Credit Cards

Pre-approval for American Express: Your Path to Financial Excellence

Discover the secrets behind American Express card pre-approval in our latest blog post. Learn how to navigate the process and secure a piece of financial prestige!

Advertisement

Decoding the American Express Card Pre-Approval Process!

Welcome to our blog, where we unravel the mysteries of credit card pre-approval, specifically focusing on the Amex card. Read on to learn about the pre-approval for American Express!

Moreover, if you’ve ever wondered how this process works or how you can secure one of these prestigious cards, you’re in the right place.

Best Credit Cards With No Foreign Transaction Fees

Discover the best credit cards with no foreign transaction fees, making your international travels hassle-free and cost-effective.

Also, American Express is synonymous with luxury and perks, but before you can enjoy the benefits, you must successfully navigate the pre-approval stage.

In this post, we’ll guide you through the ins and outs of American Express card pre-approval, helping you take the first step toward owning a piece of financial excellence. So, read on to learn more!

How do credit cards work?

The term “American Express” connotes distinction and exclusivity when used about credit cards.

But how do you acquire one of these sought-after cards?

A credit card is an actual card that may be used for cash withdrawals, bill payments, and shopping.

Also, the most straightforward way to conceptualize a credit card is as a payday loan.

Moreover, credit cards can be used to purchase online or in stores and pay bills.

So, when you use a credit card for either one, your card details are sent to the merchant’s bank.

Furthermore, the bank gets authorization from the credit card network to process the transaction.

So, your card issuer must verify your information and either approve or decline the transaction.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

What is American Express?

American Express is a leading provider of financial services worldwide, offering charge, credit, and prepaid cards to consumers and companies.

Moreover, American Express manages all card-related transactions, including those involving cards from other businesses and issuing cards.

Also, despite maintaining a card network, American Express provides merchant services and is best known for its credit and charge cards.

Why is Amex hard to get?

For one of the bank’s credit cards, many individuals visit their preferred bank to apply.

Also, they typically receive a card from a renowned network like Visa or Mastercard.

Moreover, American Express, a network and credit card provider, administers all transaction processing and setting up and managing accounts.

Therefore, American Express caters to customers with established credit.

This happens even though other major card issuers provide alternatives for applicants with different credit levels.

So, it may be challenging to obtain cards from this financial organization.

How is Amex different from other cards?

Amex credit cards stand out because they provide some of the greatest advantages in the business.

Also, these cards are only available to customers with exceptional credit.

It’s also rare for a credit card issuer to provide charge cards, and just two of the major card networks—including American Express—offer their credit cards.

So read below some of the main things that make Amex so different and maybe even better than many other cards.

Also, American Express is one of the two credit card networks that provides its credit cards.

Other banks and credit unions are permitted to issue cards on the Amex network by Amex.

Moreover, American Express is known for offering various rewards cards, including co-branded cards with retailers, cash-back cards, and travel cards.

Therefore, a few Amex cards also offer some of the top rewards programs.

4 best prepaid cards to control your budget

In this article you are going to learn about some of the best prepaid cards to control your budget.

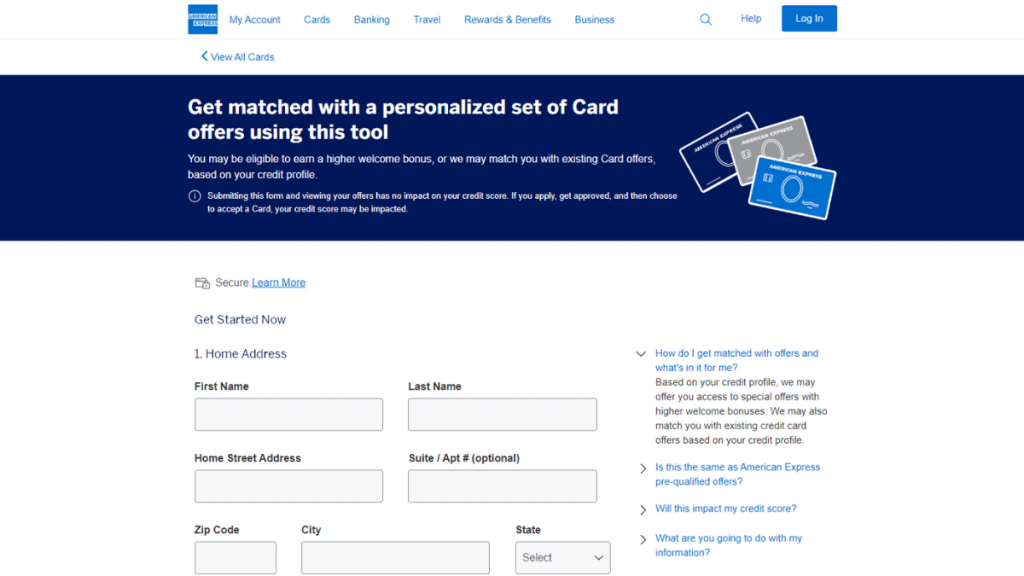

How does pre-approval for an American Express card work?

Getting preapproved for an American Express card is not just about luck; it’s a strategic process that can greatly enhance your financial well-being.

Moreover, in the following paragraphs, we’ll break down the key components of this process.

So, we’ll show you information from understanding what pre-approval means to the steps you should take to increase your chances of pre-approval.

