Read on and learn how SpeedyNetLoan can help you find and compare just the right loans for your needs.

SpeedyNetLoan – An easy and simple way to find the perfect loan for your needs with a single online application.

Advertisement

SpeedyNetLoan is an online loan aggregator that bundles together a network of lenders in a single marketplace. By filling out a single online application the platform will match you with potential lenders who will then compete for your business. You get to compare and select the best among all the offers within as little as 2 minutes.

SpeedyNetLoan is an online loan aggregator that bundles together a network of lenders in a single marketplace. By filling out a single online application the platform will match you with potential lenders who will then compete for your business. You get to compare and select the best among all the offers within as little as 2 minutes.

You will remain in the same website

Check out some of the benefits you have access to when you use SpeedyNetLoan to search and compare loans.

You will remain in the same website

SpeedyNetLoan is not a lender, so it does not perform credit checks on borrowers. However, once you opt for a loan, the actual lender might perform credit checks which could impact your credit score. Therefore we recommend that you check your credit score before applying for a loan to make sure you do not take any unnecessary hits to your credit score.

In order to apply through SpeedyNetLoan you must be 18 years old or older. You must also have a job or regular income, this includes pension, social security or disability. Having a checking account is also a requirement, and you must be either a U.S. Citizen or have Legal Resident status. The platform also requires that you present a valid driver’s license or state ID. One more important thing to mention is that this service is not available for NY residents.

With SpeedyNetLoan, after filling out and submitting the application form, you will be connected to one or more lenders within just a few minutes. After that you will apply with a lender, and as soon as that is done, the lender could make funds available in your checking account within as little as one business day. However, the process can take a little longer so expect a little variance.

Once you have submitted your application, the platform will send your information to lenders who are likely to match your borrower profile. If a match is found, SpeedyNetLoan will notify you on their website. On the same website you will be given instructions on how to connect to the lender and finish the loan process so that you can get your funds.

If SpeedyNetLoan sounds like a fit to you, you should go ahead and check out our application guide. Click the link and we will show you how to do it.

How to apply for SpeedyNetLoan?

In this SpeedyNetLoan application guide you will learn how to use this tool to start getting multiple loan offers within minutes.

If you would like to check out another loan aggregator with different lender options, you might want to take a look at the Zippyloan.

With this tool you will find lenders in all shapes and sizes and loans ranging from $100 to $15,000 which you can use for a number of purposes.

Sounds like a fit? Then click the link below and we will tell you all about it.

Applying for Zippyloan: Get multiple loan offers

Read this Zippyloan application guide and learn how to get multiple loan offers by filling in a single online form.

Trending Topics

Apple unveils a slate of new upgrades at WWDC

Apple revealed a series of updates and a host of new features for its products at the WWDC Conference last Monday. Read on for more.

Keep Reading

SavorOne Rewards for Good Credit credit card review

Excellent rewards should also come with good credit. Check out this SavorOne Rewards for Good Credit Credit Card review to learn more!

Keep Reading

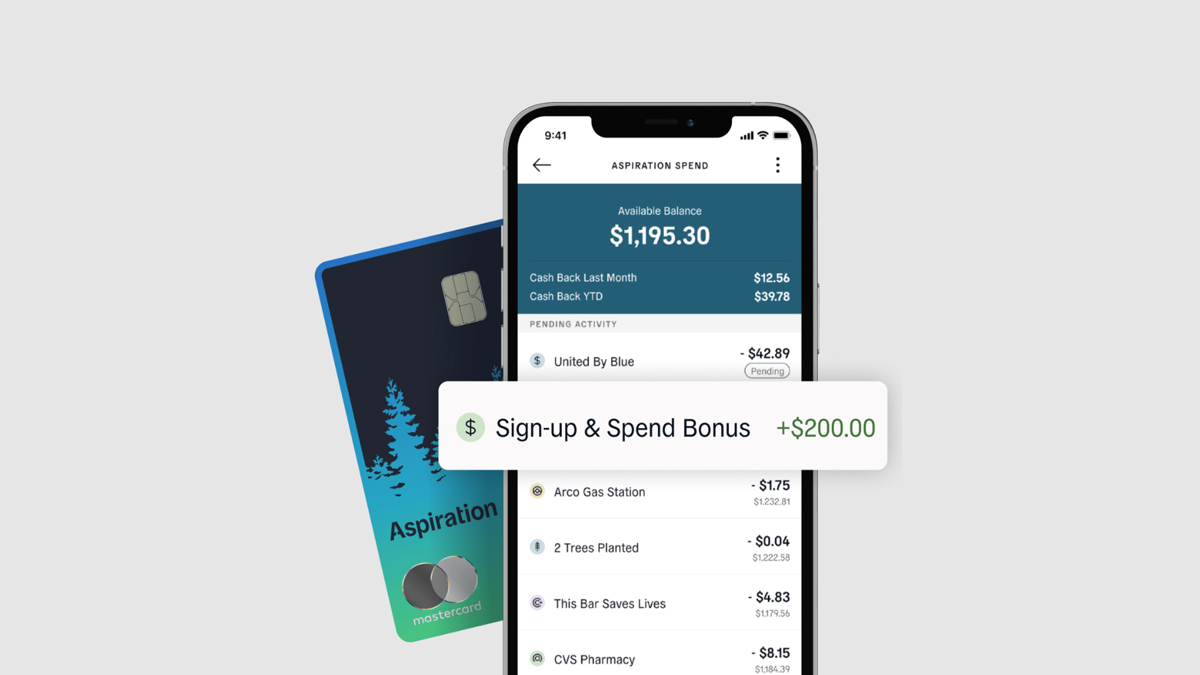

Aspiration Bank review: is it trustworthy?

In this Aspiration Bank review you will learn about how this bank helps you stay environmentally friendly with a 10% cash-back reward.

Keep ReadingYou may also like

Discover Student Loan application

If you're wondering how to apply for a Discover Student loan and enjoy its benefits, this post is what you're looking for.

Keep Reading

The best personal finance books for beginners

If you're looking to get your finances in order, check out our list of the best personal finance books for beginners in 2023.

Keep Reading

Aspiration Plus Account review

Are you looking for a new account with a high APY and great cash back rewards? Then check out this Aspiration Plus Account review.

Keep Reading