Credit Cards

Southwest Rapid Rewards® Plus card review

Read this Southwest Rapid Rewards® Plus card review and learn how this card is a perfect match if you are a southwest loyalist.

Advertisement

This card offers excellent ongoing rewards and a nice welcome bonus

If you are a frequent Southwest Airlines flier and are looking for a less expensive offer than other Southwest cards, read this. Check out our Southwest Rapid Rewards® Plus card review.

How to get your Southwest Rapid Rewards® Plus card

In this Southwest Rapid Rewards® Plus card application guide you will learn how to get this card to start earning rewards at a high rate.

- Credit Score: Good – Excellent (690 – 850)

- APR: 18.99%-25.99% Variable APR

- Annual Fee: $69

- Fees: 3% foreign transaction fee

- Welcome bonus: Earn 75,000 bonus points after you spend $3,000 on purchases within the first 3 months from account opening.

- Rewards: 2 points per dollar on Southwest purchases and Rapid Rewards car rental and hotel partner purchases, 2 points per dollar on commuting and local transit (this includes rideshare), 2 points per dollar on select streaming, phone services, cable, and internet, 1 point per dollar on all other purchases.

This is not the fanciest card in the Rapid Rewards family of Chase co-branded cards.

Still, it offers an excellent welcome bonus which contributes to you earning the Southwest Companion Pass.

Read on and learn everything you need to know about this card.

Southwest Rapid Rewards® Plus card: how does it work?

The Southwest Rapid Rewards® Plus card offers a welcome bonus of 75,000 points once you have spent $3,000 within the first three months of card membership.

The card has the lowest annual fee of all Rapid Rewards cards. This does mean it offers slightly less in terms of ongoing rewards rate and benefits.

Southwest points are worth on average 1.5 cents each depending on how you choose to redeem them.

The card also offers a 3,000-point bonus in every card anniversary.

Ongoing rewards include 2 points per dollar on Southwest purchases, Rapid Rewards hotel and car rental partner purchases, rideshare, local transit, cable, internet, phone services and select streaming.

However, most purchases will earn you 1 point per dollar. Yes, this card does not offer strong spending categories which you can benefit from.

The card also does not earn tier qualifying points which count toward elite status.

So if you are looking for benefits such as priority boarding, you should check out other Southwest cards.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Significant Southwest Rapid Rewards® Plus card benefits and disadvantages

Now that you are familiar with this card’s ins and outs, how about a comparison? After all, our Southwest Rapid Rewards® Plus card review would not be complete without it.

Check out the list of benefits and disadvantages we have prepared for you below.

Benefits

- 3,000-point anniversary bonus

- No reward caps

- High earnings rate

- High value for points

Disadvantages

- $69 annual fee

- Rewards with limited flexibility

- Does not earn points that count toward elite status

Is a good credit score required for applicants?

The Southwest Rapid Rewards® Plus card is a high-tier card which is designed for individuals in good financial standing.

For this reason, it requires applicants to have a credit score of between 690 and 850.

This generally falls within the category of Good and Excellent credit.

Learn how to apply and get a Southwest Rapid Rewards® Plus card

So, how do you like what you have seen in this Southwest Rapid Rewards® Plus card review? If this card appeals to you, you might want to take the next step and apply for it.

Click the link below to access our application guide, and we will show you how to do it.

How to get your Southwest Rapid Rewards® Plus card

In this Southwest Rapid Rewards® Plus card application guide you will learn how to get this card to start earning rewards at a high rate.

About the author / Danilo Pereira

Trending Topics

African Bank Black Card Review: Discover the Elegance of Banking!

Elevate your financial journey in this African Bank Black Credit Card review. Sophistication in every swipe! Interest-free period!

Keep Reading

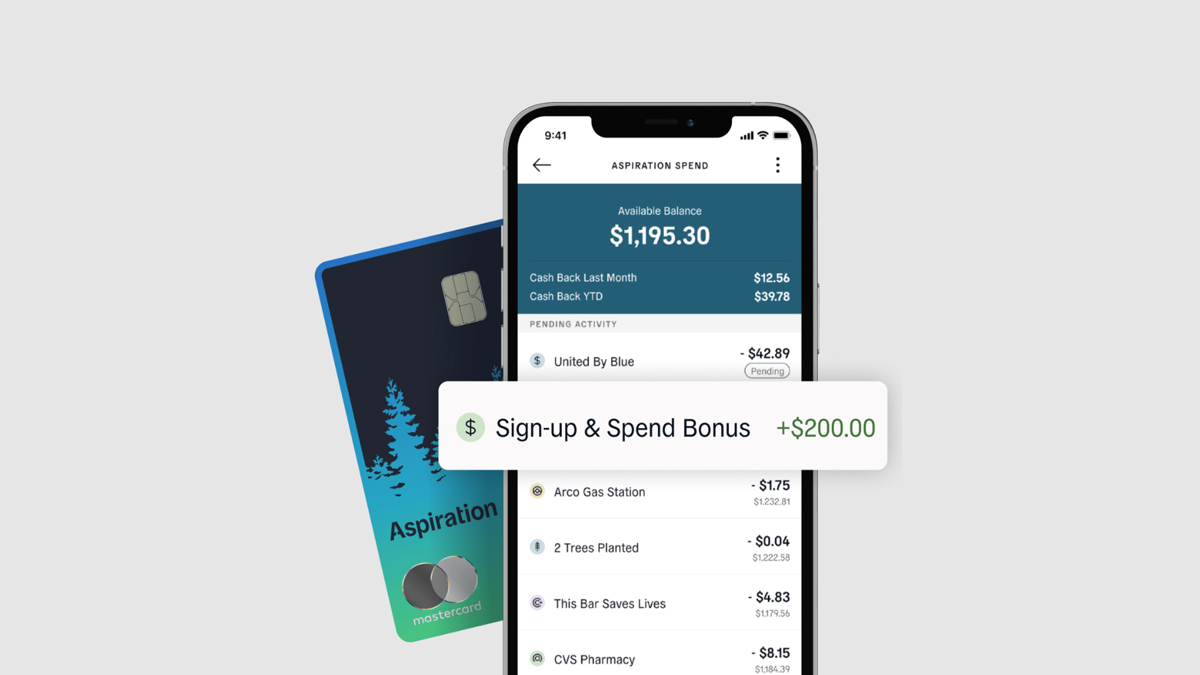

Aspiration Plus Account review

Are you looking for a new account with a high APY and great cash back rewards? Then check out this Aspiration Plus Account review.

Keep Reading

Citi Premier® Card review

Do you want to earn excellent rewards when you travel? Check out our Citi Premier® Card review to see if it's the best credit card for you.

Keep ReadingYou may also like

What is a stakeholder in simple terms?

Looking for a definition of stakeholder in simple terms? You have come to the right place. Read on and find out!

Keep Reading

How to get your myWalgreens Credit Card: online application

If you are a frequent Walgreens shopper, you are going to love this card. Here is our myWalgreens Credit Card application guide.

Keep Reading

How to get your Group One Platinum Card: online and simple application

The Group One Platinum Card application does not require a good credit score. You can get a high initial credit limit with 0% APR.

Keep Reading