Therefore, whether you’re a seasoned credit card enthusiast or a newcomer to the world of premium plastic, we can help!

So, our comprehensive guide will empower you with the knowledge you need to make informed decisions about your financial future.

Tips to pre-approval

Although American Express has no minimum credit score criteria, you must have excellent credit (or above).

Also, you may need a FICO score of at least 670 to be eligible.

Moreover, a premium Amex card like the American Express Gold Card, for instance, often requires a “very good” FICO score of 740 or above for them to accept you.

In addition, American Express restricts the number of open Amex cards a client can have.

So, they limit the customers to 10 Amex charge cards and five Amex credit cards.

So be aware of this and other information before you start the pre-approval process!

Do I need a high credit score to get a credit card?

A high credit score is a golden ticket to unlocking the world of credit cards, especially prestigious ones like American Express.

Also, it’s a fundamental requirement that lenders use to gauge your creditworthiness.

So, our credit score reflects your financial responsibility and a higher score demonstrates a history of managing credit responsibly.

In addition, American Express, known for its premium offerings, typically reserves its best cards for individuals with excellent credit scores.

Furthermore, a high credit score opens the door to American Express cards.

Also, it provides access to lower interest rates, higher credit limits, and more favorable terms on other credit products.

Therefore, it’s a mark of trustworthiness in the eyes of lenders. Also, it’s essential for securing the benefits, perks, and prestige that come with an American Express card.

So, if you’re aiming for that prestigious piece of plastic, ensure your credit score is top-notch.

The Best Instant Approval Department Store Cards

Discover the ultimate convenience and rewards with our top picks for the best instant approval department store cards. Unveil exclusive discounts, cashback offers.

How to improve the odds for pre-approval?

The techniques for increasing your chances of getting preapproved are similar to those for raising your credit score.

Also, American Express is searching for consumers who can make on-time debt payments, just like all other card issuers.

Moreover, through a soft credit check, the issuer can get a complete picture of your credit history, usage, and account management.

In addition, you advance your candidacy by making an attempt to pay on time and just charging a fair amount.

Furthermore, positioning yourself as a valuable client may be a good idea.

This can be good if you already have an American Express card in your wallet to boost your chances of preapproving for more cards.

Therefore, instead of letting your card gather dust in your wallet, use it frequently to show companies that you are a valuable, active customer.

Learn the difference between pre-approval and pre-qualification

American Express offers two pre-screening phases for candidates for credit cards: prequalification and preapproval.

Therefore, read below the explanation about these two!

Pre-approval

Pre-approval, however, entails a rigorous examination of your eligibility for an Amex credit card.

Moreover, if you don’t meet the minimal requirements for that specific card, Amex will conduct a soft credit draw, which does not affect your credit score.

However, despite its name, pre-approval does not guarantee that they will accept your application.

But it does indicate that your chances are very good.

Therefore, to ensure that American Express can verify your eligibility using your current income, assets, debt, and credit score, you must still submit a fully completed application.

Pre-qualification

Prequalified offers mainly function as a marketing chance.

Also, American Express may give you “special offers” that are appropriate for you based on your profile.

Therefore, they may frequently do this by looking at your demographics or the other cards on your credit report.

However, pre-qualification won’t tell you if you’ll get the card, but it could help you choose one that suits your spending style.

Should I get an American Express credit card?

Whether you apply for an Amex preapproved card or one from any other issuer is totally up to you.

Also, preapproval can be a risk-free method to determine which American Express cards you might qualify for.

Nevertheless, adding a new credit card to the mix may entice those who have trouble controlling their spending to do so.

Therefore, if you apply for a card for which you have already been prequalified, you can run into issues, such as if your report already has too many recent queries.

Moreover, when you receive pre-approval for a card, your financial situation matches the data that American Express has on file.

Also, this can increase the likelihood that they will accept you. So, when determining whether or not to apply for a new card, knowing where you stand may be a useful tool.

However, it won’t make your application risk-free. Therefore, make sure you consider all the information before you start the pre-approval process!

Up next, discover the best 0% APR credit card! Read on and learn more!

Best zero APR credit card

Looking for the best credit cards, such as a zero APR credit card with perks? If so, you can read our post to find out!

About the author / Victória Lourenço

Trending Topics

How to get your Group One Platinum Card: online and simple application

The Group One Platinum Card application does not require a good credit score. You can get a high initial credit limit with 0% APR.

Keep Reading

Learn how to start your own emergency fund fast

Are you trying to start your emergency fund, but don't know how? This article will show you how to start with easy tips. Keep reading.

Keep Reading

Navy Federal GO REWARDS® Review: no fees and amazing rewards

Set sail on a voyage of financial discovery with our Navy Federal GO REWARDS® Card review. Earn 15K bonus points + amazing benefits!

Keep ReadingYou may also like

Wise Debit Card review

Are you looking for a debit card that doesn't charge foreign transaction fees? Read our Wise Debit Card review to see if it's the right fit.

Keep Reading

Upgrade Visa with Cash Rewards card application

Apply for Upgrade Visa with Cash Rewards credit card to enjoy cash back rewards and special payment conditions for your card's balance.

Keep Reading

Members 1st Federal Credit Union Personal Loans review

In this Members 1st Federal Credit Union Personal Loans review you will learn about this loan's super-long payment terms and more!

Keep Reading