Finances

What does “HCOL area” mean?

What does “HCOL area” mean? Read on and find out not only what it means, but how it affects your finances.

Advertisement

Before making a decision to move from one place to another, you should learn about HCOL areas

If your goal is to achieve financial independence, you must attend to your spending in a clear and objective manner. Learning what does HCOL area mean will help you with that.

Very often, people make decisions almost entirely based on how they feel at the moment. Instead, they should look into the future to calculate whether that decision makes sense.

Living in an HCOL area is one of these decisions. This acronym which means “high cost of living,” is part of a triad that includes MCOL (medium cost of living) and LCOL (low cost of living).

This article does not aim at telling you you should never live in HCOL areas. Rather, it is intended to show you the importance of knowing whether it makes sense financially to live in such areas.

Secured vs. Unsecured credit cards

Read on and find out what the difference between secured and unsecured credit cards is.

Being wise when deciding where to live can mean the difference between managing to save for retirement or not.

It may even affect whether you will be able to travel or not during the summer holidays.

Depending on your income, you must keep an eye on your living expenses, and it may well be the case that HCOLs are not for you.

By “cost of living,” we mean money you need for basic, everyday expenses such as food, transportation, housing, etc.

These expenses are the top ones in 62% of homes, according to the 2019 Consumer Expenditure Report, and they are also directly affected depending on where you choose to live.

So let’s have a look at what all of this means to your financial life.

HCOL areas defined

Areas with a high cost of living are the ones where housing, goods, and services prices are widely above average. Entire cities can be considered HCOL areas but still have areas where prices are even higher.

These are prestigious areas where you find a lot of amenities. A few examples of HCOL cities are New York and Los Angeles.

Such cities may contain other benefits which help build up demand, such as new businesses.

New businesses attract investments, and with growth, projections speculation may increase, further increasing both property prices and the cost of living in general.

In HCOL areas, you may find rent rates up to 3 or 4 times the average rent from, say, LCOL areas. The same goes for the price of groceries and other services.

You will be redirected to another website

By submitting this form, I agree that I am 18+ years old and I agree to the Privacy Policy and Terms and Conditions. I also provide my signature giving express consent to receive marketing communications via automated emails, SMS or MMS text messages and other forms of communication regarding financial products such as credit card and loans. Message frequency varies and represents our good faith effort to reach you regarding your inquiry. Message and data rates may apply. Text HELP for help or text STOP to cancel. I understand that my consent to receive communications is not a condition of purchase and I may revoke my consent at any time.

A quick example

Consider, for example, two data scientists. One of them lives in San Francisco, while the other lives in Cincinnati. Both have roughly the same lifestyle with roughly the same spending habits.

In San Francisco, a data scientist can make as much as $120,000 a year after taxes while spending $80,000 yearly on housing, food, and transportation.

Our San Francisco data scientist then saves about $40,000 a year.

In Cincinnati, however, the same job will pay only $70,000 a year. However, living expenses are also lower, and our Cincinnati data scientist spends $40,000 a year on housing, food, and transportation.

In such a manner, he or she can save $30,000 a year. So the exact same lifestyle will cost twice as much for someone living in San Francisco as it does for someone in Cincinnati.

None of those are bad options, though. As you can see, both saved a significant portion of their income because their expenses were smaller than the amount they made.

Our example is mostly about preference. It shows that living in an HCOL area is not a bad financial decision.

As long as you can meet your financial obligations (including savings) and are happy, you can live wherever you want.

Benefits and Disadvantages of HCOL areas

Regardless of whether you decide to live in an HCOL, an MCOL, or an LCOL area, you will find pros and cons to all of them.

What matters most when selecting an area to live in is whether it meets your personal and financial needs (and remember: saving is a need).

With that in mind, what follows are a few important things you can expect from HCOL areas, starting with the bright side. Areas with a high cost of living usually offer a wide range of amenities.

They also generally have many entertainment options and offer high-paying jobs. This last factor is often what makes people opt for an HCOL area, even if it does not offer a much better quality of life.

That brings us to an important disadvantage of many HCOL areas, which is that high cost often does not translate into high quality of living.

A number of big cities are HCOL areas not because of high living standards but because of business factors.

Such factors may include industrialization, which attracts people looking for higher salaries, which increases demand for housing, goods, and services.

And as we know, if demand increases and supply does not catch up, prices rise.

With prices on the rise it can be hard for higher salaries to offset the cost of living.

Still, many people prefer these areas for their lively scene with concert halls, restaurants, etc.

We can consider these venues a pro of HCOL areas. They are the hallmark of a very economically active area.

They mean businesses are willing to establish themselves in the area because people are willing to buy from these businesses.

Should you choose LCOLs and MCOLs instead?

Since “high cost” does not necessarily mean “high quality”, LCOLs and MCOLs can be good alternatives to HCOL areas. Once again, it all depends on your priorities.

