Credit Cards

Capital One Savor Rewards application process: get up to 4% cash back

Apply for the Capital One Savor Rewards credit card today and earn cash back at a 4% rate in convenient bonus categories.

Advertisement

Out on the town frequently? Get bonuses on dining and entertainment at high rates

The Capital One Savor Rewards application is pretty simple, and this credit card earns you 3% on grocery store purchases.

But that is not the best part. How about 4% on dining and entertainment?

If you like going out, this card will give you rewards at restaurants, movie theaters, shows and more.

Sounds interesting? Learn how to get yours in a few minutes reading the lines below.

Learn how to get the Capital One Savor Rewards online

The application process for the Capital One Savor Rewards credit card is a very straightforward one. Have your personal info at hand, and we will show you how to do it in just a few minutes.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Capital One Savor Rewards online application

Go to Capital One’s website and find the menu. On the menu, look up the option “Credit Cards” and click on it. Then, click on the “Cash Back Rewards” option.

The first option the website will show you is the Savor card. Click on “See Cards”, and then on the next page scroll down to see the three options. Now scroll sideways to reveal the Savor Rewards card.

Once you have done that, click the “Apply Now” button below the Savor Rewards card. This will take you to the application form page.

Fill in your personal information such as first and last names, date of birth and Social Security Number. Then, inform them if you are a U.S. citizen.

Below that, you will find the rate and fee information. It is good to be informed about those, so read them carefully, and then hit “Continue”.

Now enter your residential address, your ZIP code, city and state. Then, right below that, enter your email address and primary phone number. Now hit continue.

Now enter your financial information. These include your employment status, occupation and annual income. You must also inform your monthly rent or mortgage, whether you have a checking and/or savings account.

Inform whether you want blank checks for cash advances, and whether you want to transfer any balance. You can also add an authorized user for your Capital One Savor Rewards if you want.

Check the box if you would like to receive paperless communications and statements, and what language you prefer their communication.

Now, hit continue, check the information the website will show you and hit “Submit Application”. Done!

Wait for the response to see if you got the Capital One Savor Rewards credit card!

What about another recommendation: Discover it Cash Back

But maybe you are looking for a less expensive cashback card than the Capital One Savor Rewards. No problem, we got you. The Discover it Cash Back card charges no annual fee.

However, it still offers excellent bonuses such as 5% cash back on daily expenses each quarter and in rotating categories up to $1,500.

Did it grab your attention? Hit the link below and we will tell you all about it.

Discover it® Cash Back review

The Discover it® Cash Back Card offers all cardholders one of the best rewards rates available in the market, plus a range of other exclusive benefits.

About the author / Danilo Pereira

Trending Topics

United℠ Explorer card online application guide

Read this United℠ Explorer card application guide to learn how to get this card and start enjoying its rich rewards!

Keep Reading

PenFed Platinum Rewards Visa Signature® Card application

Learn how the PenFed Platinum Rewards Visa Signature® Card application process works and start earning rewards on purchases today!

Keep Reading

Citrus Loans online application: Get multiple loan offers!

In this Citrus Loans application guide you will learn how to easily and quickly find lenders that are willing to provide you with funds.

Keep ReadingYou may also like

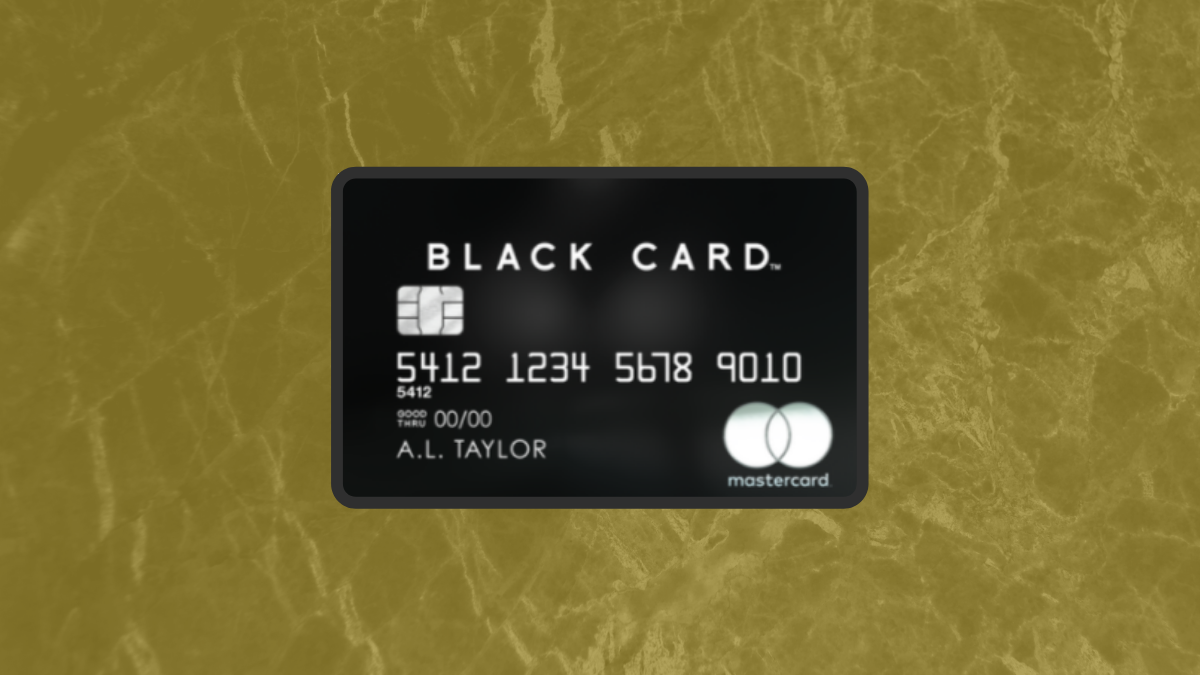

Mastercard® Black Card™ review

Read our Mastercard® Black Card™ review first to find out what you can expect from this luxurious credit card. Read on for more!

Keep Reading

Ink Business Premier℠ Credit Card review

Get an inside look at the features of the Ink Business Premier℠ Credit Card. Read on for our full review to find out if it's right for you.

Keep Reading

Absa Student Credit Card online application

Looking to get a student credit card that helps you build credit? With this Absa Student Credit Card application guide you can!

Keep Reading