Loans

LightStream Loans application

Take advantage of your good credit score to apply for a loan with LightStream loans. They have the best rates and charge no fees.

Advertisement

LightStream Loans: apply in minutes and get a fast approval

If you need a personal loan and have no time to waste, check out our LightStream Loans application article. We’ll help you get what you want. The company has a friendly website that will make it easier to understand everything and apply for the loan you need.

Don’t waste money on fees and high-interest rates. LightStream has some of the best rates in the market, and you’ll certainly find the best offer.

It doesn’t matter if you need money for a small car repair or a big wedding. They have exactly what you wish for when applying for a loan. Keep reading this post to learn how to apply for it.

Learn the online LightStream Loans application

You’re just three easy steps far from your loan. If you have a good credit score of at least 660, you’ll have no problem getting approved for your personal loan.

But remember to always pay attention to your loan offer before closing any deal. Getting a personal loan is a huge responsibility, and you’ll have to pay it all to preserve your good credit score.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Eligibility requirements

Before applying, check if you fulfill the following requirements:

- Good or excellent credit score

- Have a stable source of income, enough to pay for all of your pre-existing debt and your new personal loan

- Long credit history with diverse credit lines

Apply online by filling up the form

On their website, you can apply by filling out the form with some information. Sometimes a representative may call you to get extra info to approve you.

The application form has a friendly design that makes it easy to do it. Just answer every question about your personal info and financial field.

You’ll have to inform:

- The loan amount, purpose, and the term you intend to ask for.

- The payment method. If you choose autopay, you can get a lower APR.

- Personal information, like full name, address, cellphone, birthday, etc.

- Employment and credit information.

Submit and wait for your loan offer

You’ll get an answer as soon as possible, usually on the same day. If you agree with the loan offer you got, you can proceed and conclude the process. The money will go straight to your account in one to 30 days.

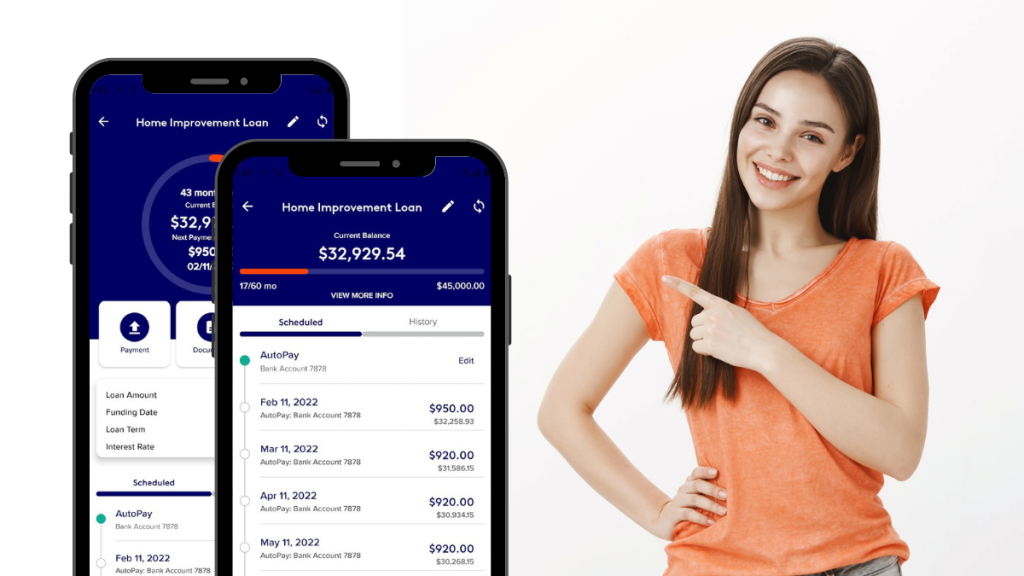

Download the app to track your application status and manage your loan

LightStream has an outstanding loan. Its design is extremely user-friendly, and you can check everything about your loan on it.

You can check your application to see when your loan gets funded. You can also manage your payments, upload documents when requested, and much more.

Another recommendation: Custom Choice Loans

If you need a loan to pay for your studies, we have another recommendation for you. We know that funding your college is a very important part of your adult life, and you deserve the best service.

Custom Choice offer studies loans with the best conditions. Check all about them in the following review.

Custom Choice Loan® review

The Custom Choice Loan® is the smartest way to finance your higher education. With low interest rates and flexible terms, they're perfect for students.

Trending Topics

Is it worth having store cards?

If you are wondering if it's worth having store cards, we'll tell you all you need to know on this topic. Read on and find out.

Keep Reading

Total Visa® Card application

Applying for the Total Visa® Card is easy and can be done in a few simple steps. Learn more about how you can get started today.

Keep Reading

Find the best Mastercard credit cards 2023

Are you looking for the best Mastercard cards for 2023? We have prepared a list with a few of them, and one is probably the right one for you.

Keep ReadingYou may also like

U.S. Bank Altitude® Go Visa Signature® Card review: High Rewards and Low Fees

How does no annual fee and cashback rewards sound for you? Check out this U.S. Bank Altitude® Go Visa Signature® Card review.

Keep Reading

Fortiva® Credit Card review

Looking for an unsecured credit card to rebuild your credit? The Fortiva® Credit Card could be the solution to your problems.

Keep Reading

How to get your Merrick Bank Double Your Line™ Platinum Visa®: online application

In this Merrick Bank Double Your Line™ Platinum Visa® application guide, we will show you how to apply for this card.

Keep Reading