beginners in 2023!

What is personal finance, and why is it important?

Personal finance is a vital skill for anyone looking to take back control of their money. It’s about learning more about our choices when it comes to finances, whether that’s spending, saving, investing or even budgeting.

By understanding personal finance you can start planning your financial future and feel more secure in your decisions. Everyone needs personal finance skills and one great place to start is personal finance books.

With personal finance books you can learn great tips on how to manage your money successfully, as well as understand the principles behind different strategies that could benefit you in the long run.

What is generational wealth and how does it work?

Learn what generational wealth means and what steps you need to take to start building one for you and your family.

Additionally, personal finance books often provide advice on tough topics like debt management and wealth building – both of which are important aspects of doing personal finance properly.

With a little bit of time and effort put into understanding personal finance basics through reading a few personal finance books, anyone can get ahead in life by taking control of their own money.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Our picks for best personal finance books in 2023

Are you looking to take control of your finances and be in the best financial shape you can possibly be? Then personal finance books are probably a great place to start.

We’ve made it easy for you by putting together our picks for the best personal finance books out there today.

Whether you’re just beginning your journey into understanding your finances or already have some experience, these books will give you invaluable advice on how to spend, save and invest smartly. Keep reading to find out which titles made our cut!

Why Didn’t They Teach Me This in School? by Cary Siegel

If you’re looking for a personal finance book that is approachable, informative, and entertaining all at once, “Why Didn’t They Teach Me This in School?” by Cary Siegel is a solid option.

This personal finance bestseller like no other has the information you need to not just become financially savvy but also feel empowered to take control of your destiny. The book goes beyond simply providing economical advice; it delves into personal inspiration.

From personal financial tips to tricks on how to get ahead. The book offers an insightful perspective into how money works and how personal psychology influences our spending habits.

Rich Dad Poor Dad by Robert Kiyosaki

While personal finance books are plentiful, “Rich Dad Poor Dad” by Robert Kiyosaki stands out as one of the best. It dives into the idea of financial literacy and questions traditional money advice.

It empowers readers to be responsible for their personal finances and offers tactics to increase personal wealth. The book encourages people to break away from their comfort zone, make different financial choices, and become more financially independent.

Through personal stories about his own experiences, Kiyosaki sheds a new light on personal finance and teaches readers how to get ahead in life. For those looking to broaden their personal finance knowledge, “Rich Dad Poor Dad” should be at the top of your list!

The Total Money Makeover by Dave Ramsey

“The Total Money Makeover” by Dave Ramsey is a personal finance book that you won’t be able to put down. It’s designed to help you bypass common financial obstacles, build your financial toolbelt, and achieve your financial goals.

Ramsey’s straightforward and no-nonsense approach helps bring clarity to complex personal finance issues that can otherwise feel overwhelming.

Each chapter focuses on a specific money topic such as budgeting, debt reduction, investing, retirement planning, insurance, taxes and more. It offers real-life strategies and solutions delivered in a friendly tone that makes it easy to understand and enjoyable to read.

Incorporating personal anecdotes from people he’s helped over the years makes “The Total Money Makeover” an inspiring financial read that you don’t want to miss out on!

The Automatic Millionaire by David Bach

If you’re looking for personal finance books and want to change your financial life dramatically, “The Automatic Millionaire” by David Bach is the perfect book for you.

This bestselling book gives readers practical steps they can take to speed up their path towards becoming a millionaire. All while engaging them through personal stories and reflective exercises.

As personal finance is truly the only way to gain personal freedom, this book serves an invaluable purpose, teaching individuals to conquer their finances through simple yet effective concepts such as automated investing and consistently living below one’s means.

While it won’t guarantee success, The Automatic Millionaire will certainly give readers guidance on how to start making positive strides towards changing their financial future.

Broke Millennial by Erin Lowry

If you’re a millennial in the market for personal finance books, consider “Broke Millennial” by Erin Lowry. Considered a modern guide to personal finance, this book provides an entertaining and approachable take on personal finance management.

It begins by how to create an achievable budget, including strategies and tricks to curbing impulse spending.

From there, it continues on to more advanced personal issues such as investing and credit building techniques. Lowry tackles budgeting from a relatable perspective; making personal finance seem attainable rather than out of reach.

Those looking for a no-nonsense way of managing their personal finances should certainly look into this easy-to-follow book.

Financial planning for beginners: an easy guide

Are you interested in establishing a solid financial plan but aren’t sure where to begin? Whether you’re new to budgeting or just looking for smarter ways to manage your money, top-notch financial advice can help set you up for success.

