News

Dollar Tree and Dollar General earnings beats expectations

With inflation at an all-time high, consumers are looking elsewhere for their shopping, and value retailers, such as Dollar Tree and Dollar General, are benefitting from it. See below how they managed to beat the market’s expectations and what are their plans for the future.

Advertisement

Both retailers had stocks soaring during the first quarter of 2022.

In a surprising turn of events, shares of Dollar Tree and Dollar General soared last Thursday.

Not only did the discount stores shares beat Wall Street’s predictions for their quarterly earnings, but they also raised an interesting viewpoint for the coming year.

And, most importantly, it really showed how consumers are choosing lower prices to deal with inflationary times.

Both retail stores stated that they see the current situation as an opportunity to grow.

Dollar Tree shares grew 21.87%, closing at $162.80, while Dollar General shares increased 13.71%, closing at $222.13 on Thursday.

A clear indicator that more Americans are weighing value more intently before making their purchases.

Todd Vasos, the Dollar General CEO, said they’re already noticing their core customers shopping more intentionally at their stores.

He mentioned that lately, they’re also starting to see their next tier of customers shopping with them more often as well.

Rick Dreiling, Dollar Tree Executive Chair, noted the many challenges most consumers are currently facing as well.

From a 40-year high inflation to record high gas prices, and an added uncertainty about the future due to current events.

Not only that, but several Americans are now living paycheck to paycheck. He said that during these difficult times, value retail stores can help families to meet their evolving needs by stretching their dollars.

Both Dollar Tree and Dollar General had better than expected revenue, same-store sales and earnings in their fiscal first quarter.

Dollar General stated that its expectations for net sales growth is of 10% to 10.5% compared to previous expectations.

Dollar Tree said it expects net sales for the remaining of the year to go from $27.76 billion to $28.14 billion.

Below you’ll find the major takeaways from both stores first-quarter earnings.

Dollar Tree and Dollar General are selling different mix of items

Consumers are still going to stores, but now are purchasing different merchandise. Food is still a priority in their baskets and it’s what steered the sales for both Dollar Tree and Dollar General in their first quarter.

During the same time period of 2021, shoppers had more money because of child tax credits and government stimulus checks.

That meant more impulsive buying of items they’d want instead of essentials. Now that money is gone, and the essentials – like groceries and gas – are more expensive.

Todd Vasos noted that while same-store sales at Dollar General decreased in seasonal, apparel and home products during the fiscal first quarter, more consumables were sold.

For the most part, same-store sales had a minor decrease of 0.1% when compared to the same period in the previous year. Financial analysts had that number anticipated at 1.3%.

At Dollar Tree, the retailer’s expansion of its food and beverage sections paid off. That is because salty snacks, cookies and drinks are a few of the items rising in popularity.

Dollar Tree is the parent company of Family Dollar – a branch that focuses more heavily on food.

Michael Witynski, Dollar Tree’s CEO, told financial analysts that he believes that food is a traffic driver.

As customers experience the items sold and the value they’re getting off of them, that will help to drive traffic into all of the store, and not just that category over time.

The sales patterns of Dollar Tree and Dollar General echoed those of the two biggest retailers in the country – Walmart and Target.

Both companies also saw a bigger shift toward grocery shopping and away from non-essential items in their first quarter.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

Taking the opportunity

Even before the current inflationary period, both Dollar Tree and Dollar General had bigger plans for their stores.

New strategies to attract more customers, store footprints and expansion into new categories were all part of it.

The retailers reiterated those plans last Thursday, saying the economic situation makes the offerings more coercive.

Dollar General has approximately 18,000 stores across the country and will open over 1,000 new ones by the end of 2022.

It plans to expand its newest store concept, called PopShelf, and hopes to add more health-related products. The retailer will also start its global expansion by opening 10 new stores in Mexico.

Chief Financial Officer John Garratt also told analysts that most of the company’s new locations will employ its larger format.

That means 8,500 square feet with aisles focusing on beauty and health. Plus, coolers that will manage to hold produce and other grocery items.

The company will also add more end caps and attractive displays to emphasize their private label, which offers several items at $1.

Vasos said that Dollar General has noticed an increase in their private brand business for the last few weeks.

Dollar Tree, on the other hand, is adding 590 new stores to their 15,500 branches. Their plan is to add a larger range of items and raise their $1 price to $1.25.

There will also be merchandise ranging from $3 to $5 at their stores.

Dollar Tree and Dollar General are controlling higher costs

Even though Dollar Tree and Dollar General were able to beat Wall Street’s quarterly expectations, they weren’t immune to higher costs during that period.

Now, some investors grew concerned about whether both retailers will be able to keep their prices low without damaging their profits.

Especially since both retailers managed to increase their earnings despite the surge in fuel and freight prices. Which is something bigger retail stores – like Target and Walmart – weren’t able to do.

Todd Vasos assured that Dollar General is able to trade different items, or trade down in portions should particular products have a rise in prices.

He noted that the company is keen on managing its inventory to avoid an excess of items that don’t sell.