A person who is married with kids and makes 6 figures a year can probably afford a comfortable life in an HCOL area without major hurdles.

However, with the ability to work remotely, living in an MCOL area or LCOL area could help you save for retirement faster.

Besides, HCOL areas being almost always big cities, someone looking to live closer to nature and MCOL area or LCOL area could make much more sense.

Take a cold look into your finances and your life priorities. They will provide you with the directions you need to make a better financial decision about where to live.

Which credit score do you need to buy a house in any of these areas?

Unless you have hundreds of thousands of dollars in your savings account, you will need to get a loan to buy a house.

It doesn’t matter if you choose an LCOL, MCOL, or an HCOL area. You’ll always need a certain credit score in order to get a loan.

The loan offer you’ll get from the lender will be better or worse depending on this three-digit number. Sometimes it is just not worth it.

Are you wondering if your credit score can get you a house? The following link will take you to the article we’ve made to help you clarify this question.

What credit score do you need to buy a house?

If you are trying to find out what is the right credit score to buy a house, you have come to the right place. Read our article and find out!

About the author / Danilo Pereira

Trending Topics

5 ways to improve your credit score: these tips are life-saving

There are many ways to improve your credit score, but here you'll find some of the easiest tips to do it. Keep reading to get them!

Keep Reading

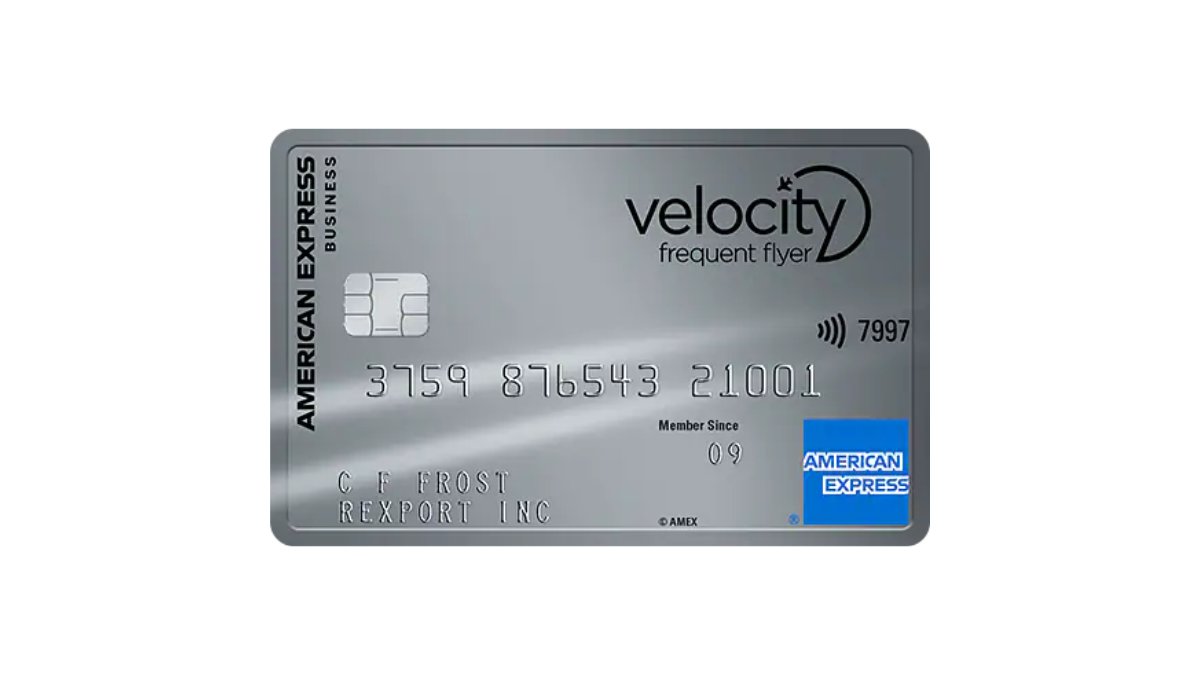

American Express® Velocity Business Card Review: Earn more

Soar into the world of business travel! Explore every feature of the American Express® Velocity Business Card in this review. Earn points!

Keep Reading

British Airways Credit Card review: Travel More and Spend Less

Want travel rewards and access to airport lounges? Read this British Airways Credit Card review and learn how you can get what you want.

Keep ReadingYou may also like

Wells Fargo Autograph℠ Card review

Looking for a unique credit card that comes with plenty of rewards and perks? Then check out our Wells Fargo Autograph℠ Card review.

Keep Reading

First National Bank eStyle Checking account review

In this First National Bank eStyle Checking account review you will learn how this account protects you from overdraft fees.

Keep Reading

Virgin Australia Velocity Flyer Review: Unleash Your Wanderlust!

Explore this review of the Virgin Australia Velocity Flyer Credit Card! Enjoy exclusive perks, and pay no annual fee for the first year!

Keep Reading