In the following link, we’ll provide an easy guide on financial planning for beginners so that anyone can start taking control of their finances today.

We’ll cover setting realistic goals, outlining a basic budget, and creating a savings plan that will get you closer to reaching long-term objectives. Keep reading to learn all the tips and tricks you need to finally master your money!

Financial planning for beginners: an easy guide

With our beginner's guide to financial planning you will learn how to achieve more with your money in the near or distant future.

About the author / Aline Barbosa

Trending Topics

Norwegian Cruise Line® World Mastercard® application: Exclusive Benefits and Rewards

Start earning high rewards on travel purchases with a little help from our Norwegian Cruise Line® World Mastercard® application guide.

Keep Reading

Chime Visa® Debit Card Review: Your Key to Hassle-Free Banking!

No more banking fees! Unveil the Chime Visa® Debit Card in this review and say goodbye to hidden charges and hello to convenient banking!

Keep Reading

Simplii Global Money Transfer review: convenient and inexpensive

Simplii Global Money Transfer review: send money anywhere in the world, using multiple currencies, and paying zero transfer fees.

Keep ReadingYou may also like

Application for the Extra debit card: learn how!

Are you tired of having a debit card with no benefits? It's time to apply for Extra debit card and get credit card advantages with it.

Keep Reading

Capital One Bank review

This Capital One Bank review will show you how this bank works and highlight some pros and cons of using its services.

Keep Reading

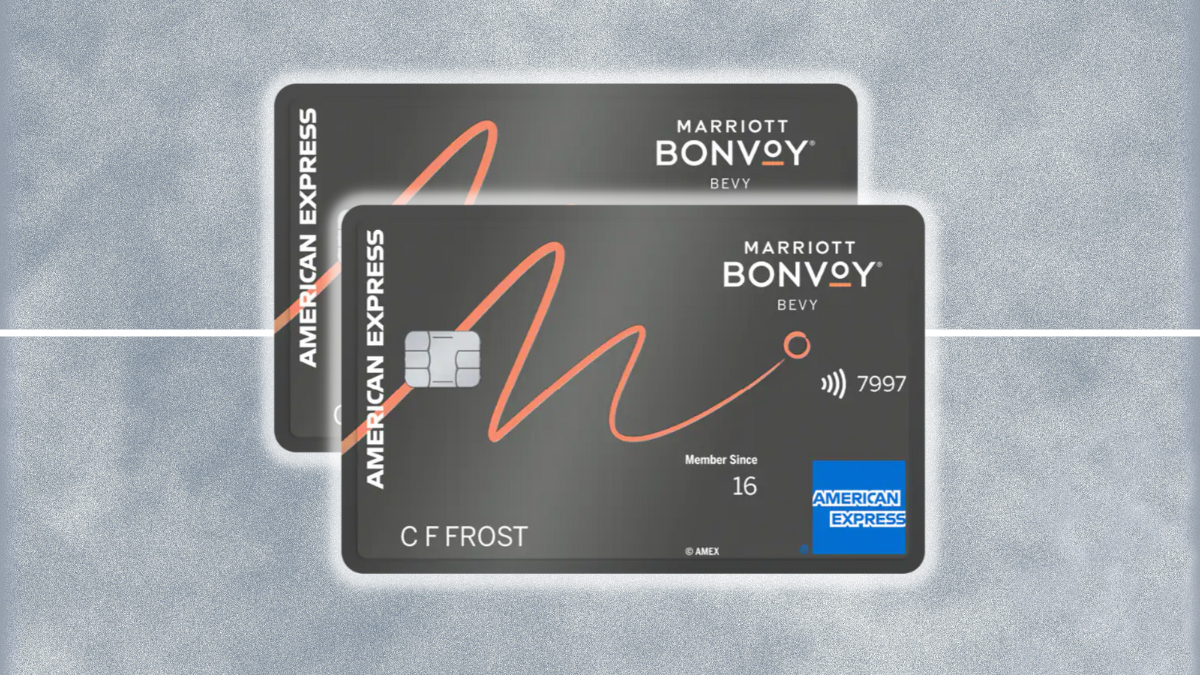

Marriott Bonvoy Bevy™ American Express® Card review: Premium Rewards

In this Marriott Bonvoy Bevy™ American Express® Card review you will see how this card helps you get luxury hotel stays, and much more!

Keep Reading