Not only that, but Dollar General has other tricks up its sleeve that will assist in cost-saving and profit-driving.

Recently, the company added self-checkout to over 8,000 of their stores. It also has plans to turn 200 locations into self-checkout only as well.

Dollar General is adding more vehicles to its private fleet of trucks with the goal of accounting for more than 40% of its transportation by the end of 2022.

The company’s also carrying more pharmacy items, which accounts for better margins than groceries.

Dollar Tree’s recent price hike helped boost its profitability. In 2021, the company announced it would raise their $1 items slightly, by a quarter.

There are also more products with $3 and $5 price tags in stores as well.

Michael Witynski believes that a bigger range in prices means more sales during key seasons of the year. He added that the company’s stronger sales happen around Valentine’s Day and Easter.

He finished his statement by saying Dollar Tree hopes that a similar dynamic will happen with back-to-school shopping, as well as Halloween and the holiday season.

In the following link, you’ll learn why the American economic confidence is at its lowest. Follow through to read more!

Economic confidence is the lowest since 2009

46% of Americans say the economy is doing bad and heading for the worse. Read more to learn why that is, and what concerns the average American consumer.

About the author / Aline Barbosa

Trending Topics

LendKey Student Loans Review: Empower Your Education!

Refinance existing loans to save on interest or explore low-rates in this LendKey Student Loans review! Up to 100% financing!

Keep Reading

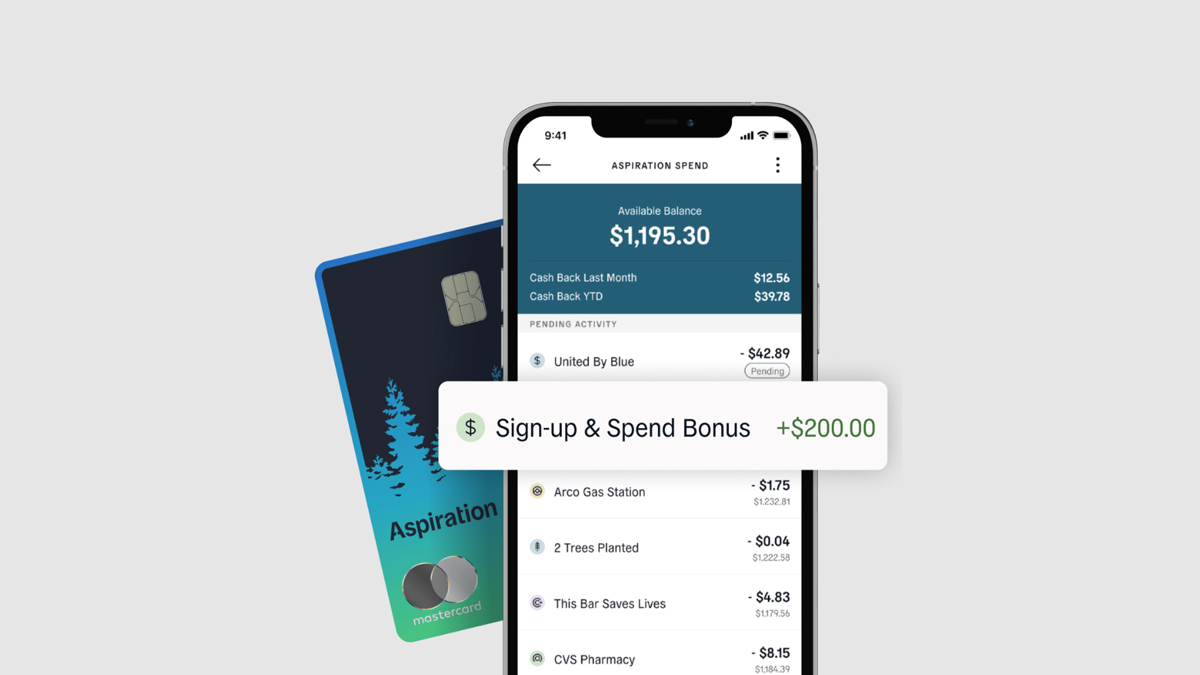

Aspiration Plus Account review

Are you looking for a new account with a high APY and great cash back rewards? Then check out this Aspiration Plus Account review.

Keep Reading

Chase Freedom Flex℠ credit card review

The Chase Freedom Flex℠ credit card has many benefits, and this review will show you all of them. Read it if you like cashback rewards.

Keep ReadingYou may also like

How to apply for LendingPoint Personal Loans: step by step of the application process

Learn how to apply for LendingPoint Personal Loans and get approved today, even if you do not have good credit.

Keep Reading

VentureOne Rewards Credit Card review

If you're looking for a travel rewards credit card with no annual fee, the VentureOne Rewards Credit Card is worth a closer look.

Keep Reading

Rescue One Financial Review: Escape Debt’s Grip!

Review the Rescue One Financial Loans and say goodbye to financial stress with personalized solutions and debt reduction!

Keep Reading