Credit Cards

Citi Prestige application process: Earn ThankYou points at a 5X rate

Applying for the Citi Prestige card you get ThankYou points at the rate of 5X points per dollar, and you can redeem them for a number of awards.

Advertisement

Earn points at a high rate and redeem them for a variety of awards with Citi Prestige

The Citi Prestige card is a high-end credit card with excellent earning rates and flexible redemption options. Check how the application process for getting the Citi Prestige card works here in this blog post.

Redeem your points for cash rewards, gift cards, mortgages, student loan rebates, and more. You can even shop with your points at partners such as Amazon.com and Best Buy.

Learn how to get this credit card online

Do these benefits and rewards sound interesting to you? Then you might want to consider applying for the Citi Premier card. Below we have prepared a complete walkthrough of the process.

It is very easy to do. All you need is your cell phone or desktop computer, your personal info at hand, and a few minutes of your time. Let’s get on with it Citi Prestige card application process.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Applying Online for Citi Prestige

On Citi’s website, locate the “Credit Cards” menu. On your desktop, it is at the top left corner of the page.

Run your mouse over it to reveal a dropdown menu with the credit card options, and then select the “View All Credit Cards” option.

On your mobile, you will find the “Credit Cards” menu inside the three-line menu at the top left corner of the page.

Once you click the three-line menu, you will see the “Credit Cards” option. Click it, and select “View All Credit Cards”.

Now scroll down until you find the Citi Premier card. You can also use your browser’s “Find in Page” tool to search for the name of the card and find it even faster. Once you have found it, it’s time to start your Citi Prestige application.

Click “Learn More & Apply” to see the offer, and on the next page, click on “Apply Now”. Then enter your personal information according to what the application form requires.

You must enter your first and last names, Social Security Number, and date of birth. Scroll down and enter your address, phone, and email. These will be the issuer’s communication channels with you.

Further below, enter your financial information, including annual income and monthly mortgage or rent payments. Then you are going to have to create a security word.

Once you have done that, scroll down to review the terms and conditions. After doing that, check the last two boxes of the page to confirm you agree to the terms and conditions.

Then click “Agree and Submit,” and you are done!

What about another recommendation: Chase Sapphire Reserve

If you would like to check out a similar offering for comparison, you should definitely take a look at the Chase Sapphire Reserve. Besides offering excellent earning rates, it gives you the chance to earn a 60,000-mile bonus.

Click the link below to learn more about this card.

Chase Sapphire Reserve review

Learn about Chase Sapphire Reserve's amazing bonus, benefits and perks. You are going to love it!

About the author / Danilo Pereira

Trending Topics

Upgrade Bitcoin Rewards Visa review: earn 1.5% cash back in the form of bitcoin

In this Upgrade Bitcoin Rewards Visa review you will see how you can earn 1.5% cash back in the form of bitcoin.

Keep Reading

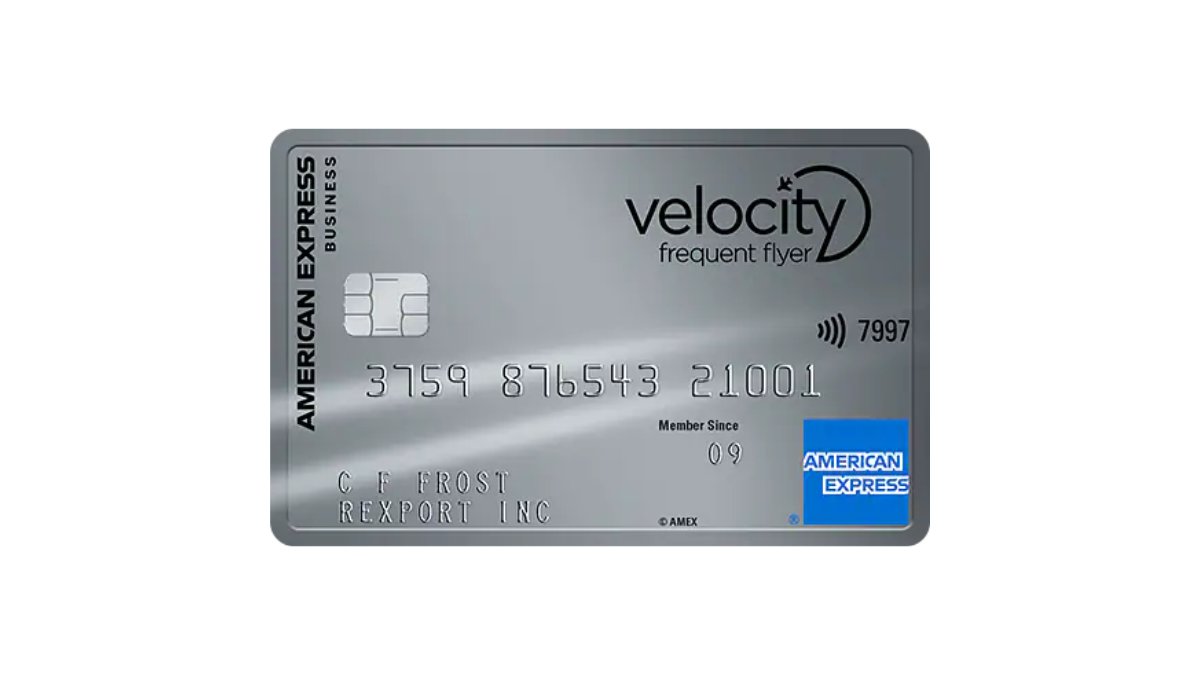

American Express® Velocity Business Card Review: Earn more

Soar into the world of business travel! Explore every feature of the American Express® Velocity Business Card in this review. Earn points!

Keep Reading

St. George Vertigo Card Review: Elevate Your Spending Experience!

Explore this St. George Vertigo Card review and learn how this credit card blends low fees, cashback rewards, and security features.

Keep ReadingYou may also like

The Post New recommendation – Red Arrow Loans

Red Arrow Loans is an online loan aggregator that matches your borrower profile to lenders who are likely to provide you with funds.

Keep Reading

Eastern Bank Personal Loans review

Looking for a personal loan with great rates and a flexible repayment plan? Then check out this Eastern Bank Personal Loans review.

Keep Reading

Discover it® Secured Card application process

Learn the application process for the Discover it® Secured Card and enjoy double cash back rewards at the end of your first year!

Keep Reading